Nghe An: Nearly 2,000 businesses get tax extension

(Baonghean.vn) - The Covid-19 epidemic has been severely affecting production and business activities nationwide and Nghe An is no exception. Implementing the Government's policy, Nghe An Tax Department has been implementing tax extensions according to Decree 41/2020 of the Government.

Land use revenue exceeds plan

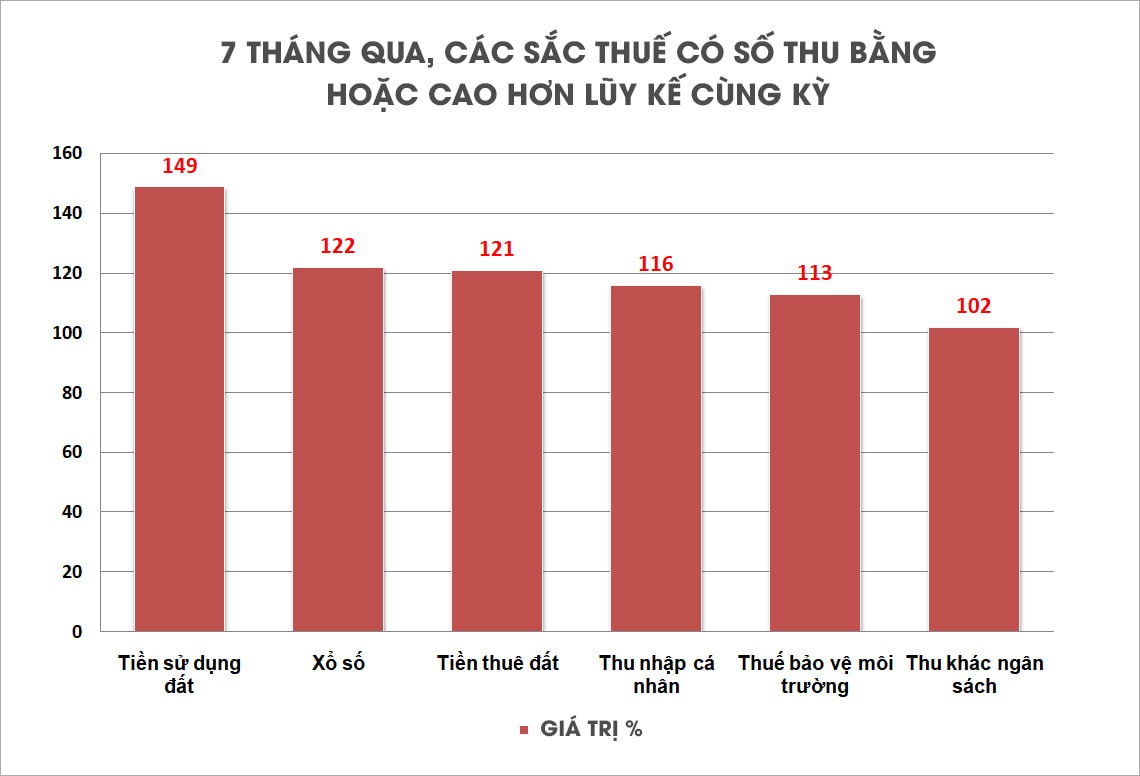

According to the Report of Nghe An Tax Department, the total domestic tax revenue of the whole province in July 2020 reached 1,307 billion VND, equal to 104% compared to the number implemented in July 2019. The accumulated revenue in the first 7 months of 2020 reached 8,086 billion VND, equal to 63% of the Central budget estimate, 60% of the Provincial People's Council budget estimate and equal to 104% compared to the same period.

Excluding land use fees, the cumulative 7 months reached 5,598 billion VND, equal to 51% of the estimate and 91% compared to the same period.

|

| Beer production at Saigon Song Lam Beer Company. Photo: Tran Chau |

Taxes with lower cumulative revenue than the same period: revenue from central state-owned enterprises (69%); local state-owned enterprises (88%); foreign-invested enterprises (84%); non-state industry, trade and services (CTNDV NQD) (83%)...

Regarding the implementation of revenue estimates by locality, 2 Tax Departments have completed the total revenue estimates: Phu Quy 2 (total reached 135%, excluding land reached 60%); Bac Nghe 2 (total reached 100%, excluding land reached 68%).

|

| Graphics: Lam Tung |

The tax sector has urged and issued 69,948 debt notices, sent 2,147 text messages urging tax debt collection; issued 1,025 enforcement decisions with the amount of 370 billion VND, the amount collected through enforcement is 7.8 billion VND. In July, the total debt collected was 113 billion VND, of which this year's debt was 105 billion VND, and the debt collected from previous years was 8 billion VND. The total estimated debt by July 31, 2020 for the whole sector is 1,318 billion VND.

Ms. Nguyen Thi Trang - Head of the Budget Synthesis Department - Nghe An Tax Department said: Revenues from production and business activities such as: Central State-owned enterprises (SOEs), Local SOEs, Enterprises with FDI, and NQD service enterprises are all lower than the progress of the budget implementation as well as compared to the same period. The reason for the decrease in revenue is due to the double impact of the Covid-19 pandemic and related policies.

|

| Instructions for businesses to declare taxes at Nghe An Tax Department. Photo: Lam Tung |

Focus on tax extension for businesses

The severe impact of the Covid-19 epidemic has caused hundreds of businesses to suffer, production and business chains have been disrupted, contracts have been broken, import and export goods have been stagnant...

In the above context, the Government has issued many policies to support businesses to overcome the difficult period. Notable among these is Decree 41/2020/ND-CP dated April 8, 2020 of the Government extending the deadline for tax and land rent payments, effective from April 8, 2020.

The Decree details the taxpayers that are subject to the application in 5 basic groups such as: Manufacturing industries, business industries (Transportation and warehousing; accommodation and catering services; education and training; healthcare and social assistance activities; real estate business; Labor and employment service activities; activities of travel agencies, tourism businesses and support services related to promoting and organizing tours; Creative, artistic and entertainment activities; library, archive, museum activities; sports, entertainment activities, movie screening activities...); Production of priority development support industrial products; Small and micro enterprises; Credit institutions, foreign bank branches providing support to customers affected by the Covid-19 epidemic...

|

| Production at enterprises in the Southeast Economic Zone. Photo: Lam Tung |

To implement the above policy, Nghe An Tax Department has stepped up propaganda to taxpayers and at the same time carried out procedures and documents so that businesses can receive support.

As of July 31, 2020, 2,616 taxpayers (including 1,977 enterprises and 639 business households) had extended their tax payment with an extension amount of VND 758 billion (including VND 753 billion for enterprises and VND 5 billion for business households). Some large enterprises with extensions include: Masan Mb One Member Co., Ltd. requested an extension of more than VND 57 billion; Hoa Sen Nghe An One Member Co., Ltd. requested an extension of more than VND 17 billion...

Currently, the tax sector is continuing to implement steps to manage taxes on e-commerce business activities, receiving and processing dossiers of exemption and reduction of land use fees and land rent; dossiers of recording revenue and expenditure of land rent and land use fees; dossiers requesting extension of land rent payment; dossiers requesting personal income tax refund; dossiers determining land rent unit prices in a timely and correct manner, strengthening tax management...

.jpg)

![[Infographics] 5 biện pháp phòng, chống dịch COVID-19 [Infographics] 5 biện pháp phòng, chống dịch COVID-19](https://bna.1cdn.vn/thumbs/540x360/2025/05/22/anh-2.jpg)

-5b8619d675cc4f38cedd8c853332ddab.jpg)