Vietnam's public debt is high, requiring tough measures to keep it safe.

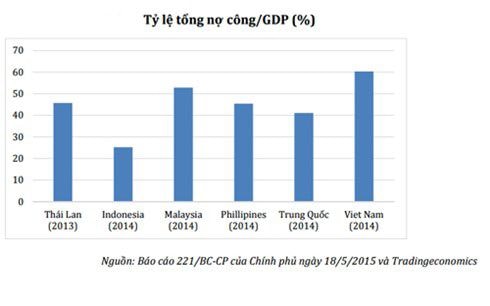

Vietnam's total public debt to GDP ratio at the end of 2014 was over 60%, the highest compared to developing countries in the region.

According to the Vietnam Institute for Economic and Policy Research (VEPR), the way Vietnam calculates public debt is not in line with international standards, so there is a significant difference between the government's published figures and calculations by independent organizations. Government-guaranteed debt is increasing and increasing pressure on state budget debt repayment.

Many differences in public debt figures

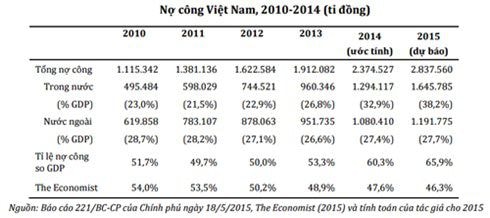

Specifically, VEPR said that according to official data from the Ministry of Finance, the public debt ratio increased from 51.7% in 2010 to 53.3% of GDP in 2013 after decreasing to about 50% in the period 2011-2012. The public debt ratio is estimated to increase to about 60.3% of gross domestic product (GDP) in 2014 and about 64% of GDP in 2015. This ratio has increased slightly compared to the previous estimate of 59.6% of GDP in the Report on loan use and public debt management of the Ministry of Finance to the National Assembly on May 18, 2015.

|

| 1 |

A calculation by the World Bank (WB, 2015) shows that Vietnam's public debt ratio in 2014 was about 59.6% of GDP, lower than the official estimate. Data from The Economist (2015) shows that the public debt ratio tends to decrease gradually even though the absolute debt amount increases. In a study by the Academy of Policy and Development, the authors pointed out that the data calculated according to the Law on Public Debt Management has a narrower scope than international organizations. The method of calculating public debt proposed by the above study, which includes debts that the budget is forced to pay, shows that public debt in 2014 was at 65.2% of GDP.

In terms of total public debt to GDP, Vietnam's ratio at the end of 2014 was over 60%, the highest compared to developing countries in the region (including China, Malaysia, Thailand, Philippines, Indonesia).

|

Debt repayment pressure from the national budget

According to VEPR, government debt accounted for a relatively stable proportion of about 79% of total public debt in the period 2010-2013. This proportion tends to increase slightly, partly due to the Government's restriction on granting guarantees for loans since 2013 with Decision 689/QD-TTg. The Government wants to reduce the debt burden after many years of rapid increase but not used for the right purpose. However, government-guaranteed debt also increased significantly from 226 trillion VND in 2010 to 452 trillion VND in 2014. Note that not only is it used to meet capital for key national projects and works, a significant amount of government-guaranteed debt is said to serve the purpose of "restructuring domestic and foreign debts of corporations, general companies and underwriting of policy banks".

For example, in 2013, the Government guaranteed DATC’s bond issuance to restructure Vinashin’s $600 million loan. This may have continued in 2014.

Also according to VEPR, the proportion of domestic debt tends to increase from 44.4% in 2010 to 54.5% in 2014. Because domestic debt accounts for a large proportion, the risk of public debt crisis in Vietnam is not yet dangerous even though the public debt/GDP ratio is quite high. However, domestic public debt also has certain negative impacts on the economy such as increasing interest rates and narrowing capital sources for the private sector and causing inflationary pressure.

According to VEPR analysis, the principal debt to be paid was 62,600 billion VND, the budget expenditure to pay the principal was 62,500 billion VND in 2010. By 2013, the total principal debt to be paid doubled (125,800 billion) while the budget expenditure to pay the principal reached 55,600 billion VND, the amount of principal debt to be repaid was 70,200 billion VND. The scale of debt repayment continued to increase to 77,000 billion VND in 2014.

In addition, interest payments also account for a large proportion of budget revenues and expenditures. Compared to total expenditures, interest payments account for an increasingly large proportion, from 3.2% in 2010 to 6.7% in 2014. In absolute terms, interest payments in 2014 increased 2.6 times compared to 2010.

Interest payments are lower than only those for education and training (17.3%), pensions and social security (10.8%) and administrative management (9.7%) and overwhelm other regular expenditures. The proportion of budget revenue devoted to interest payments, which has always been high, is estimated at 9.2% for 2015.

Need tough solutions

According to VEPR's assessment, "the debt repayment budget is eroding capital sources for development investment, which is a direct consequence of the high public debt ratio."

From this reality, VEPR believes that the negative impact of public debt should be understood in essence as the cumulative risk of loose fiscal policy and ineffective public investment spending. The public debt ceiling should be considered as a hard constraint to improve the effectiveness of fiscal policy, in addition to the meaning of a safety threshold to prevent a possible public debt crisis in the future.

For that reason, VEPR recommends: “Maintaining a fixed public debt ceiling is essential in controlling macroeconomic risks in the medium term. Instead of expanding the public debt ceiling, it is necessary to take drastic measures to bring and maintain public debt at an acceptable threshold”./.

According to VOV

| RELATED NEWS |

|---|

.jpg)