Promoting the effectiveness of policy bank capital sources

(Baonghean.vn) - In the first 9 months of the year, policy credit capital has provided capital to many policy beneficiaries in the province to invest in production and business, serving essential needs. Currently, the Social Policy Bank Branch continues to improve the quality of credit activities, add more sources, and meet the production loan needs of families in the policy area.

Anh Son, Con Cuong leads

Coming to village 8, Linh Son commune, Anh Son district, people admire the spirit of 3/4 disabled soldier Hoang Van Cam to overcome difficulties and develop the economy. In 2014, he borrowed 30 million VND from the Social Policy Bank from the near-poor household program to develop the farm economy. In 2017, he was considered by the Savings and Credit Group to borrow 50 million VND for newly escaped poverty households to continue investing in the farm. Up to now, his farm has an area of nearly 6 hectares, including chicken barns, ponds for raising fish, fish for meat; developing paper materials, incense materials, etc.

Every year, the farm supplies the market with tons of paper materials, tons of chickens and fish; after deducting expenses, the farm brings in hundreds of millions of dong in income. In addition to borrowing capital to develop the farm economy, his family also borrowed capital from the Social Policy Bank to cover tuition fees for 3 students with an amount of up to 78 million dong. Currently, the children have graduated, have stable jobs and have paid off the debt to the Bank.

War invalid Hoang Van Cam shared: Previously, his family's circumstances were extremely difficult, his salary was only enough to cover the family's basic needs. Since he had access to policy capital to develop the economy and student capital to help his children pay for their tuition, his family's life has been much less difficult and has gradually improved.

|

| The family of war invalid Hoang Van Cam is one of the typical families in using policy loans effectively. Photo: Viet Phuong |

The family of war invalid Hoang Van Cam is one of the typical families in using policy loans effectively. Mr. Nguyen Van Quy - Chairman of Linh Son Commune People's Committee, member of the Board of Directors of the District Social Policy Bank said: "In recent years, policy credit programs have contributed greatly to ensuring social security, creating jobs for local workers, contributing to the implementation of new rural construction in the area".

Currently, Anh Son is the leading unit of the Nghe An Social Policy Bank Branch in maintaining and promoting the effectiveness of policy credit programs. Policy capital has been increasingly implemented in the right address, safely and effectively. The credit scale has been distributed reasonably, the proportion of credit programs is increasingly closer to reality. Mr. Tran Khac Thi - Director of Anh Son Social Policy Bank said: "We have coordinated well with entrusted organizations, savings and loan groups to actively urge borrowers to repay principal and interest on time, raising awareness of borrowers to borrow and pay. Saving money through the Group has been trusted by group members and considered an important resource to repay debts when due as well as to use when facing difficulties. Saving and credit groups are regularly guided after restructuring and are always prevented when there are signs of not complying with State regulations. Up to now, 99% of the groups have been rated as good".

In Con Cuong, the Executive Board of the District Social Policy Bank has closely followed the Resolution of the Representative Board to focus on directing the successful completion of assigned tasks. The capital mobilization target in the locality was exceeded, with the mobilized capital balance reaching 49,571 million VND/52,400 million VND, equal to 94.6% of the annual plan assigned by the superiors. The plan for using assigned capital was completed at 99.8%; the total outstanding debt reached 317,830 million VND; focusing on timely disbursement of credit programs, avoiding capital stagnation; actively handling and collecting due and overdue debts effectively; bad debts were gradually reduced and reached a low level.

Strive to exceed the set target

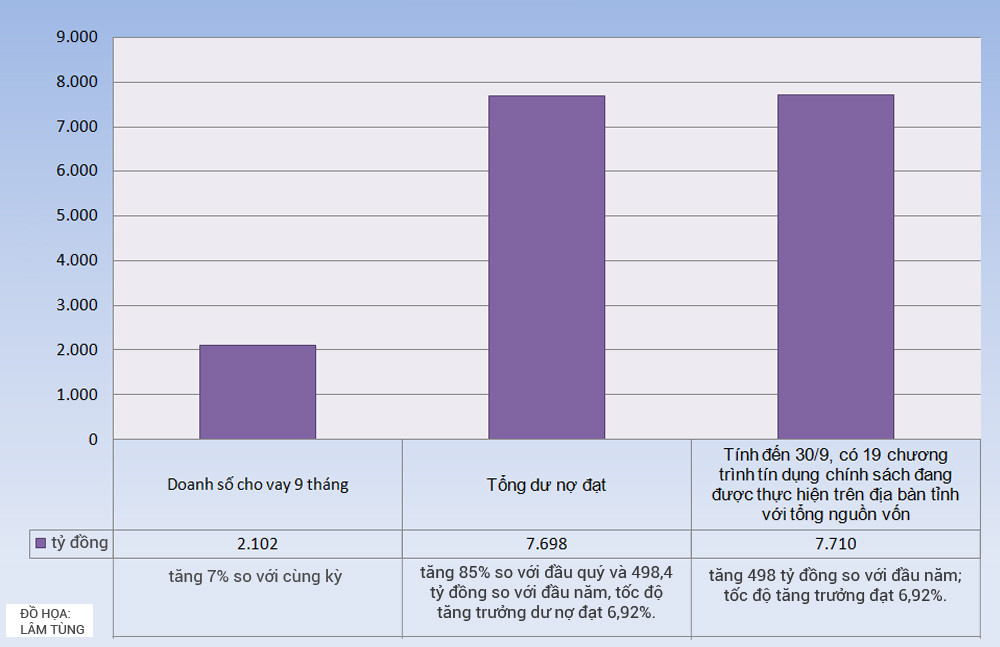

According to the Provincial Social Policy Bank, as of September 30, there were 19 policy credit programs being implemented in the province with a total capital of VND 7,710 billion, an increase of VND 498 billion compared to the beginning of the year; the growth rate reached 6.92%. Closely following the plan target of outstanding loan growth of credit programs assigned by the Central Government during the year, the Provincial Social Policy Bank Branch has coordinated with entrusted organizations to organize timely disbursement with loan turnover in 9 months reaching VND 2,102 billion, an increase of 7% over the same period. Up to now, the total outstanding loan has reached VND 7,698 billion, an increase of 85% compared to the beginning of the quarter and VND 498.4 billion compared to the beginning of the year, the growth rate of outstanding loan has reached 6.92%. Most of the credit programs have completed the plan target of outstanding loan assigned by the Central Government up to September 30; Some programs that increased rapidly during the year were near-poor households increasing by 249 billion VND, newly escaped poverty households increasing by 266 billion VND, and production and business households in difficult areas increasing by 137 billion VND.

|

| Graphics: Lam Tung |

According to Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank Branch, in 9 months, policy credit capital has provided capital to 64,714 poor and near-poor households and other policy beneficiaries to invest in production, business, and serve essential needs. Along with the growth in outstanding loans, the branch has paid special attention to improving the quality of policies, evaluating each debt, and grasping the debt repayment capacity of customers to urge and collect. Up to now, the total bad debt accounts for only 0.43%; the whole province has 190 communes without overdue debt, accounting for nearly 40% of the total number of communes in the province. Commune transaction points are where the main transactions with customers of the Social Policy Bank arise, therefore, in order to serve better and better, the Branch continues to drastically implement solutions to constantly improve the quality of transactions.

|

1. The Social Policy Bank works with loan groups in Ta Ca commune (Ky Son). 2. Nghi Loc Social Policy Bank transaction office disburses capital. 3. Checking the production loan model in Ky Son. Photo: Thu Huyen |

However, up to now, there are 2 localities that have not yet implemented the budget allocation target entrusted to the Bank for Social Policies, which are Vinh city and Hung Nguyen district. Some units have performed poorly, such as Cua Lo, Thai Hoa, Do Luong, Quynh Luu, Tan Ky, Quy Hop. Some places where associations at district and commune levels have not paid attention to doing a good job of consolidating and perfecting the activities of savings and loan groups, and have not actively participated in the activities of savings and loan groups to evaluate loans and check the use of loans within 30 days after disbursement. To complete the 2018 plan target, according to the representative board of the Board of Directors of the Bank for Social Policies, Nghe An branch, in the coming time, the Branch will continue to direct and effectively implement the work of mobilizing capital sources in the area such as: Mobilizing deposits of organizations and individuals; savings deposits at commune transaction points, savings deposits of savings and loan groups and other organizations. The Social Policy Bank coordinates with the government and organizations at all levels to review the capital needs of the completed programs, focusing on the loan program to support ethnic minorities according to Decision 2085 to submit to the Central Government for additional capital sources to meet the production loan needs of poor households and policy beneficiaries. At the same time, focus on directing the good implementation of credit work: disbursement, debt collection, timely preparation of risk handling records and improving the quality of transaction work at the commune level...

.jpg)