Nghe An: 7 months of outstanding credit increased by more than 9%

(Baonghean.vn) - In the first 7 months of 2018, credit institutions in Nghe An focused on lending capital to priority sectors, while always paying attention to improving credit quality, ensuring safety and efficiency in business operations.

|

| Banks mobilize capital to ensure lending to the economy. Photo: Viet Phuong |

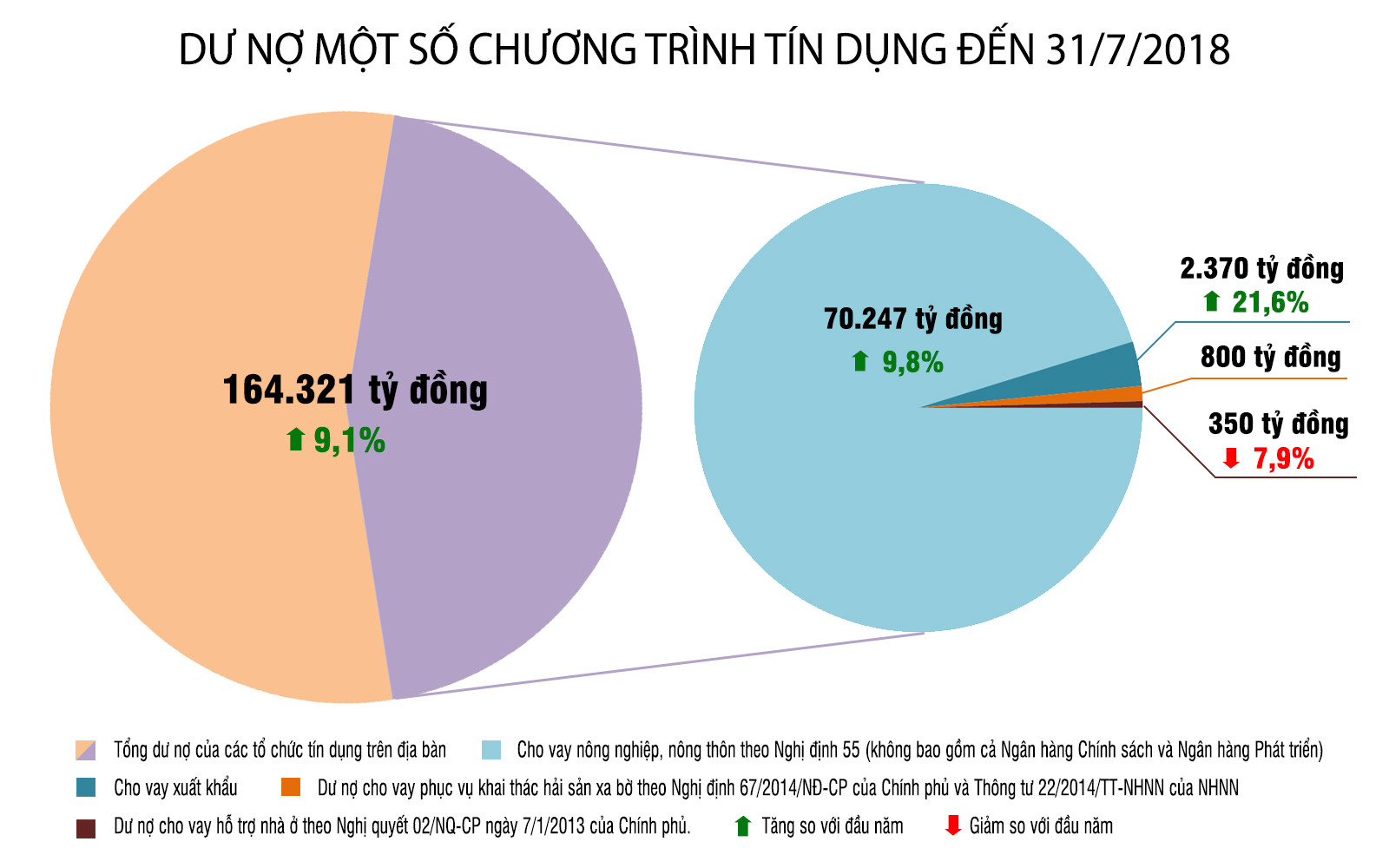

As of July 31, 2018, the total outstanding debt of credit institutions in the area is estimated at VND 164,321 billion, an increase of VND 980 billion compared to the beginning of the month, equivalent to 0.6%; compared to the beginning of the year, an increase of VND 13,731 billion, equivalent to 9.1%; higher than the growth rate of the same period last year by 8.1%.

Outstanding loans of some credit programs as of July 31, 2018 were high, such as: Agricultural and rural loans under Decree 55 (excluding the Policy Bank and Development Bank) were estimated at VND 70,247 billion, up 9.8% compared to the beginning of the year.

Export loans are estimated at VND2,370 billion, up 21.6% compared to the beginning of the year. Outstanding loans for offshore fishing under Decree 67/2014/ND-CP of the Government and Circular 22/2014/TT-NHNN of the State Bank are estimated at VND800 billion.

|

| Graphics: Huu Quan |

However, outstanding loans to support housing under Resolution 02/NQ-CP dated January 7, 2013 of the Government are estimated at 350 billion VND, down 7.9% compared to the beginning of the year.

According to the State Bank of Vietnam, Nghe An branch, in the first 7 months of the year, the capital mobilized in the area is estimated at 117,397 billion VND, an increase of 1,124 billion VND compared to the beginning of the month, equivalent to 0.97%, and 9,971 billion VND compared to the beginning of the year, equivalent to 9.3%; higher than the growth rate of the same period last year of 8.9%. To date, the total bad debt of banks in the area is estimated at 1,385 billion VND, accounting for 0.8% of total outstanding debt, an increase of 211 billion VND compared to the same period last year, equivalent to 18%.