Portrait of a living legend of global investors

(Baonghean) - Running the world's largest hedge fund and famous for his accurate global macroeconomic forecasts that make governments and investors hold their breath. That is Ray Dalio - founder of Bridgewater Associates, a living legend of the global investment world.

|

| Ray Dalio – a global speculative legend with insightful comments on the nature of global finance (source: Forbes) |

Starting a business at the age of 12

Ray Dalio was born in 1949 in Jackson Heights, Queens, to an Italian family with no connection to the thriving financial industry in the United States. His father was a jazz musician in Manhattan, New York, while his mother was a housewife.

At the age of 8, Ray moved with his family to Manhasset and attended a local school. “It was a very unhappy time. I was a bad student in school, I learned by rote and had a terrible memory. I really hated studying,” Ray Dalio recalls.

But Ray's life took a turn at the age of 12 when he was hired as a caddy at a local golf club. Working at Links Golf Club helped Dalio learn his first lessons in the market and the value of money.

Golfer tips and conversational advice helped him quickly acquire his first shares of Northeastern Airlines. At $5 a share, these were the only stocks Dalio could afford at the time.

Ray Dalio got lucky on his first trade. Northeastern Airlines shares tripled in value shortly after. Dalio immediately cashed out with a substantial profit. “I realized the game wasn’t that hard,” Ray Dalio remarked.

His affinity for stocks and numbers helped Dalio enter college with market experience and a few thousand dollars in his account.

While still at Harvard Business School, Ray Dalio was hired as an accountant at the New York Stock Exchange, and then participated in transactions at Merrill Lynch.

All of that experience helped him and a group of friends set up a small property trading company called Bridgewater Associates – the greatest achievement of his later career.

Master of economic machine optimization

“Everything in the economy works like a machine. It’s the same way nature, the family, the cycle of life works. Our problem is to understand how the economic machine works to create the most wealth.”

Ray Dalio has talked about his approach to the markets, and how he turned Bridgewater Associates into the largest hedge fund on the planet with an account of up to 160 billion USD.

Dalio is actually a “macro” investor, whose main job is to bet on economic trends, such as changes in stock prices, inflation, and GDP growth. Researching profitable opportunities, Bridgewater buys and sells hundreds of different financial instruments around the world.

From Japanese bonds to copper futures in London to currency contracts in Brazil – which explains why the firm has kept an eye on the Greek debt crisis.

In 2007, Dalio predicted that the mortgage boom would have a bad ending. And a year later, he warned the Bush administration that the world's biggest banks were on the brink of bankruptcy.

And all of those predictions came true with the financial crisis of 2008. Of course, Dalio has a basis for his comments, and it is proven through his investment decisions. That basis is based on principles and systems.

He believes that what investors need is a balanced portfolio, one that yields well in different market conditions so that they can make money quickly and effectively. At the same time, he uses financial techniques to grasp basically all the bets.

Expert of “deadly” predictions

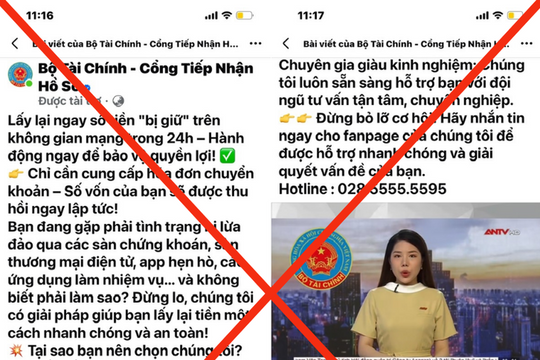

|

| Ray Dalio is famous for his business principles and strict working style that helped make him successful (source: AZ quotes) |

Ray Dalio's predictions have been about bad things, and most of them have been accurate. By studying the history of finance, Ray and his Bridgewater colleagues pieced together a detailed history of previous financial crises, dating back to Weimar Germany.

The brains at Bridgewater looked at all the public filings of most of the world's major financial institutions and built projections of how much money these institutions could lose on bad loans. The figure they came up with was $839 billion.

Armed with this information, Dalio did not hesitate to go straight to the US Federal Reserve in December 2007 and ask to meet some staff of Henry Paulson, the Chairman of this agency. But no one paid attention to what Ray presented, so he went to the White House, where he presented the numbers to higher economic officials. Ray's warning continued to be ignored in Washington.

In his January 2008 company newsletter, Ray Dalio argued that it would be a disaster in which “leverage creates a financial crisis, which in turn creates an economic crisis. This will continue until the monetary system recovers, currency devaluation, government guarantees, and the efficiency of key financial intermediaries.”

And as the crisis worsened, Dalio continued to assess it more accurately than senior policymakers. Finally, after the world knew the financial system was in a deep recession, few policymakers actually respected Ray Dalio's analysis.

Thanh Son