A series of car brands may no longer be protected in Vietnam.

The proposal to reduce tax on new components only applies to three businesses, the rest will not be protected in assembly but will have to switch to importing.

The Ministry of Finance recently submitted to the Government a proposal to adjust the import tax rate for auto parts to 0%, in order to help domestic auto manufacturers reduce production costs, thereby reducing car prices, increasing competitive advantage with imported cars when the 2018 import tax on complete units from ASEAN is approaching to 0%, thereby protecting the domestic auto manufacturing industry.

According to the new proposal, the import tax on components will be reduced to 0% within 5 years from 2018 to 2022 for two main vehicle lines: passenger cars and small trucks. Passenger cars include passenger cars with less than 9 seats, engines of 2 liters or less, fuel consumption of less than 7 liters/100 km and small trucks include trucks with a total weight of 5 tons or less. Other vehicle lines are not included in the incentives.

Offer is for a limited number of car manufacturers only

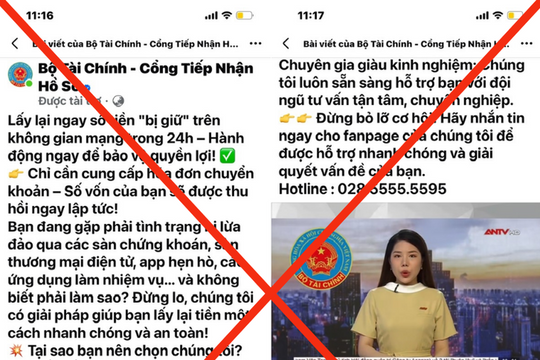

|

Domestically assembled cars like Vios can have component taxes reduced. |

Two options proposed by the Ministry of Finance to reduce tax on components for cars and small trucks include:

(1) Reduce import tax of 163 component lines to 0%.

This will help reduce the average tax rate on the entire set of components from the current 14-16% to 7% for passenger cars and 1% for small trucks.

(2) Reduce import tax of 19 lines of components (engines, gearboxes, transmissions, high-pressure pumps) from 3%, 5%, 10%,...., 50% to 0%. At the same time, reduce tax of 42 other types of accessories from 15%, 20% and 25% to 10%.

This method helps reduce the average tax rate for the entire set of components from the current 14-16% to 9-11% for cars and 7.9% for trucks.

Components that are subject to a 0% tax rate must satisfy the condition that they cannot be produced in Vietnam. The first option shows that the cost reduction will be deeper, more beneficial to the manufacturer. However, the constraint in the proposal is that not all car manufacturers with assembled cars will enjoy the incentives, but require ensuring a group of three other conditions including growth rate; the company's output in the year; output of registered car models and domestic value ratio. Specifically, as shown in the table below for passenger cars:

| Route | 2018 | 2019 | 2020 | 2021 | 2022 | Total stage 2018-2020 |

| Annual growth rate | 16% | 16% | 16% | 16% | 16% | |

| Minimum overall output (units) | 34,000 | 40,000 | 46,000 | 53,000 | 61,000 | 234,000 |

| Minimum output per vehicle and domestic production value ratio | 20,000 (20%) | 23,000 (25%) | 27,000 (30%) | 31,000 (35%) | 36,000 (40%) | 137,000 (40%) |

With the above roadmap, the Ministry of Finance believes that only three businesses are qualified. The Ministry did not specify which companies they are, but experts said that based on actual sales and production, they are Truong Hai, Hyundai Thanh Cong and Toyota Vietnam.

At the end of 2016, Truong Hai sold 65,000 cars, of which Kia 33,000 and Mazda 32,000. Most of the cars of these two brands are assembled, some imported models have low sales, not contributing much. With the growth rate and the strategy of developing assembly for export, the output of 61,000 assembled cars in 2018 is very feasible. Potential models to achieve a minimum output of 20,000 cars/year are Mazda3, CX-5 and Kia Morning.

Hyundai Thanh Cong also opened the door to new proposals. In 2016, the sales volume was 36,000 cars, of which the imported i10 alone was more than 21,000. In 2017, the i10 switched from import to assembly, the selling price decreased, so the company is confident that the number of over 20,000 is completely reasonable. From 2017-2018, Hyundai will also switch 90% of the products being sold to assembly, currently including Santa Fe, Elantra, i10 and Tucson. Therefore, the overall production target is also within reach.

Finally, Toyota Vietnam. The Japanese joint venture still has Vios and Innova to look forward to becoming the sales trigger for the coming years. Vios has the highest sales of Toyota, selling up to 17,600 cars in 2016, so it can reach 20,000 cars in 2018. Innova is lower at about 11,300 cars. A car model with sales as high as Innova is Fortuner, but the company switched from assembly to import in early 2017.

How do other car companies gain/lose?

|

Assembled cars must reach 20,000 units in 2018 to qualify for tax reduction. |

According to representatives of car manufacturers belonging to the Vietnam Automobile Manufacturers Association (VAMA), the proposal benefits a few businesses, while the rest are disadvantaged. Even the three companies themselves are not completely sure. The proposed tax incentives do not apply to components that can already be produced in Vietnam. This could lead to a situation where one company cannot use components from another.

In the rest of the market, most car manufacturers cannot meet the above standards, which means that if they want to assemble cars in Vietnam, they still have to pay high component taxes as they do now.

Disagreeing with the proposal, VAMA proposed that the Ministry of Finance apply the above import tax rate for components to all brands and models assembled in Vietnam. The association believes that when the import tax on cars from ASEAN is 0%, the import tax on components must also be 0% for all subjects to create fairness between CBU and CKD cars, and there is nothing more special to call it "incentive".

A representative said that the cost of producing a car model in Vietnam is about 20% higher than in Thailand. When the tax on components is reduced to 0%, the total cost of production will decrease by about 3-4%, which means that cars assembled in Vietnam are still about 16-17% higher than those in Thailand. Therefore, by 2018, imported Thai cars will be significantly cheaper, threatening assembled cars.

"Not only reducing component tax to 0%, assembled cars also need other incentives, otherwise they will lose completely."

The "other incentives" this person mentioned may include incentives on special consumption tax. In early July, the Ministry of Finance hadproposal to exempt special consumption taxFor the value created domestically for each car model, this is a huge incentive that, if realized, will help assembled cars reduce prices deeply, threatening imported cars.

Both proposals have a major problem of violating the principle of equal treatment (MFN) between countries in the WTO. However, according to the Ministry of Finance, it is still possible to "get around" it because the basis of the exception in the WTO is to meet environmental requirements (applicable to small capacity engines) and only carried out in a short period of time (5 years). This is also the method that neighboring countries such as Indonesia and Thailand have applied for a long time.

For car importers, the two proposals are a major blow to their business. Those who import cars are completely dependent on the cost price in the exporting country and the tax barriers of the Vietnamese government.

Car manufacturers in Vietnam are "holding their breath" waiting for changes in the Government's policy on the domestic automobile industry, directly affected by the war between assembly and import. However, to be able to come to a conclusion and the proposals to come into reality, it is not possible to apply them from the beginning of 2018, because it takes time to adjust, approve as well as for car manufacturers to prepare for business plans. Some experts predict that by mid-2018 or even early 2019, the new proposals can be implemented.

According to VNE

| RELATED NEWS |

|---|