500 million VND from customer's ATM card was taken out of account

The State Bank requested Vietcombank to coordinate with the investigation agency to clarify the customer's complaint about 500 million VND disappearing from the ATM card.

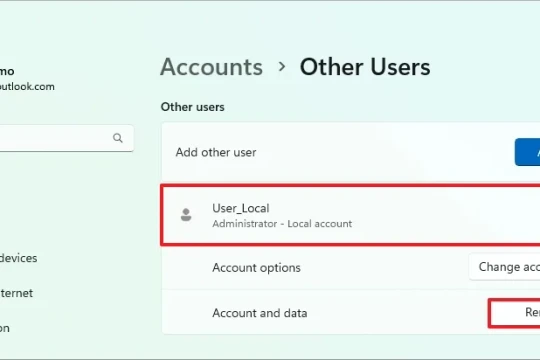

A representative of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) confirmed that the bank received a complaint from Ms. HTN Huong (Trung Hoa ward, Cau Giay district, Hanoi) about the disappearance of 500 million VND in her account number 001100115xxxx opened at Vietcombank, Tran Quang Khai branch.

Lost 500 million in 7 transactions, got back 300 million

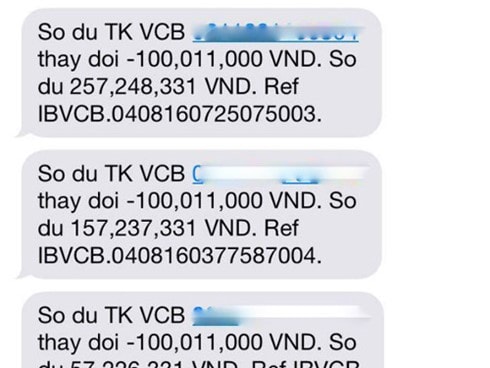

Specifically, at 12:56 on August 4, 2016, although no transaction was made, Ms. Huong's account was suddenly deducted 100 million VND. At 5:17 on August 5, 2016, the account automatically made 3 more transactions via Internet banking, each transaction deducting another 100 million VND.

|

| Ms. Huong's account was continuously deducted even though she did not make any transactions. Photo: VOV. |

After 7 such transactions, her account was deducted 500 million VND. At the same time, Ms. Huong also received a message from the bank notifying her account balance via email, but not by OTP code message as usual when making a transaction.

Seeing something unusual, Ms. Huong called Vietcombank to report and locked the account at 7:50 a.m. on August 5, 2016.

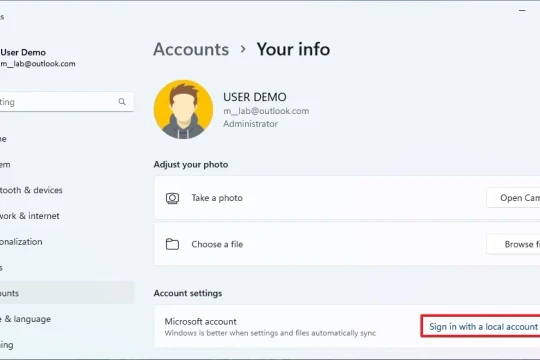

On the morning of August 8, after asking Ms. Huong to file an investigation, Vietcombank's transaction office in Ngoc Khanh (Ba Dinh, Hanoi) transferred back VND300 million to Ms. Huong.

The remaining 200 million VND of Ms. Huong is still "missing".

On the morning of August 12, a representative of the State Bank of Vietnam (SBV) said that the SBV has requested Vietcombank to coordinate with the investigation agency to clarify the above reflection, and will soon have official information.

The police have a clue.

Meanwhile, a Vietcombank representative said this morning the bank will work with the investigation agency to clarify the matter.

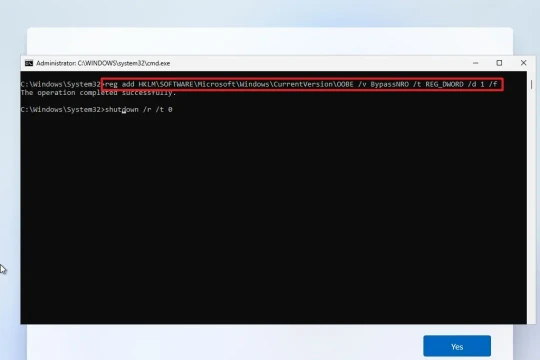

“There is a fake website that looks like Vietcombank’s website, but takes customers to a completely different link, causing the above incident. The police have found traces, but the customer is not cooperating with the investigation agency,” said a bank representative.

Affirming that the clue lies on the customer's device, the bank said that because the customer has not cooperated, the investigation is facing difficulties.

|

| The State Bank of Vietnam said it is asking Vietcombank to coordinate with the investigation agency to clarify the customer's complaint about 500 million VND disappearing from the ATM card. Photo: Duy Tin. |

“There is no such thing as a bank security system being hacked. Hacking is an attack on an organization, and the above case is just called Phishing, meaning they steal the accounts of individual users. Our security system has no problem at all,” Vietcombank representative emphasized.

The bank added that it cannot say that the bank "compensated" the customer 300 million VND, but "this is the loss the bank recovered for the customer after the above incident".

“We do not want to release too much information yet, because that would disrupt the investigation. During the working session yesterday afternoon (August 11), we had many in-depth discussions with customer Huong about this matter,” the representative said.

Can prosecute the case of fraud and appropriation of property

In response to the bank's response, Ms. Huong said that she had requested that all work between her and the bank be done via official dispatch. "They should tell me how the investigation is going, and when they will return my money," Ms. Huong said.

This customer added that she mainly conducts transactions on the computer and does not install transaction apps on her phone. She also does not click on strange websites as the bank said.

“I just came back from abroad on July 18, so I didn’t make any transactions. I don’t think I visited any strange websites. I registered to receive OTP codes via phone, but when the transaction occurred, I didn’t receive any text messages with OTP codes. I think there’s a problem with the bank’s system, because if not, why didn’t I receive an OTP code and the money was transferred?”, Ms. Huong added.

Sharing with Zing.vn, Ms. Huong said that she had just transferred the above amount of money into her ATM account to prepare for an important payment the next day. But before she could make the payment, an incident occurred with 4 card-to-card transfers and 3 Internet banking transactions.

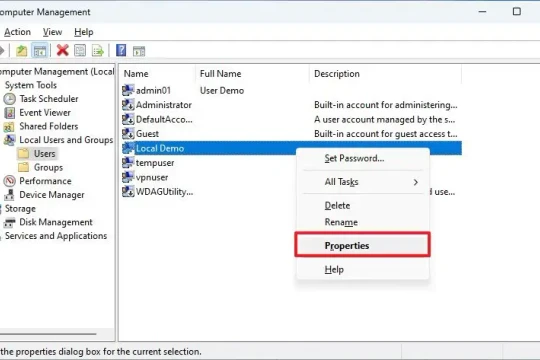

Lawyer Tran Tuan Anh, Director of Minh Bach Law Firm, commented that this case showed signs of fraudulent appropriation of property as prescribed in Article 139 of the 1999 Penal Code, amended and supplemented in 2009.

“What customers need to do now is to immediately file a report with the Investigation Agency, closely coordinate with the bank and the Investigation Agency to provide honest information, in order to quickly identify the behavior and the criminal to minimize damage,” said lawyer Tuan Anh.

According to this lawyer, in case of determining signs of crime, the Investigation Agency needs to initiate a case of Fraudulent Appropriation of Property, to investigate and find the perpetrator.

As for civil liability, because this behavior has signs of crime, Ms. Huong will be identified as the victim in the case. She has the right to file a petition, requesting the prosecuting agencies to force the offender to compensate her for the entire amount of money that was appropriated.

During the process of handling the case, the investigating agency also needs to clarify the errors of the related parties (such as the bank, the customer, etc.). Especially whether there is a security error on the bank's side or not, in order to immediately have a solution to avoid causing damage to the customer.

In recent days, Vietcombank has also continuously sent text messages and emails advising its customers to avoid risks in transactions and using online banking services.

The bank said that there are currently many methods used by criminals to defraud customers, such as impersonating Vietcombank staff to trick them into transferring money, faking notifications or VCB-iB@nking account login screens, etc.

“Customers absolutely must not provide any service security information, such as login name, access password, OTP transaction authentication code, Smart OTP activation code, email address and personal information to anyone and in any form,” Vietcombank recommends.

This is not the first time Vietcombank has sent system-wide warning messages about the risk of losing card information security.

Several other banks such as TPBank, Viettinbank, VIB, Sacombank... have recently also continuously issued warnings about electronic banking transactions, especially after the aviation incident at the end of last month.

According to Zing.vn

| RELATED NEWS |

|---|