Elderly people are most susceptible to investment scams

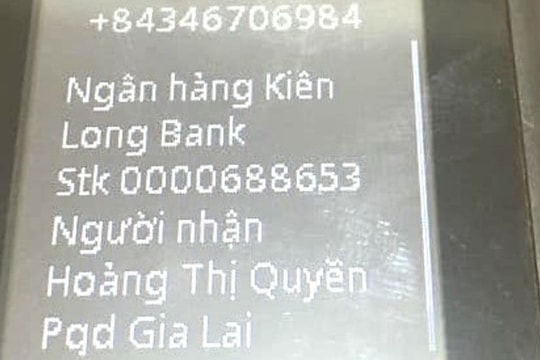

Scammers call to entice elderly people to invest money in real estate, cars, art... to get high interest rates.

Financial Conduct Authority (FCA)has just warned of an increase in the number of scam calls targeting people aged 55 and over. Currently, savings interest rates are low, so people do not earn high returns on their deposits. Therefore, scammers take advantage of this to invite the elderly to buy real estate, expensive art collections, classic cars... with the assertion that they will earn high profits.

|

Nick Hewer helps seniors in the UK avoid investment pitfalls. |

To combat this, the FCA has launched the ScamSmart campaign with the support of Nick Hewer, host of Channel 4's Countdown. Nick Hewer says he has been the target of unwanted calls from scammers himself, so he has plenty of experience sharing tips and effective ways to protect yourself from these scams.

"You need to think clearly because everyone wants to invest to make a profit. You should ask yourself if making money is so easy, why are they calling you instead of taking the opportunity yourself. If you still want to continue to get rich, you need to visit the FCA website. There we have published a warning list of fraudulent companies for people to learn about," Mr. Nick Hewer shared.

Research from the campaign shows that more than 60% of people who fall into the trap often do not report it to the authorities, so the amount of damage can be much higher than announced. The most common methods used by scammers are phone calls, emails or letters sent to homes. FCA officials advise people to be cautious when receiving unexpected contacts from unknown people offering to buy or sell products and services.

One of the most common tricks is real estate consulting. Some companies buy agricultural land or areas that are not allowed to be zoned for residential use, then divide them into small lots and sell them to investors. Buyers are instructed that these agricultural lands have great potential for building houses and increasing in value. In addition, the seller also stimulates greed by advising customers to buy quickly because this land has attracted many people's attention, otherwise they will miss the opportunity to buy at the current low price. Many people feel that it is a bargain and decide to put all their retirement savings into this gamble without realizing that they are holding a knife by the blade.

|

Phone calls are a popular method used by scammers to lure the elderly into investing in "ghost" projects. |

Last month, the FCA won a High Court case against Asset Land, a company that had persuaded investors to buy plots of land at inflated prices. Last year, eight people were jailed in a land scam that saw 110 investors lose at least £4.3m.

Up to 40% of people recently interviewed by the FCA said they had contacted at least one company they had never heard of. About 40% withdrew their savings to invest because of low interest rates. More people over 55 are taking on risky trades because they are no longer working or running a business and would rather get a good return for their retirement than enjoy low interest on savings.

People over 65 who have saved up around £10,000 are at greater risk of being scammed. Many people buy products without checking whether the company offering them is licensed to do business, or who will protect them in the event of problems or fraud.

According to VNE

| RELATED NEWS |

|---|

.jpg)