Nghe An: Focusing on solutions to collect budget in 2020

(Baonghean) - 2020 is the final year of implementing the 5-year socio-economic development plan 2016 - 2020, the fourth year of implementing the 2015 State Budget Law and the period of stabilizing the State budget for the period 2017 - 2020, so it is very important in implementing the socio-economic development goals and tasks of the whole period. Nghe An Newspaper reporter interviewed Mr. Trinh Thanh Hai - Director of Nghe An Tax Department about budget collection solutions in the coming time.

PV:Sir, could you please tell us what the 2019 budget revenue results of Nghe An were?

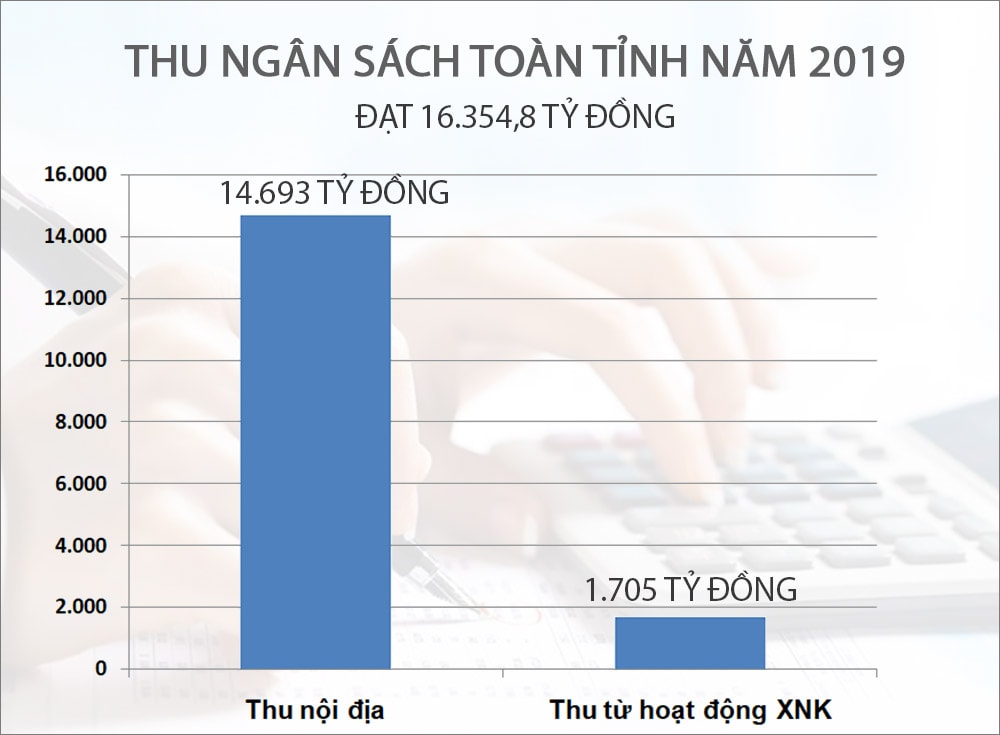

Mr. Trinh Thanh Hai:In 2019, the province's total budget revenue reached 16,354.8 billion VND, reaching 135% of the estimate assigned by the Provincial People's Council and increasing by 16.2% over the same period in 2018. Of which, domestic revenue reached 14,693 billion VND, reaching 124.2% of the estimate compared to the estimate assigned by the Provincial People's Council, increasing by 17.2% over the same period in 2018; Revenue from import-export activities was 1,705 billion VND, reaching 100.3% of the estimate assigned by the Provincial People's Council, increasing by 8.6% over the same period in 2018.

Total state budget revenue in the area in 2019 exceeded the estimate assigned by the Provincial People's Council and increased compared to the same period in 2018. Regarding budget revenue in the districts, all 21/21 districts, cities and towns completed and exceeded the estimate assigned by the Provincial People's Council.

|

| Leaders of Nghe An Tax Department have a professional dialogue with businesses about using electronic invoices. Photo: Lam Tung |

For Nghe An Tax Department, many taxes have completed the estimate: Revenue from the private service sector reached 4,759 billion VND, equal to 106% of the estimate, revenue from local state-owned enterprises reached 126 billion VND, equal to 101% of the estimate, personal income tax reached 592 billion VND, equal to 117% of the estimate, up 15% over the same period, environmental protection tax reached 1,955 billion VND, in addition, items such as registration fees, fees and charges, non-agricultural land use tax, land rent... all reached and exceeded.

Some revenue items did not meet the budget estimate such as: Revenue from Central State-owned Enterprises, revenue from foreign-invested enterprises, and lottery revenue. It can be said that 2019 is the most comprehensive year of the Nghe An Tax Department in terms of budget revenue. Achieving that success can be said to be thanks to many comprehensive and drastic solutions, including attention and direction from superiors.

|

| Chart of budget revenue in the province in 2019. Graphics: Lam Tung |

PV:It is known that tax debt in 2019 has decreased compared to last year, can you tell us more about this issue?

The Tax Department has fully implemented measures and procedures for debt management and tax debt enforcement, and has called, texted, and emailed business owners to request payment of outstanding tax arrears, specifically: 47,936 tax debt notices have been issued, 12,121 businesses have withdrawn money from bank accounts, 582 businesses have enforced invoices, 325 businesses have declared assets, and 44 businesses have revoked licenses.

|

| Vinh City Tax Department enforces tax debt collection for business households in Vinh market. Photo: Vo Huyen |

With many drastic solutions, by December 31, 2019, the tax debt was 1,027 billion VND, 59 billion VND lower than the tax debt as of December 31, 2018 and the tax debt target assigned by the General Department of Taxation was 1,076 billion VND. 2019 is the first year that Nghe An Tax Department has completed the tax debt collection target assigned by the General Department of Taxation, and is also the first year in many years that the tax debt has decreased compared to many previous years and is the year with the lowest tax debt on the total state budget revenue.

PV:To complete the 2020 budget collection, what key solutions do you think need to be focused on?

Mr. Trinh Thanh Hai:2020 is the final year of implementing the 5-year Socio-Economic Development Plan 2016 - 2020, the fourth year of implementing the 2015 State Budget Law and the period of stabilizing the State Budget for the 2017 - 2020 period, so it is very important in implementing the socio-economic development goals and tasks of the entire 2016 - 2020 period.

To achieve the 2020 target in the context of large enterprises not investing in industrial parks, beer and alcohol business declining, no tax generation, many revenue sources not really sustainable, the Tax sector identified the following solutions: Regularly monitor the revenue situation, grasp the revenue sources and the number of taxpayers in the area, evaluate, analyze and forecast revenue sources, in order to have timely direction and urging.

|

| Professional training at Nghe An Tax Department. Photo: Lam Tung |

Advise the Provincial People's Committee to issue documents directing and urging local departments, branches and sectors to coordinate with the Tax Department on budget collection and payment, and sign coordination regulations with district-level authorities on tax collection in each locality.

Strengthen the work of preventing revenue loss, vigorously implement the established programs to prevent tax loss such as real estate, mineral exploitation, food and beverage, motorbikes, gasoline, research and implement other programs to prevent revenue loss...

Fully and resolutely deploy measures to collect tax debts, enforce tax debts, closely monitor and supervise changes in debts. In addition, promptly support tax propaganda and support, promote tax administrative reform, contribute to improving the business environment, and encourage enterprises to conduct electronic transactions with the Tax authorities.

|

| Instructions for businesses to declare taxes at Nghe An Tax Department. Photo: Lam Tung |

PV:Thank you!

Nghe An Tax Department improves propaganda skills and supports taxpayers

(Baonghean.vn) - On the morning of November 23 in Cua Lo town, Nghe An Tax Department organized a training course to improve professional skills and propaganda skills to support taxpayers for leaders of the Branches and the Taxpayer Propaganda Team of the Branches in the province.

.png)

.jpeg)