Need 'boost' to boost credit growth

(Baonghean.vn) - Although the Government and the banking sector have continuously implemented monetary policies to support economic recovery and reduce interest rates to ease difficulties for customers, credit growth remains very low. To stimulate credit demand, solutions are needed to bring capital into production and business.

Difficulties in credit growth

From March 15, 2023 to present, on the basis of closely following actual developments and continuing to implement the policies of the National Assembly, the Government, and the Prime Minister in removing difficulties for the economy and reducing lending interest rates, the banking industry has adjusted interest rates down 4 times, with a reduction of 0.5 - 2%/year.

Along with the interest rate reduction, the State Bank of Vietnam, Nghe An Branch, also continues to direct local units to deploy credit packages. Notably, the VND120,000 billion package for loans for social housing, workers' housing, renovation and reconstruction of old apartments according to Resolution 33/NQ-CP of the Government; the VND15,000 billion package for forestry and fishery sectors...

In addition, the State Bank of Vietnam, Nghe An branch, continues to direct credit institutions to strictly implement the 2% interest rate support program from the State budget of VND 40,000 billion according to Decree 31/2022/ND-CP of the Government, Circular No. 03/2022/TT-NHNN and Directive No. 03 of the Governor. As of August 31, 2023, the cumulative interest rate support loan turnover from the beginning of the program to the end of the month was VND 737.4 billion; the outstanding loan balance supported at the end of the month was VND 225 billion at 10 commercial bank branches with 36 customers, the amount of interest rate support was more than VND 3.5 billion.

The leader of the State Bank of Nghe An branch said: The State Bank has continuously issued documents requesting banks to strictly implement regulations on deposit interest rates and publicly post deposit interest rates. At the same time, they must comply with the commitment to reduce lending interest rates. Banks must reduce costs to reduce lending interest rates to support businesses to recover and develop production and business.

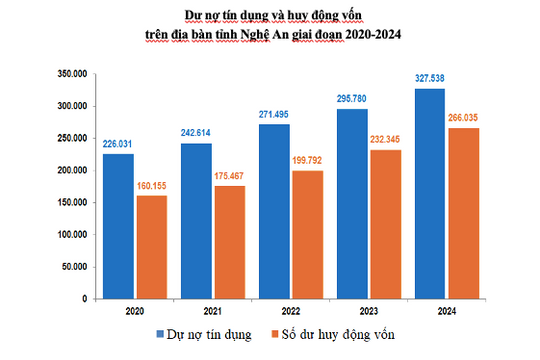

By September 30, 2023, the capital mobilized in Nghe An (excluding the Development Bank) is estimated at VND 221,040 billion, an increase of VND 21,249 billion compared to the beginning of the year, equal to 10.6%; this increase is considered quite high compared to the same period in 2022 (7.6%).

With good mobilization and abundant capital, many banks such as BIDV, Vietinbank, Agribank, Vietcombank, etc. continuously deploy preferential credit packages and offer programs to reduce loan interest rates for existing customers.

In the context of declining loan demand, although banks have taken many measures to reduce lending interest rates and stimulate credit demand, credit growth is still very difficult. Credit growth in the first 9 months of 2023 of the entire banking industry only reached 5.5%, far from the target of 14% in 2023 set by the State Bank. This is also considered the lowest growth rate in the past 10 years. Although the State Bank has issued solutions to support growth such as reducing interest rates, lending to repay debts of other credit institutions, etc., this situation has not been resolved. The VND 15,000 billion package for lending to the forestry and fishery sector has not yet had any customers eligible to access it; and before that, banks had offered many preferential loan packages, but credit demand was low, businesses were not very interested, and capital was still "unsold".

Data from the State Bank shows that as of September 30, 2023, the total outstanding debt of credit institutions in the area is estimated at VND 273,999 billion (excluding the Development Bank), an increase of VND 13,475 billion compared to the beginning of the year. Thus, credit growth in the first 9 months of the year only reached 5.1%, while in the same period in 2022 it was 11.2%.

Find the solutioncredit growth method

At BIDV Nghe An Bank, Ms. Nguyen Thi Thu Huong - Deputy Director said, if the growth in the first and second quarters was low, the third quarter has accelerated, the current outstanding loan growth has reached 8%, the growth target of 10% this year will certainly be achieved. However, BIDV Nghe An's customers are mainly large enterprises and large projects, so the outstanding loan growth is better than the general level. As for the retail customer segment, personal loans are still very low and difficult.

Sharing about the reasons for low credit growth, according to Ms. Nguyen Thi Thu Huong - Deputy Director of BIDV Nghe An Bank, there are two main reasons: Low credit demand and credit access is still difficult.

Ms. Huong explained: The economy is still facing general difficulties, the real estate sector is still sluggish, manufacturing industries are in sharp decline, and businesses have few orders. In the context of economic difficulties, income and profits are decreasing, so people's consumption needs are decreasing, leading to a decrease in the need for loans.

Regarding the second reason, over the past two years, capital mobilization channels for the economy, such as securities and corporate bonds, have encountered difficulties, leading to increased pressure on credit funding. However, for credit channels, there are mandatory standards on documents and financial conditions to ensure credit quality control, and these standards are always maintained and not reduced. While the difficult economy generally affects the operations of all customers, weakening their financial situation and ability to repay debts, leading to a decrease in customer credit ratings. Therefore, credit financing requires more conditions, making it more difficult for customers to access loans.

So what is the solution for banks to easily provide capital to businesses? From the banking perspective, to reduce cost pressure for customers, share the common difficulties of the whole economy, and increase credit demand stimulation, since the beginning of the year, a number of banks have repeatedly reduced interest rates, often implemented credit packages with good interest rates, and regularly designed service products to ensure financial cost savings for customers.

Currently, at our bank, the loan interest rate for customers ranges from 6.5%/year to 9.0%/year, including a special short-term loan package for production and business and a medium- and long-term credit package "Steadfast companion" with attractive interest rates for each program and many incentives.

In order to overcome difficulties in accessing capital, banks need to regularly review the process to be able to streamline some steps; carefully advise and guide customers on providing and supplementing complete documents to properly assess the financial capacity of customers in order to promptly provide credit to supplement capital sources for customers.

In addition, to promote credit growth and develop production and business, the efforts of banks alone are not enough, but there needs to be additional "support" solutions from departments and local authorities. It is necessary to promote public investment disbursement, quickly remove legal difficulties related to real estate projects, and have programs to stimulate people's consumption. In particular, there needs to be practical policies to support businesses with effective business plans so that commercial banks can access credit...

.jpg)