Gold price today March 17, 2025: World and domestic gold prices increased by 5 million in the first half of March

Gold price today March 17, 2025: World gold price increased by nearly 100 USD in March. Along with domestic gold price setting a new record with an increase of more than 5 million VND since the beginning of the month.

Domestic gold price today March 17, 2025

At the time of survey at 4:30 a.m. on March 17, 2025, domestic gold prices were at an all-time high for both gold bars and gold rings:

The price of SJC gold bars listed by DOJI Group is at 94.3-95.8 million VND/tael (buy - sell), unchanged in both buying and selling directions.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 94.3-95.8 million VND/tael (buy - sell), unchanged in both buying and selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 94.3-95.8 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 700 thousand VND/tael for buying and 200 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 94.5 - 95.8 million VND/tael (buying - selling, increased 100 thousand VND/tael in buying direction - unchanged in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 94.5 - 95.8 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 94.9-96.3 million VND/tael (buy - sell); unchanged in both buying and selling directions.

Bao Tin Minh Chau listed the price of gold rings at 95-96.6 million VND/tael (buy - sell); unchanged in both buying and selling directions.

Closing the week at an all-time high, gold bars increased by more than VND5 million per tael in the first half of March. The price of 9999 gold rings also increased by VND5.3 million per tael compared to the beginning of this month.

The latest gold price list today, March 17, 2025 is as follows:

| Gold price today | March 17, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 94.3 | 95.8 | - | - |

| DOJI Group | 94.3 | 95.8 | - | - |

| Mi Hong | 94.3 | 95.8 | -700 | -200 |

| PNJ | 94.3 | 95.8 | - | - |

| Vietinbank Gold | 95.8 | - | ||

| Bao Tin Minh Chau | 94.5 | 95.8 | - | - |

| Phu Quy | 94.5 | 95.8 | - | - |

| 1.DOJI- Updated: 17/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 94,300 | 95,800 |

| AVPL/SJC HCM | 94,300 | 95,800 |

| AVPL/SJC DN | 94,300 | 95,800 |

| Raw material 9999 - HN | 94,900 | 95,400 |

| Raw materials 999 - HN | 94,800 | 95,300 |

| AVPL/SJC Can Tho | 94,300 | 95,800 |

| 2.PNJ- Updated: 17/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 94,500 | 96,200 |

| HCMC - SJC | 94,300 | 95,800 |

| Hanoi - PNJ | 94,500 | 96,200 |

| Hanoi - SJC | 94,300 | 95,800 |

| Da Nang - PNJ | 94,500 | 96,200 |

| Da Nang - SJC | 94,300 | 95,800 |

| Western Region - PNJ | 94,500 | 96,200 |

| Western Region - SJC | 94,300 | 95,800 |

| Jewelry gold price - PNJ | 94,500 | 96,200 |

| Jewelry gold price - SJC | 94,300 | 95,800 |

| Jewelry gold price - Southeast | PNJ | 94,500 |

| Jewelry gold price - SJC | 94,300 | 95,800 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 94,500 |

| Jewelry gold price - Jewelry gold 999.9 | 93,600 | 96,100 |

| Jewelry gold price - 999 jewelry gold | 93,500 | 96,000 |

| Jewelry gold price - 99 jewelry gold | 92,740 | 95,240 |

| Jewelry gold price - 916 gold (22K) | 85,630 | 88,130 |

| Jewelry gold price - 750 gold (18K) | 69,730 | 72,230 |

| Jewelry gold price - 680 gold (16.3K) | 63,000 | 65,500 |

| Jewelry gold price - 650 gold (15.6K) | 60,120 | 62,620 |

| Jewelry gold price - 610 gold (14.6K) | 56,270 | 58,770 |

| Jewelry gold price - 585 gold (14K) | 53,870 | 56,370 |

| Jewelry gold price - 416 gold (10K) | 37,630 | 40,130 |

| Jewelry gold price - 375 gold (9K) | 33,690 | 36,190 |

| Jewelry gold price - 333 gold (8K) | 29,360 | 31,860 |

| 3.SJC- Updated: 17/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 94,300 | 95,800 |

| SJC 5c | 94,300 | 95,820 |

| SJC 2c, 1C, 5 phan | 94,300 | 95,830 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 94,200 | 95,700 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 94,300 | 95,800 |

| 99.99% Jewelry | 94,200 | 95,400 |

| 99% Jewelry | 91,455 | 94,455 |

| Jewelry 68% | 62,028 | 65,028 |

| Jewelry 41.7% | 36,935 | 39,935 |

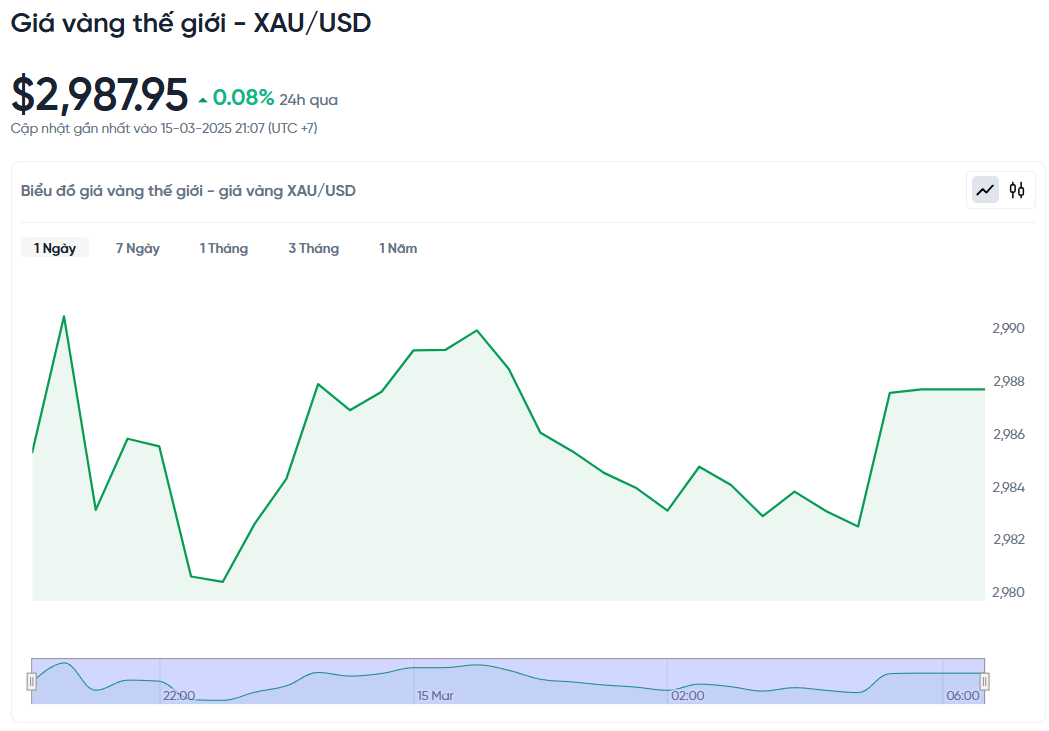

World gold price today March 17, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 2,987.95 USD/ounce. Today's gold price is unchanged from yesterday but increased by 74.64 USD/ounce compared to last week. Converted to the USD exchange rate, on the free market (25,820 VND/USD), the world gold price is about 94.03 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 1.77 million VND/tael higher than the international gold price.

The world gold price has just reached an important milestone last week when it surpassed the threshold of 3,000 USD/ounce. Although currently down more than 20 USD compared to the peak, the world gold price last week still increased to 74.64 USD/ounce. Compared to the beginning of March, the gold price has increased sharply by nearly 100 USD/ounce.

Analysts have been waiting for gold to break $3,000 since the start of the year, and some predict that this key level could trigger profit-taking. However, market sentiment remains bullish, and more analysts are raising their gold price targets for this year.

Paul Williams, CEO of Solomon Global, commented that the price of gold breaking through the psychological $3,000 mark is a direct response to escalating trade tensions and the accompanying economic uncertainty.

Mr Trump’s latest tariff threat, a 200% levy on wine imports from the EU, has sent shockwaves through global markets, spurring demand for safe-haven assets. This is not just a knee-jerk reaction to individual policies, but also a response to investors seeking protection from systemic risk.

Stuart O'Reilly, Chief Market Analyst at The Royal Mint, said: 'While equity markets have been volatile recently, safe-haven assets such as gold have been rallying, sending the price of gold to record highs. Supported by global trade tensions and continued central bank buying, the price of gold in sterling has risen more than 9% since the start of the year.'

Alex Kuptsikevich, Market Analyst at FxPro, said that the decline in inflationary pressures over the past week has also contributed to the rise in gold prices. This has created conditions for the Federal Reserve to cut interest rates this year, and the market is now expecting two rate cuts by the end of the year.

In addition to the safe-haven appeal, Macquarie also said that gold prices are supported by the worsening outlook of the US government's growing debt. The US government is once again facing the risk of a shutdown due to the failure of Congress to pass a new budget bill. Analysts predict that the US government will not be able to significantly cut spending.

Jesse Colombo, an independent precious metals analyst, said gold prices are in a strong uptrend. He said weak equity markets could continue to support gold's rally. "The shift from equities to gold is just beginning, and this will fuel gold's rally for years to come," Colombo said.

Other US economic data due for release on Thursday includes a report on weekly jobless claims.

Gold price forecast

Paul Williams predicts that with the current momentum, gold prices could reach $3,500 by summer and $4,500 within a year.

Kuptsikevich said that gold prices could correct after hitting $3,000, but noted that buyers are still holding the upside momentum. "Technically, we see a typical bullish continuation after a downside correction. The potential target for this rally is the $3,190 area, and the further target is the $3,400 area," he said.

David Morrison, senior market analyst at Trade Nation, said that gold could see a short-term correction after reaching this historic level. 'Traders need time to get used to trading in this new price zone. It will be interesting to see how gold fares over the weekend. It is worth noting that gold is not yet overbought at current levels,' he said.

Despite the high price of gold, Macquarie notes that the market is not in much of a bubble right now. They add that with investment demand for gold-backed ETFs down 20% from their 2020 all-time high, the market still has plenty of room to rise well beyond the $3,000 mark.

Technically, April gold futures bulls have a clear near-term technical advantage. The bulls’ next upside price objective is to close above strong resistance at the record high of $2,974. Meanwhile, the bears are aiming to push prices below strong technical support at last week’s low of $2,844.10.

First resistance is now seen at last night's high of $2,958.90, followed by $2,974. First support is seen at last night's low of $2,942.20, followed by Wednesday's low of $2,911.

Fifteen analysts participated in the Kitco News gold survey this week. While Wall Street optimism has eased slightly from last week, the majority still expect gold prices to continue rising. Specifically, nine experts (60%) predict gold prices will rise next week, while three analysts (20%) see prices falling, and the remaining three predict prices will remain flat.

Meanwhile, Kitco’s online survey of 262 participants found that retail investor sentiment was largely unchanged from last week. 175 traders (67%) expect gold prices to surpass $3,000 next week, while 47 (18%) expect prices to fall, and 40 (15%) expect prices to remain flat.

Commodity analysts see very low downside risk for gold this year. They argue that for the structural support environment for gold to change, there would need to be a change in U.S. budget deficit forecasts or positive reasons for real yields to be higher over the long term. However, this is not their current base case.