Nghe An: Finding solutions to effectively implement budget collection work

(Baonghean.vn) - That was the direction of comrade Nguyen Xuan Son - Standing Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Council at the working session with Nghe An Tax Department according to the budget collection monitoring program.

Inadequacies in budget collection

On the morning of May 13, the Standing Committee of the Provincial People's Council worked with the Nghe An Tax Department according to the program to monitor budget collection in the province in the 3 years 2016 - 2018.

|

| Comrade Nguyen Xuan Son - Standing Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Council chaired the meeting. Attending were Vice Chairmen of the Provincial People's Council: Cao Thi Hien - Member of the Provincial Party Committee Standing Committee and Hoang Viet Duong - Member of the Provincial Party Executive Committee. Photo: Mai Hoa |

According to the report of Nghe An Tax Department, in the three consecutive years of 2016 - 2018, tax collection results in the province have increased by 12-24% and exceeded the Central budget and the Provincial People's Council's estimates. Specifically, in 2016, revenue reached 9,930 billion VND; in 2017, it reached 11,208 billion VND; in 2018, it reached 12,529 billion VND.

However, if land use fees are deducted, domestic revenue in 2017-2018 did not meet the estimate, focusing on central enterprises, foreign-invested enterprises, and non-state industrial and commercial sectors.

|

| Vice Chairwoman of the Provincial People's Council Cao Thi Hien requested the Tax Department to clarify many problems in tax collection in the area. Photo: Mai Hoa |

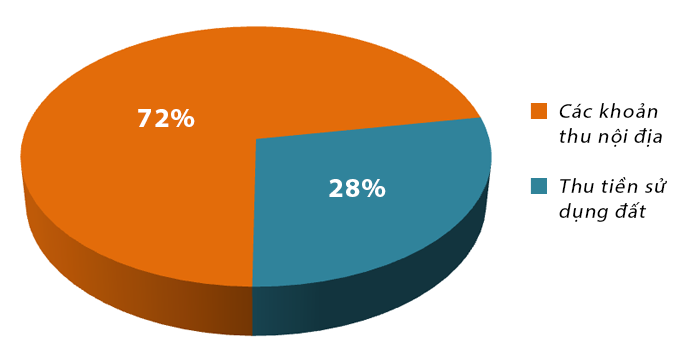

On the other hand, the revenue structure excluding land use fees in total domestic revenue has gradually decreased over the years: 77% in 2016; 75% in 2017 and 72% in 2018. This means that land use fees over the years have accounted for a large proportion, increasing year by year, from 23% (in 2016) to 28% (in 2018).

There is also tax loss in some areas such as: hotel business, motels, restaurants, gasoline, motorbikes, real estate, commerce... Tax debt collection is still difficult...

|

| The structure of land use fee revenue accounts for a high proportion of total domestic revenue. Graphics: Huu Quan |

At the meeting, through monitoring tax collection practices in a number of localities, many members of the monitoring delegation raised many existing problems and limitations in current tax collection work.

That is, the work of making estimates and assigning revenue estimates is not close to reality; there are estimates lower than reality and vice versa. Some businesses do not properly account for costs and revenues, mainly increasing costs to reduce profits to reduce the amount of corporate income tax payable.

The monitoring and management of households with lump-sum tax are not strict; some households with lump-sum tax and special consumption tax have not been managed. Some households have registered their business lines but have not been included in the tax system...

|

| Director of Nghe An Tax Department Trinh Thanh Hai said that the main source of tax loss is in the business sector. Photo: Mai Hoa |

On the other hand, revenue loss is also manifested through self-declaration, self-calculation and self-payment by enterprises, because enterprises' self-awareness is not high and the tax authorities' inspection and examination work is not really effective.

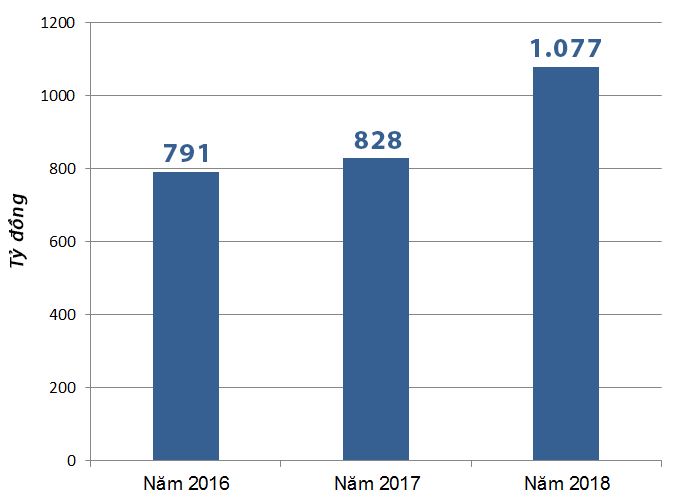

Some members also raised concerns that although the Tax sector has implemented many measures to manage, collect debts and enforce taxes, tax debt collection is still difficult; tax debts and difficult-to-collect tax debts are higher year after year.

|

| Tax debt in the province is higher year after year. Graphics: Huu Quan |

Have good solutions to prevent loss of revenue

Speaking at the meeting, Chairman of the Provincial People's Council Nguyen Xuan Son emphasized that budget revenue is one of the important targets set out in the Resolution of the 18th Provincial Party Congress, term 2015 - 2020. And currently, compared to the target of total revenue of 25,000 - 30,000 billion VND in 2020, it is extremely difficult.

Therefore, the selection of the topic of budget collection supervision by the Provincial People's Council is with the hope of finding more positive solutions to promote increased revenue in the area in the coming time.

|

| Comrade Nguyen Xuan Son - Standing Deputy Secretary of the Provincial Party Committee, Chairman of the Provincial People's Council emphasized that the key of the Tax sector is to have solutions and measures to prevent tax losses, ensuring fairness and transparency in this activity. Photo: Mai Hoa |

The Chairman of the Provincial People's Council also said that, in addition to difficulties caused by objective factors, the Provincial People's Council will have the responsibility to coordinate with all levels and sectors to resolve them; the Tax Department needs to be serious, responsible, and research solutions to overcome difficulties and problems caused by subjective errors of the sector.

Pay attention to tax management operations, ensuring accuracy, completeness, transparency and fairness among subjects; strengthen and improve the quality of inspection and examination work, and combat tax loss and tax evasion.

At the same time, there must be more drastic solutions in tax debt collection; propaganda work must be strengthened to create a change in awareness and voluntariness of taxpayers...

.jpg)

.jpg)