Why is it difficult for cooperatives to access credit capital?

Capital for expansion, production development, investment in equipment, machinery, etc. is always a difficult problem for the collective economic sector. Due to objective and subjective difficulties, very few cooperatives and cooperative groups have access to credit capital from banks.

Cooperatives lack capital

In 2025, Tho Thanh General Service Agricultural Cooperative (Tho Thanh commune, Yen Thanh district) will convert to a new cooperative model, operating in multiple sectors, becoming a reliable address for thousands of farming households in the area.

In the early days, the cooperative had only 58 members and faced many difficulties. With efforts and dynamism, up to now, the cooperative has developed quite strongly. To better serve the agricultural production sector, the cooperative has invested in purchasing machinery to serve the people, such as tray seedling planting machines, plows, harvesters, transplanters, and tray seedling planting machines. In rice production as well as livestock farming, Tho Thanh General Service Agricultural Cooperative follows a chain of links, from production to harvesting and consumption of output products. Along with that, the cooperative performs well in the environmental sector, waste collection and treatment; internal credit activities...

Mr. Ho Si Quang - Chairman of the Board of Directors and Director of Tho Thanh General Service Agricultural Cooperative said: The Party and State's policies are very interested in collective economy and cooperative development. However, since its establishment, we have not been able to access bank credit capital. To maintain production and business activities, our Cooperative needs a large amount of capital, but we do not have collateral. The Cooperative's land cover is 600m2Land in a prime location of the commune with a value of tens of billions of dong, but cannot be mortgaged for loans because it is a collective book. And according to regulations, it is not allowed to borrow working capital for seasonal production; only capital can be borrowed to invest in machinery and raw materials but must have purchase invoices. When completing these procedures to borrow capital, the Cooperative will lose its investment opportunity.

“We share the bank's regulations and the concerns of credit officers, but we need solutions to create conditions for cooperatives like ours to borrow capital to invest in production and business,” Mr. Quang shared.

Similarly, the Agricultural and Environmental Services Cooperative of Hung Nguyen Town (Hung Nguyen District) was once famous for its tray plating service, but now the scale of all services has been reduced, operations are facing many difficulties, and one of the many reasons is the lack of capital. Mr. Nguyen Quoc Hue - Director of this Cooperative said: Most cooperatives cannot access bank loans because they do not have collateral, and if they have a cover, it is a collective cover that cannot be borrowed. Even in the past, borrowing from the Nghe An Province Cooperative Development Support Fund through the Social Policy Bank was very difficult. Cooperatives need to borrow capital but have difficulty with collateral, some cases do not have a clear production and business plan or are not convincing about feasibility and efficiency.

"To have capital to maintain operations, I had to use my family's personal card to borrow capital for the cooperative. This is a vicious cycle, a common situation of many cooperatives today. When implementing interest rate support credit packages, credit institutions need to research and implement simple and convenient procedures so that the policy can be put into practice, and cooperatives can more easily access preferential interest rate loan packages," said Mr. Hue.

Need to review and remove difficulties

After 2 years of implementing Resolution No. 20-NQ/TW of the Party Central Committee on continuing to innovate, develop and improve the efficiency of the collective economy in the new period and the revised Law on Cooperatives in 2023, awareness of the viewpoints, nature, position and role of the collective economic sector and cooperatives has become increasingly clearer and more consistent among Party committees, authorities at all levels and people of all walks of life. State management of the collective economy has been gradually innovated, and the state management apparatus for the collective economy and cooperatives has been gradually improved and more professionalized.

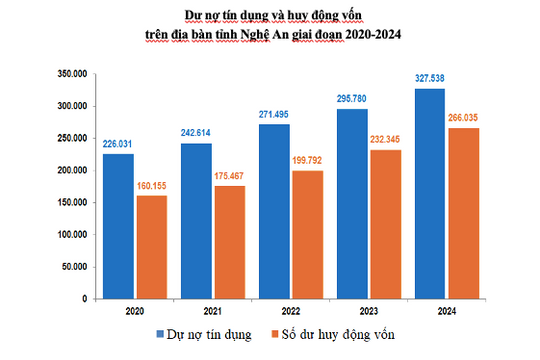

In 2024, Nghe An will develop 30 more cooperatives, bringing the total number of cooperatives operating in the province to 888/925. Of these, 545 cooperatives operate effectively (accounting for 61.4% of the total number of cooperatives operating). However, very few cooperatives are eligible to access bank loans. According to information from the State Bank of Vietnam, Nghe An branch, only 46 cooperatives have borrowed bank loans, of which 39 cooperatives still have outstanding loans with a total outstanding loan balance of more than 124 billion VND, cumulative loan turnover since the beginning of 2025 is more than 121.7 billion VND, bad debt is 2,320 billion VND...

Cooperatives' access to credit policies is still slow and faces many difficulties because they do not have collateral and are not bold enough to develop plans to expand production. Many cooperatives lack financial transparency, operate inefficiently, have weak management, and have limited staff qualifications. Meanwhile, the pandemic and economic difficulties, along with the pressure of fluctuating commodity and input material prices, have affected the business activities of cooperatives. Cooperatives develop unevenly between localities, regions, and areas, between agricultural and non-agricultural sectors. Market issues, application of science and technology, and digital transformation in cooperative operations still have many limitations. There is a situation of ineffective use of loans, wrong purposes, long-term overdue debts, and a mentality of dependence and waiting for support from the State...

In addition, the credit limit of lending policies is still low, mainly based on the value of mortgaged assets without considering the feasibility of the loan plan and there is no mechanism for cooperatives to borrow working capital for seasonal production.

Faced with the shortcomings in lending activities, solutions are required to enhance credit for collective economic types. In the report on the credit situation for the collective economic sector and cooperatives, Mr. Doan Manh Ha - Deputy Director of the State Bank of Nghe An branch said that it is necessary to review and propose to improve mechanisms and policies to facilitate the expansion of credit investment and increase access to banking products and services of the collective economic sector. Direct credit institutions to balance capital sources, focus credit on cooperative economic organizations and cooperatives operating in production and business fields, priority fields according to the Government's policies, new cooperative models that operate effectively, cooperatives participating in the development of products with strengths, production according to the value chain applying high technology, with high commercial value. Regularly research and develop diverse bank credit products; Review, improve and innovate processes, procedures and conditions for granting credit in accordance with the requirements and practical operations of cooperatives to gradually expand and increase capital support, as well as access to bank credit for collective economic types.

To be able to access bank credit capital, cooperatives need to overcome limitations such as scale, competitiveness, and management capacity; focus on improving management skills; develop scientific production and business plans that are suitable for practice; balance capital sources, depending on the financial capacity of the cooperative to decide on investment; strengthen joint ventures and associations between enterprises to implement projects and ensure resources. In particular, in the business process, cooperatives need to be aware of accumulating assets to have conditions to access loans from credit institutions.

.jpg)