Hoang Mai Town: Land use rights collection increased, corporate tax and fee collection... fell short

(Baonghean.vn) - Although revenue in Hoang Mai town in the 3 years 2016 - 2018 all had good growth, the main increase came from land use rights fee revenue, while some revenue from enterprises, registration fees... were all in short supply.

|

On the afternoon of April 22, the Provincial People's Council's Supervisory Delegation had a working session with the People's Committee and the Tax Department of Hoang Mai town according to the program of supervising budget collection in the province. Comrade Hoang Viet Duong - Member of the Provincial Party Executive Committee, Vice Chairman of the Provincial People's Council chaired the meeting.Photo: Mai Hoa |

Bad debts tend to increase

Evaluation of budget collection in the town in the 3 years 2016 - 2018 shows that the results of each year are higher than the previous year, from nearly 192 billion VND (in 2016) to 296 billion VND (in 2018) and compared with the annual plan, it exceeded the estimate by 118 - 163%.

|

| Head of Hoang Mai Town Tax Department Ngo Gia Tinh explains the reasons for revenue shortfall in some revenue items. Photo: Mai Hoa |

However, the main source of revenue increase is from land use rights fees, while revenue from enterprises, registration fees, mineral exploitation fees, etc. are all in short supply. This reality affects the budget management in the area. Some revenue sources such as non-agricultural land use tax are facing difficulties.

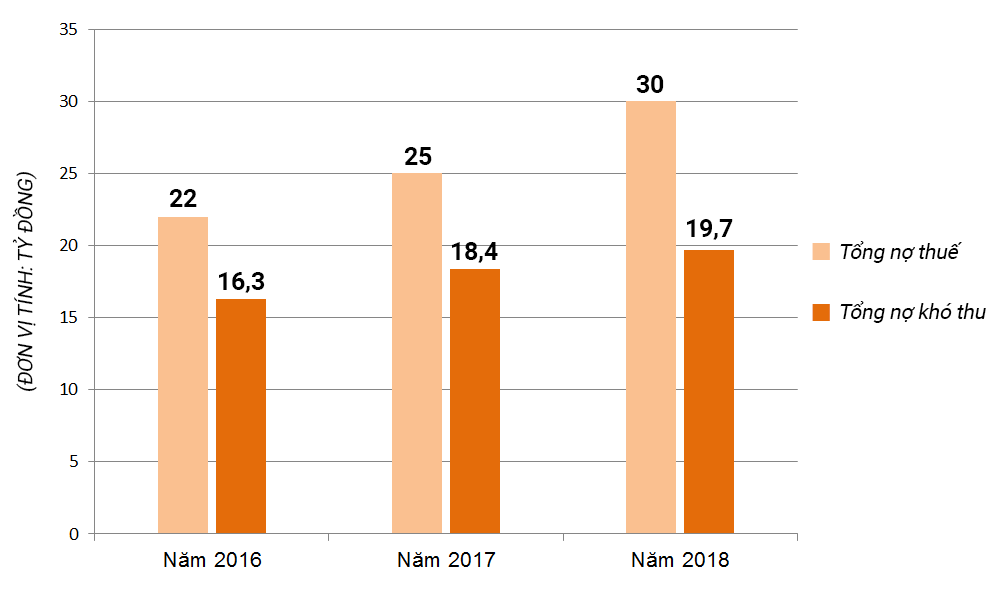

On the other hand, although the Town Tax Department has proactively implemented many enforcement measures for eligible cases, the situation of tax arrears and bad debts in the town tends to increase due to the subjects being slow in fulfilling their tax obligations.

|

| The situation of tax arrears and bad debts in Hoang Mai town tends to increase. Implemented by: Huu Quan |

There are solutions to prevent revenue loss.

From the practical supervision of budget collection and tax obligations of the town, at the meeting, some members of the supervision team raised the following reality: The application of the mechanism of enterprises self-declaring, self-calculating, and self-paying taxes has not created self-awareness from taxpayers, leading to inaccurate accounting of revenue, deductible expenses, pre-tax profits, etc. This situation requires the Tax authority to have solutions to strictly inspect and control to overcome.

Another problem is that some sources of revenue such as: Mineral exploitation rights fees or fixed revenue at the commune level, personal income tax, etc., the actual revenue is higher than the estimate and vice versa. This shows that the budget estimate is not tight and accurate, so the town needs to coordinate with all levels and sectors to make reasonable adjustments.

|

| One-stop shop at Hoang Mai Town Tax Department. Photo: Mai Hoa |

Some members also recommended that the Tax Department should closely coordinate with relevant agencies and units, especially wards and communes, in reviewing, making statistics and establishing accurate tax records for business households in the area, especially in the field of transportation business, to prevent tax losses...

Concluding the meeting, Vice Chairman of the Provincial People's Council Hoang Viet Duong highly appreciated the leadership and direction of the People's Committee of Hoang Mai town and the town's Tax Department in the management, urging collection and enforcement of tax debt collection in the area.

The Vice Chairman of the Provincial People's Council also emphasized that the town needs to pay attention to nurturing revenue sources and ensuring sustainable growth through promoting investment attraction for projects, promoting production development and strengthening the management of revenue and expenditure of the local budget.

|

| Vice Chairman of the Provincial People's Council Hoang Viet Duong concluded at the meeting. Photo: Mai Hoa |

Along with that, attention is paid to implementing solutions to prevent tax losses, focusing on reviewing, checking, and correctly assessing taxpayers to impose taxes and self-declare and pay taxes accurately, correctly, and fully.

On the other hand, the town needs to publicize tax payment and taxpayers, mobilize supervision from the whole society in this field; at the same time, remind and have solutions to urge timely tax collection...