General Department of Taxation reviews names of Vietnamese tycoons in Paradise Papers

The General Department of Taxation will review and compare data in the Paradise Papers with the presence of individuals and organizations in Vietnam.

A representative of the General Department of Taxation said that this agency will compare tax data to see whether the individuals and organizations in Vietnam named in this file are subject to tax declaration and payment or not.

However, this will require the coordination of many Vietnamese authorities.

|

| Checking the names in the Paradise or Panama Papers is not easy. |

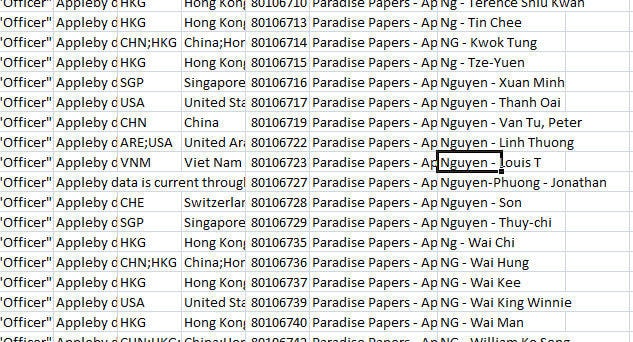

As of November 21, according to the announcement of the International Consortium of Investigative Journalists (ICIJ), Vietnam has 92 offshore entities, 22 individuals and 171 addresses mentioned in the files.

The data can be found at offshoreleaks.icij.org.

According to ICIJ, among dozens of companies headquartered in tax havens related to Vietnam, 14 are located in the British Virgin Islands, 11 are located in the Cayman Islands, and the rest are located in Panama, the Bahamas, and the Cook Islands.

The Virgin Islands, Bahamas and Panama are all known as “tax havens” because of their favorable tax rates and the relative ease of setting up a business there.

Some organizations and individuals in the profile are related to some quite famous names and places such as: Phu Quoc, Hoi An, Furama, Ha Noi, Ho Chi Minh City...

The Paradise Papers also revealed the overseas activities of more than 120 world politicians and tycoons. The US has nearly 8,000 foreign entities and 27,000 individuals; China has nearly 4,700 entities and 39,000 individuals…

|

| The Paradise Papers have just published hundreds of individuals, organizations and addresses related to Vietnam after a series of names were published in the Panama Papers in 2016. |

Previously, the Panama Papers released on May 10, 2016, also announced that Vietnam had 189 individuals, 19 offshore companies and 23 intermediary companies on this list. However, the results of this review have not been announced yet. A source said that there has been no specific conclusion related to this review.

Some individuals have spoken out that being on the list is normal, completely legal, and valid. But that is only a very small number, the majority of assets, transactions of individuals and organizations, and the movement of money flow remain a mystery.

At that time, some reporters went to the addresses listed in the Panama Papers and found that many of them were ghost addresses, with no business names as mentioned in the papers.

The International Consortium of Investigative Journalists (ICIJ), the source of the Panama Papers, also asserted that not everyone whose name is on this list has committed illegal acts. Because the establishment of companies and trust funds is completely legal and normal in the world.

Experts say that the use of “tax havens” to avoid taxes is common among multinational corporations and companies. This is also a headache for many countries, including developed countries.

A recent study by the International Monetary Fund (IMF) found that developing countries lose about $213 billion each year due to tax evasion by multinational corporations.

According to Vietnamnet

| RELATED NEWS |

|---|