Gold price forecast for early 2026 to have a new strong growth cycle

World gold prices have temporarily calmed down after the peak in 2025, but experts predict that early 2026 will open a new strong growth cycle.

The world gold price is temporarily stagnating after 2 consecutive weeks of decline, but the fundamentals remain very stable. According to Ole Hansen, Head of Commodity Strategy at Saxo Bank, although the short-term momentum is weak, the long-term trend of the world gold price has not weakened.

Market sentiment shifted from euphoria to caution as investors reassessed factors such as interest rate cuts, fiscal stress, hedging needs and strong buying from central banks, he said.

In Asia, physical demand is cyclical. In India, the post-festival period typically sees a dip in purchasing power, but is expected to recover later in the year as global gold prices stabilize.

In China, the government ended VAT exemptions for some retailers buying gold through Shanghai exchanges, causing costs to increase slightly.

However, major investment channels such as gold bars, gold coins and ETFs are still tax-free, helping to maintain purchasing power and support stable world gold prices.

Fed Chairman Jerome Powell’s remarks that a December rate cut was “not certain” sent the dollar soaring and temporarily cooled global gold prices. However, US-China trade tensions and deeper issues such as supply chains, technology, and industrial policy remain unresolved.

Investors understand that the need to hold defensive assets like gold remains long-term, strengthening the position of world gold prices in the context of global instability.

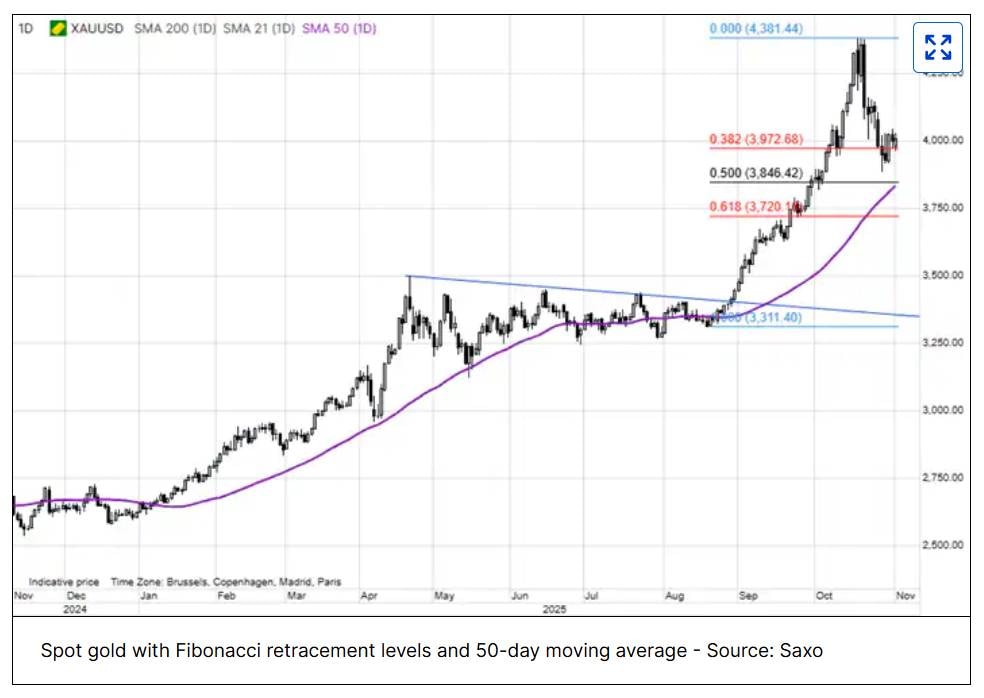

According to Hansen, this correction helps the market relieve pressure and maintain the long-term uptrend. The technical support zone of the world gold price is currently around 3,835 - 3,878 USD/oz, corresponding to the 50% Fibonacci level of the increase from August and the 50-day moving average.

Data shows that ETF capital flows remain stable, with no signs of strong withdrawals, while central banks continued to net buy more than 220 tons of gold in the third quarter, a factor that helped world gold prices maintain a balanced momentum.

Despite the short-term weakness, macro factors such as public debt, currency risks and Fed policy are still the driving force for the long-term upward trend of world gold prices.

According to Ole Hansen, the 2025 peak may have appeared, but the current phase is just accumulation before the new bull cycle. History shows that after sideways periods, gold often rebounds strongly when money flows back.

If the pattern repeats, early 2026 will mark the start of a new gold wave, bringing world gold prices into the next chapter in a strong growth cycle.