More than 4,300 billion VND in credit debt is frozen for customers affected by the Covid-19 epidemic

(Baonghean.vn) - A report from the Finance sector shows that, as of September 2022, banks have restructured debt repayment terms and maintained the debt group for 3,276 customers with a total debt value (principal and interest) with restructured repayment terms of VND 4,347.6 billion.

Nearly 200,000 loan customers have also had their loan interest rates waived, reduced, or lowered, with the total accumulated debt value waived, reduced, or lowered since January 23, 2020 being VND 117,101.7 billion. The amount of interest that credit institutions and credit branches have waived or reduced for existing loans is VND 364.5 billion. In addition, new loans with lower interest rates than before the pandemic, with cumulative sales from January 23, 2020 to now reaching VND 212,797 billion for 141,930 customers.

Regarding policy credit: Accumulated from January 23, 2020 to present, the Provincial Social Policy Bank has restructured debt and maintained the debt group for 15,985 individual customers with a total debt value of restructured repayment term of 367.7 billion VND; provided new loans to 3,916 individual customers with an amount of 153.4 billion VND.

|

Banks and credit institutions implement debt relief policies for many customers affected by Covid-19. Photo: Tran Chau |

In addition, the Provincial Social Policy Bank has disbursed loans to 56 enterprises that meet the conditions for loans to pay salary suspension for employees affected by the epidemic according to Resolution No. 42/NQ-CP and Resolution No. 68/NQ-CP of the Government with a total disbursement amount of VND 21,984 million.

|

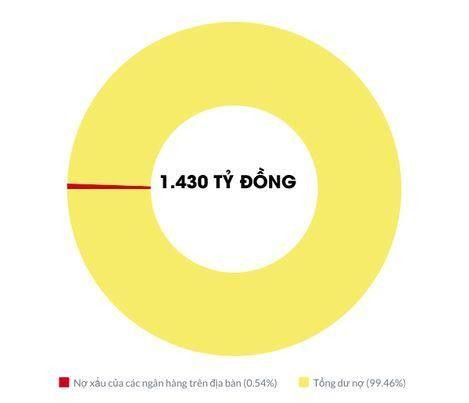

Chart of bad debt ratio in total outstanding debt of banks in Nghe An province. Graphics: Hong Toai |

As of September 30, 2022, the total outstanding debt of banks and credit institutions in the area is estimated at VND 266,466 billion, an increase of VND 23,852 billion compared to the beginning of the year, equal to 9.8%, higher than the same period in 2021 (2.6%). Total outstanding debt increased by VND 3,514 billion compared to the previous month, equal to 1.3%.

As of September 30, 2022, bad debt of local banks is estimated at VND 1,430 billion, accounting for 0.54% of total outstanding debt. If not counting the Development Bank, bad debt is estimated at VND 1,420 billion, accounting for 0.56%.