Nghe An increases mobilized capital as a 'leverage' for credit growth

Continuously increasing deposits in the banking system will be an opportunity for credit institutions to expand lending to support businesses and facilitate the implementation of monetary policies.

Mobilized capital and loans continue to grow well

With the economy still fluctuating and other investment channels unstable, savings are a safe option chosen by many people, while also helping banks ensure capital to meet increasing credit needs.

According to information from the State Bank of Vietnam, Nghe An branch, by December 31, 2024, the capital mobilized in the area (excluding the Development Bank) is estimated at VND 264,872 billion, an increase of VND 32,528 billion compared to the beginning of the year, equal to 14% (the same period in 2023 was 16.3%).

The total outstanding debt of credit institutions in the area is estimated at VND 324,485 billion, an increase of VND 28,706 billion compared to the beginning of the year, equal to 9.7% (the growth rate in 2023 is 8.9%). Excluding the Development Bank, the total outstanding debt is estimated at VND 316,275 billion, an increase of VND 30,053 billion compared to the beginning of the year, equal to 10.5% (the growth rate in 2023 is 9.9%). Of which, the outstanding medium and long-term debt is estimated to account for 39% of the total outstanding debt, the outstanding debt in VND is estimated to account for 98.8% of the total outstanding debt.

.jpg)

Outstanding loans are concentrated in a number of sectors such as wholesale, retail, auto and motorbike repair, accounting for 29.9% of total outstanding loans; processing and manufacturing industries account for 17.9% of total outstanding loans; agriculture, forestry and fisheries account for 15% of total outstanding loans; activities of hiring jobs in households, production of material products and services for self-consumption of households account for 8.5%; Real estate business activities account for 3.9% of outstanding loans in the whole area.

The bad debt ratio of Nghe An Banking industry is always maintained at a low level (below 2%) compared to the general level of the whole country.

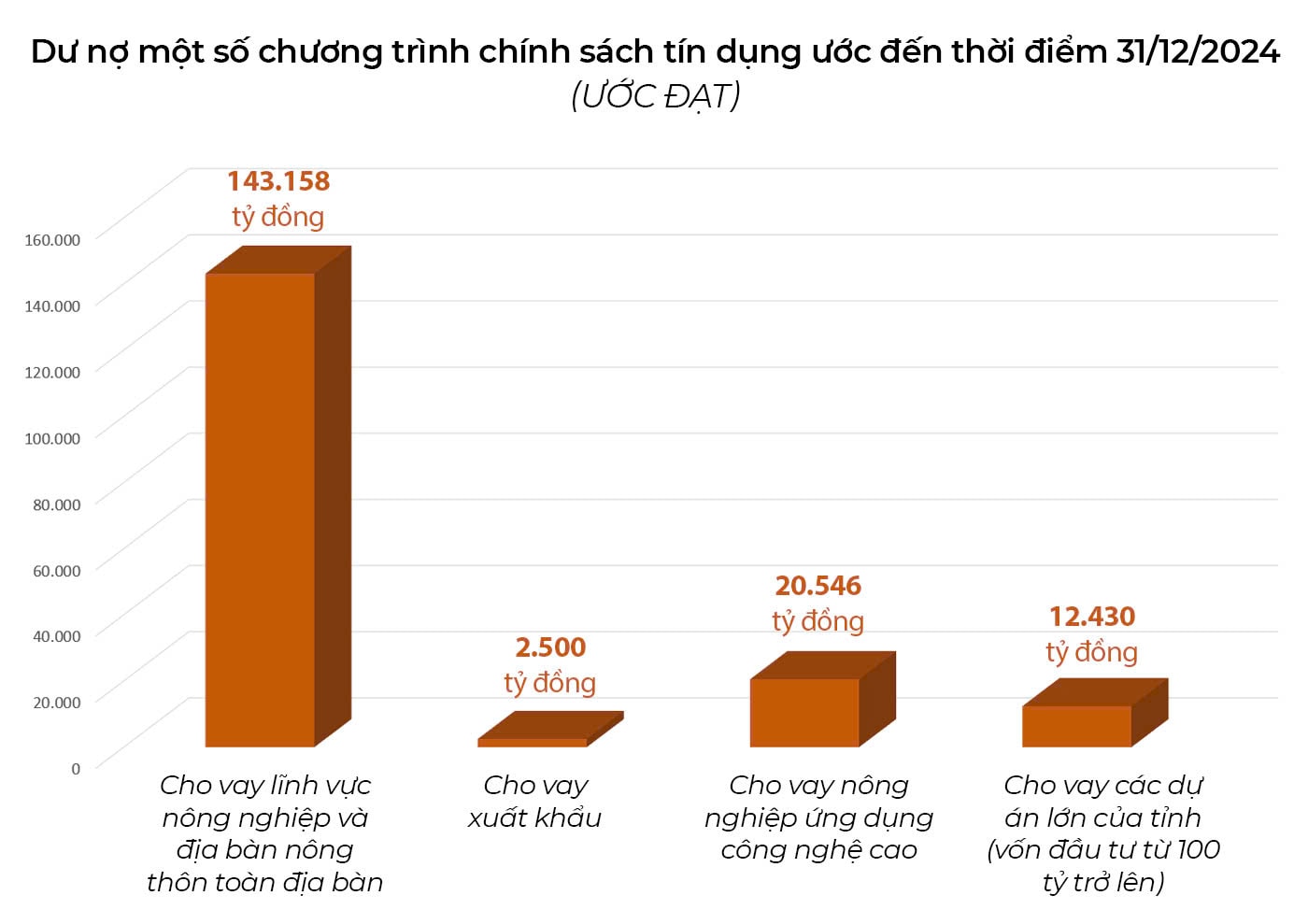

Outstanding loans of some credit policy programs estimated as of December 31, 2024 are: Loans for agriculture and rural areas in the whole area are estimated at VND 143,158 billion, up 8% compared to the beginning of the year, accounting for 44% of outstanding loans in the whole area. Export loans are estimated at VND 2,500 billion, down 12.6% compared to the beginning of the year. High-tech agricultural loans are estimated at VND 20,546 billion, up 1.3% compared to the beginning of the year, accounting for 6.3% of outstanding loans in the whole area. Housing support loans under Resolution 02/NQ-CP dated January 7, 2013 of the Government are still VND 68 billion. Preferential loans to implement social housing policies under Decree 100/ND-CP and Circular 25/2015/TT-NHNN are VND 469.9 billion with 1,349 customers. Loans for shipbuilding under Decree 67/2014/ND-CP are estimated at 76 billion VND. Loans for large projects of the province (investment capital from 100 billion VND or more) that banks are sponsoring: Currently, there are 49 large projects of the province being sponsored by 15 banks in the area with outstanding loans of 12,430 billion VND, total committed funding amount of nearly 20,000 billion VND; disbursed 18,220 billion VND.

Many policies to support economic recovery

Implementing monetary policy and policies to support economic recovery, the State Bank of Vietnam, Nghe An Branch, continues to direct local units to implement Directive 01/CT-NHNN to balance capital sources, meet credit capital needs for the economy, thereby continuing to remove difficulties for customers.

Specifically, effectively implement the contents under the direction of the Prime Minister and the State Bank on stimulating consumption, supporting production, business and developing the domestic market. Strengthen safe, effective and healthy credit, limit the increase and occurrence of bad debt, ensure the safety of credit institutions' operations. Direct credit to production sectors, priority sectors, sectors that are the driving force of economic growth according to the policy of the Government and the Prime Minister; increase lending for living and consumption; strictly control sectors with potential risks.

Promote the implementation of credit programs for the forestry and fishery sectors (the estimated scale of the Program implementation is about 50,000 - 60,000 billion VND). By October 31, 2024, the cumulative disbursement turnover of the Program in Nghe An province reached 33,015 million VND.

Regarding the 120,000 billion VND credit program (to date this package has increased to 145,000 billion VND) for loans for social housing, workers' housing, renovation and reconstruction of old apartments according to Resolution 33/NQ-CP of the Government, the Provincial People's Committee has announced a list of 03 projects that meet the legal conditions to access loans according to Resolution 33/NQ-CP.

Commercial bank branches in the area have actively approached and received loan requests from investors. Many working sessions have been organized between banks and businesses. However, currently, there has been no disbursement data in the area under the 120,000 billion VND credit package.

Promoting the implementation of green sector lending, 13 credit institutions have issued green credit loans with outstanding loans reaching 21,710 billion VND, accounting for 7% of total outstanding loans in the whole area, of which outstanding medium and long-term loans account for 75%.

Maintain stable deposit interest rates, reduce costs to reduce lending interest rates in time to support people and businesses in the area. Lending interest rates are controlled and new lending interest rates have decreased by about 3% compared to the beginning of 2022 until now.

Resolutely implement solutions to remove difficulties for businesses and people, especially extending the debt restructuring period and maintaining the debt group according to the provisions of Circular 02/2023/TT-NHNN (amended and supplemented by Circular 06/2024/TT-NHNN dated June 18, 2024). Accumulated from April 24, 2023 to

On October 31, 2024, the debt repayment period was restructured and the debt group was maintained for 207 customers, with the total restructured debt value (principal and interest) being VND 2,583.6 billion.

According to the leader of the State Bank of Vietnam, Nghe An branch, in the last months of the year, banks are accelerating capital mobilization to meet credit demand, helping to ensure stable liquidity, promoting economic growth, especially during the peak period of production and business. Seasonal capital demand is increasing in the last months of the year, but with banks launching many preferential interest rate credit packages and increasing the size of credit packages, businesses are no longer "thirsty for capital" as in previous times.

.jpg)