Gold price today March 15, 2025: World and domestic gold prices increase to historic levels

Gold price today March 15, 2025: World gold price increased sharply to the historical mark of 3000 USD. Pulling domestic gold price to an all-time high of over 96 million for both gold bars and gold rings.

Domestic gold price today March 15, 2025

At the time of survey at 4:30 a.m. on March 15, 2025, domestic gold prices increased to an all-time high for both gold bars and gold rings:

DOJI Group listed the price of SJC gold bars at 94.3-95.8 million VND/tael (buy - sell), an increase of 1.4 million VND/tael in both buying and selling.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 94.3-95.8 million VND/tael (buy - sell), an increase of 1.4 million VND/tael in both buying and selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 94.8-96 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1.3 million VND/tael for both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 94.4-95.8 million VND/tael (buying - selling), an increase of 1.4 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 94.5 - 95.8 million VND/tael (buy - sell), gold price increased 1.5 million VND/tael in buying - increased 1.4 million VND/tael in selling compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 94.9-96.3 million VND/tael (buy - sell); an increase of 1.3 million VND/tael for buying and an increase of 1.4 million VND/tael for selling.

Bao Tin Minh Chau listed the price of gold rings at 94.9-96.5 million VND/tael (buy - sell); increased 1.55 million VND/tael for buying and increased 1.5 million VND/tael for selling.

The latest gold price list today, March 15, 2025 is as follows:

| Gold price today | March 15, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 94.3 | 95.8 | +1400 | +1400 |

| DOJI Group | 94.3 | 95.8 | +1400 | +1400 |

| Mi Hong | 94.8 | 96 | +1300 | +1300 |

| PNJ | 94.3 | 95.8 | +1400 | +1400 |

| Vietinbank Gold | 95.8 | +1400 | ||

| Bao Tin Minh Chau | 94.4 | 95.8 | +1400 | +1400 |

| Phu Quy | 94.5 | 95.8 | +1500 | +1400 |

| 1.DOJI- Updated: 03/15/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 94,300▲1400K | 95,800▲1400K |

| AVPL/SJC HCM | 94,300▲1400K | 95,800▲1400K |

| AVPL/SJC DN | 94,300▲1400K | 95,800▲1400K |

| Raw material 9999 - HN | 94,900▲1300K | 95,400▲1400K |

| Raw materials 999 - HN | 94,800▲1300K | 95,300▲1400K |

| AVPL/SJC Can Tho | 94,300▲1400K | 95,800▲1400K |

| 2.PNJ- Updated: 03/15/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 94,500▲1200K | 96,200▲1400K |

| HCMC - SJC | 94,300▲1400K | 95,800▲1400K |

| Hanoi - PNJ | 94,500▲1200K | 96,200▲1400K |

| Hanoi - SJC | 94,300▲1400K | 95,800▲1400K |

| Da Nang - PNJ | 94,500▲1200K | 96,200▲1400K |

| Da Nang - SJC | 94,300▲1400K | 95,800▲1400K |

| Western Region - PNJ | 94,500▲1200K | 96,200▲1400K |

| Western Region - SJC | 94,300▲1400K | 95,800▲1400K |

| Jewelry gold price - PNJ | 94,500▲1200K | 96,200▲1400K |

| Jewelry gold price - SJC | 94,300▲1400K | 95,800▲1400K |

| Jewelry gold price - Southeast | PNJ | 94,500▲1200K |

| Jewelry gold price - SJC | 94,300▲1400K | 95,800▲1400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 94,500▲1200K |

| Jewelry gold price - Jewelry gold 999.9 | 93,600▲1400K | 96,100▲1400K |

| Jewelry gold price - 999 jewelry gold | 93,500▲1390K | 96,000▲1390K |

| Jewelry gold price - 99 jewelry gold | 92,740▲1390K | 95,240▲1390K |

| Jewelry gold price - 916 gold (22K) | 85,630▲1280K | 88,130▲1280K |

| Jewelry gold price - 750 gold (18K) | 69,730▲1050K | 72,230▲1050K |

| Jewelry gold price - 680 gold (16.3K) | 63,000▲950K | 65,500▲950K |

| Jewelry gold price - 650 gold (15.6K) | 60,120▲910K | 62,620▲910K |

| Jewelry gold price - 610 gold (14.6K) | 56,270▲850K | 58,770▲850K |

| Jewelry gold price - 585 gold (14K) | 53,870▲820K | 56,370▲820K |

| Jewelry gold price - 416 gold (10K) | 37,630▲580K | 40,130▲580K |

| Jewelry gold price - 375 gold (9K) | 33,690▲530K | 36,190▲530K |

| Jewelry gold price - 333 gold (8K) | 29,360▲460K | 31,860▲460K |

| 3.SJC- Updated: 03/15/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 94,300▲1400K | 95,800▲1400K |

| SJC 5c | 94,300▲1400K | 95,820▲1400K |

| SJC 2c, 1C, 5 phan | 94,300▲1400K | 95,830▲1400K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 94,200▲1400K | 95,700▲1400K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 94,300▲1400K | 95,800▲1400K |

| 99.99% Jewelry | 94,200▲1400K | 95,400▲1400K |

| 99% Jewelry | 91,455▲1386K | 94,455▲1386K |

| Jewelry 68% | 62,028▲952K | 65,028▲952K |

| Jewelry 41.7% | 36,935▲583K | 39,935▲583K |

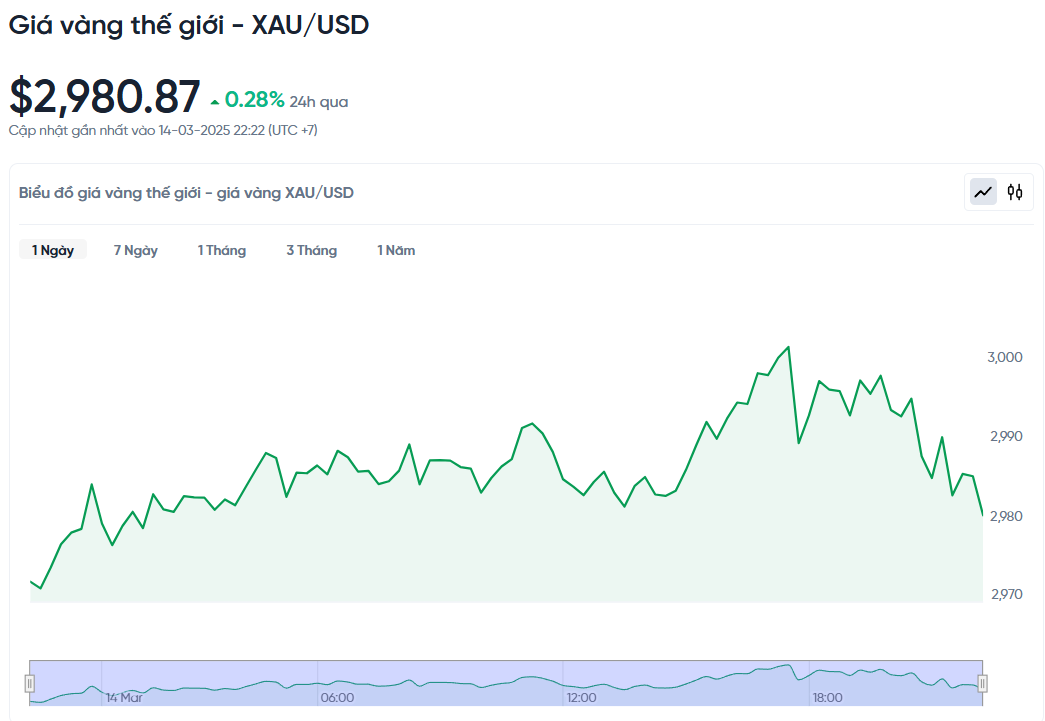

World gold price today March 15, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 2,980.87 USD/ounce. Today's gold price increased by 8.63 USD compared to yesterday. Converted according to the USD exchange rate, on the free market (25,840 VND/USD), the world gold price is about 93.88 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 1.92 million VND/tael higher than the international gold price.

The world gold price has surpassed the important threshold of 3,000 USD for the first time, marking a historic milestone as investors flock to this safe asset to protect against economic instability caused by US President Donald Trump's tariff war.

Spot gold prices rose to a record high of $3,004.86 per ounce at 5:30 p.m. yesterday, March 14. Meanwhile, US gold futures also rose 0.4% to $3,002.30.

According to Tai Wong, an independent metals trader, the price of gold breaking above the $3,000 mark was driven by investors looking for an absolute safe asset amid the volatile stock market due to Mr. Trump's policies.

Gold prices are up nearly 14% this year so far, in part due to concerns about the impact of tariffs and a slump in stock markets.

President Trump’s protectionist policies have caused turmoil in global markets, leading to a weeklong sell-off in US stocks that pushed the S&P 500 into correction territory and wiped out $4 trillion in market value. Ole Hansen, head of commodity strategy at Saxo Bank, said real asset managers, especially in the West, need strong equity markets and recession fears to return to gold — and that’s happening.

Demand from central banks has also contributed to the rise in gold prices. China, one of the largest buyers of gold, increased its gold reserves for the fourth consecutive month in February. David Russell, CEO of GoldCore, said central banks are continuing to buy gold at record levels to diversify away from the increasingly volatile US dollar.

Expectations of further monetary easing by the US Federal Reserve have also supported non-yielding gold. The Fed is expected to keep interest rates unchanged next week, although traders are betting on further rate cuts in June.

However, gold prices are likely to correct sharply once trade issues are resolved and asset markets recover, according to Tai Wong.

Besides gold, other precious metals also recorded price increases. Silver increased 0.3% to $33.9 an ounce, platinum increased 0.3% to $997.00, and palladium increased 2.1% to $978.18.

Gold price forecast

Amid the strong rally, many experts on Wall Street have raised their forecasts for gold prices. Macquarie Group predicts that the precious metal could reach $3,500 an ounce by the third quarter of 2025. In recent trading, gold futures surpassed $2,990 an ounce as rising trade tensions and low inflation data fueled speculation that the Fed could soon cut interest rates.

Marcus Garvey, head of commodity strategy at Macquarie, said gold prices are far exceeding initial expectations. His new forecast suggests gold could average $3,150 an ounce by the third quarter of 2025 and peak at $3,500 an ounce.

BNP Paribas also raised its gold price forecast to above $3,100/ounce in the second quarter of 2025. According to strategist David Wilson, this change mainly comes from inflation risks due to tariff policies, along with declining growth expectations of the US and global economies, causing increasing demand for gold.

Additionally, Goldman Sachs recently raised its year-end gold price forecast to $3,100 an ounce, up from its previous forecast of $2,890 an ounce.

Gold ETFs have also been buying more aggressively as interest rates have fallen, offsetting investor repositioning amid signs of easing uncertainty. However, if trade and geopolitical tensions remain high, especially tariff disputes in the US, gold prices could surge to $3,300 an ounce as speculation returns.

Key factors driving gold prices to continue rising include a weaker US dollar, rising trade tensions and geopolitical uncertainties. While gold may not hit $3,300 an ounce anytime soon, the overall trend remains upward.

Although the long-term trend of gold is upward, the market can still witness strong fluctuations. In the short term, gold prices could fall by $50 to $70 per ounce due to profit-taking pressure, before recovering if the global economic situation worsens. This is an important factor that investors need to consider before making a trading decision.

Short-term corrections can present buying opportunities, especially as technical analysis suggests a bullish flag could push gold prices to $3,300 an ounce. Corrections to the $2,900 an ounce region are still seen as good buying opportunities.

In the domestic market, gold prices also increased sharply following the world trend. On March 14, SJC gold bars reached a record high of VND96 million/tael, while gold rings reached VND96.5 million/tael. With the current increase in world gold prices, the VND100 million/tael mark is gradually becoming a reality.