Rectifying tax management, not omitting any taxpayers for non-agricultural land use tax

(Baonghean.vn) - The provincial Tax Department has just issued a document urging its affiliated Tax Departments and Branches to review, report, and manage taxes for cases of land use without decisions or land lease contracts. This is the issue that Nghe An Newspaper has reflected in the article "Paradox behind industrial clusters in Quy Hop".

Two Tax Departments "received" reminders

On April 9, 2024, the Provincial Tax Department issued Official Dispatch No. 1921/CT-HKDTK to the Tax Inspection and Examination Departments No. 01, 02, 03; Department of Management of Business Households, Individuals and Other Revenues; Vinh City Tax Department and Regional Tax Departments. Here, the Provincial Tax Department commented: "Recently, the Provincial Tax Department has issued many documents directing departments and Tax Departments to review and report cases of land use for land lease purposes without a Decision, Land Lease Contract, or Land Use Right Certificate (Official Dispatch No. 302/CT-HKDTK dated January 14, 2022, No. 552/CT-HKDTK dated February 3, 2023).

Accordingly, only 6 Tax Departments reported (Vinh City Tax Department and Regional Tax Departments: Song Lam I, Song Lam II, Phu Quy I, Bac Nghe I, Bac Nghe II) with a total of 22 cases of organizations using land without a Decision, Land Lease Contract, Land Use Right Certificate, the land lease term has expired but they are still using the land without procedures for land lease extension. In which, the Tax Departments have currently managed the collection of land rent and non-agricultural land use fees for 21/22 cases.

However, through coordination with relevant agencies, there is still information reflecting that there are organizations and individuals using land in the province but do not have Decisions, Land Lease Contracts, and Land Use Rights Certificates (which have not been reported in the reviewed list of the Tax Departments).

Therefore, "to fully implement tax management, not to miss any taxpayers", the Provincial Tax Department assigned the Tax Inspection - Examination Departments No. 01, 02, 03; the Department of Management of Business Households, Individuals and Other Revenues; the Vinh City Tax Department and the Regional Tax Departments to continue reviewing, reporting and managing taxes for cases of land use without a Decision, Land Lease Contract, or Land Use Right Certificate.

Specifically: “Regularly coordinate with the District People's Committee and relevant agencies to grasp information on cases of organizations using land for purposes requiring land rent payment without a Decision, Land Lease Contract, or Land Use Right Certificate to manage the collection of land rent and non-agricultural land use tax according to the provisions of Clause 2, Article 4, Circular 77/2014 dated June 16, 2014 of the Ministry of Finance.

At the same time, report to the Provincial Tax Department (for organizational land users) to transfer information to the competent authority for handling; For land users who are individuals and households, proactively report and request the District People's Committee (the competent authority to issue the Decision on land lease for individuals and households) to handle in accordance with regulations".

The Provincial Tax Department specifically reminded the Phu Quy I Tax Branch: "Strictly implement tax management for cases of land use without Decision, Land Lease Contract, Land Use Right Certificate in industrial clusters in the area". Remind the Bac Nghe II Tax Branch: "Manage the collection of land rent and non-agricultural land use for Long Thanh Investment and Construction Joint Stock Company for the land area whose lease term has expired but there are no procedures for extending the land lease term according to regulations".

And there are separate instructions for Tax Inspection and Examination Departments No. 1, 2, 3: During the inspection at the taxpayer's headquarters, the Inspection and Examination Teams shall conduct a review of land-using organizations that do not have a Decision or Land Lease Contract. If any of the above cases arise, the results of the review shall be summarized and reported to the Department of Business Household Management, Individuals and Other Taxes within 5 working days from the end of the Team's working time.

At the same time, it is emphasized: "Any Tax Department or Department that fails to review and manage land rent and non-agricultural land tax for cases of land use without a Decision or Land Lease Contract, or whose land lease term has expired but the land is still being used without procedures to extend the land lease term must take full responsibility."

Will "care" about industrial clusters in Quy Hop

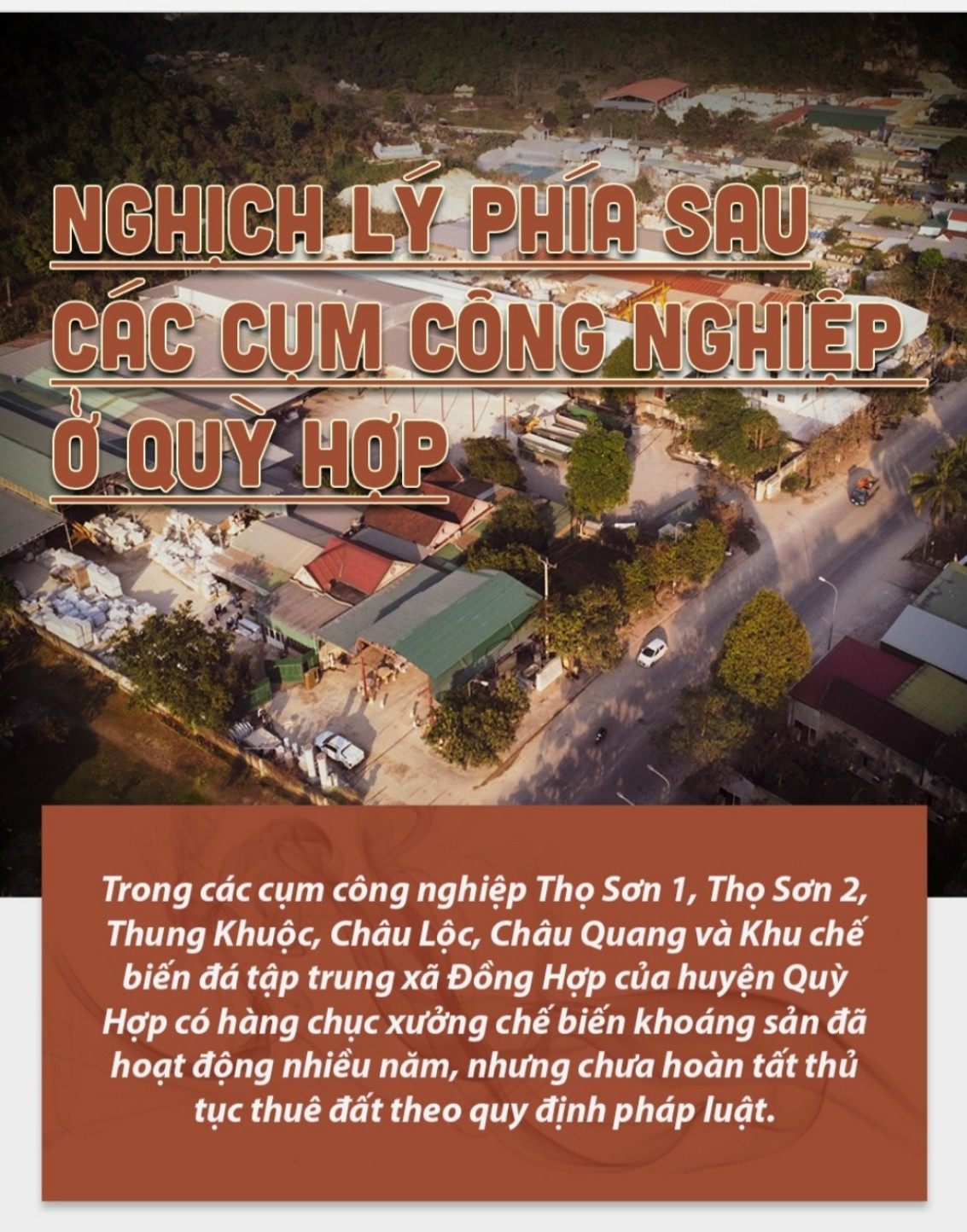

On March 21, 2024, Nghe An Newspaper published an article “The paradox behind industrial clusters in Quy Hop”. Here, information in the Industrial Clusters and Concentrated Stone Processing Zones in Quy Hop district shows that there are still 25 factories that have been operating for many years but have not been leased land by competent authorities (Tho Son 1 Industrial Cluster has 5 factories; Tho Son 2 Industrial Cluster has 7 factories; Thung Khuoc Industrial Cluster has 3 factories; Chau Quang Industrial Cluster has 1 factory; Chau Loc Industrial Cluster has 2 factories; Dong Hop Commune Concentrated Stone Processing Zone has 7 factories). Thereby, it is determined that this is a problem that needs to be promptly considered and resolved.

Recently, the People's Committee of Quy Hop district has completed the review of land-related issues that 25 processing factories in industrial clusters in the area are using. The review data shows that the land in the industrial clusters used by the 25 factories but not yet leased by competent authorities is very large.

Specifically, Dai Gia Phat Company is using 21,000m2; Hop Thinh Company Limited is using 56,000m2; An Loc Joint Stock Company is using 80,000m2; Toan Thang Company Limited is using 29,000m2; Hoang Anh Mineral Exploitation and Processing Company Limited is using 10,320.5m2; Phuc Hung Trading Company Limited is using 10,000m2; Tho Hop White Stone Powder Joint Stock Company is using 19,215m2; Long Anh Mineral Company Limited is using 15,212.5m2; Luong Vy Production and Trading Company Limited is using 17,516m2...

Industrial clusters in Quy Hop district have been recognized and approved for detailed planning for many years. Of which, Thung Khuoc Industrial Cluster was recognized and approved for detailed construction planning by the Provincial People's Committee in 2007. Tho Son 1 Industrial Cluster, Tho Son 2 Industrial Cluster, Chau Loc Industrial Cluster, Chau Quang Industrial Cluster, were all approved for detailed construction planning by the Provincial People's Committee in 2015.

This information proves that, for many years, the management of land rent and non-agricultural land tax collection at industrial clusters in Quy Hop district has not been in accordance with regulations, significantly affecting the revenue source for the State budget. The basic reason is that there are problems leading to 25 mineral processing factories not being leased land by competent authorities; but the Quy I Tax Department also has some responsibility in the management of land rent and non-agricultural land use tax!

Regarding this issue, a representative of the Provincial Tax Department said that, along with the direction in Official Dispatch No. 1921/CT-HKDTK dated April 9, 2024, the Tax Department has made specific requests to the Phu Quy I Tax Branch. "Land-using organizations are responsible for declaring taxes to the Tax authority; in the opposite direction, the Tax authority is also responsible for urging land-using organizations to fulfill their tax obligations to the State.

Therefore, the Tax Department has directed the Phu Quy I Tax Branch to conduct a review and promptly issue a comprehensive and detailed report. Once the report is available, the Tax Department will work with the Department of Natural Resources and Environment, report to the Provincial People's Committee to consider resolving difficulties, and thoroughly handle the land lease for mineral processing factories of organizations in industrial clusters in Quy Hop district, thereby recovering to the state budget the land lease fees and non-agricultural land taxes...", the representative of the Provincial Tax Department affirmed.