Exceeding tax collection targets, actively supporting people and businesses to overcome difficulties

(Baonghean.vn) - The Tax sector must be determined to exceed the budget revenue target, while actively supporting people and businesses, according to the direction of Deputy Minister of Finance Cao Anh Tuan at the online conference to review tax work in the first 6 months and deploy tasks for the last 6 months of 2023.

Attending and chairing the conference from Hanoi were comrades: Cao Anh Tuan - Deputy Minister of Finance; Mai Xuan Thanh - Acting Director General of the General Department of Taxation and representatives of leaders of departments and offices under the General Department of Taxation and related ministries and branches.

Chairing the conference from Nghe An bridge point were comrade Nguyen Dinh Duc - Director of Nghe An Tax Department; representatives of departments, offices of the Provincial Tax Department and regional tax branches.

In the first 6 months of 2023, the implementation of tasks was carried out in the context of complicated and unpredictable socio-economic developments, especially the GDP in the first 6 months of the year was lower than the set scenario (only 3.72%), but the whole industry was proactive, had creative solutions and implementation scenarios, so basically the set goals were well achieved.

Budget revenue managed by the industry is estimated at 743,003 billion VND, equal to 54.1% of the ordinance estimate, equal to 94.2% over the same period.

By locality, 19/63 provinces and cities have budget implementation progress higher than 55%; 15/63 localities, including Nghe An, have average collection level of 50-55%; and 23/63 localities have collection progress lower than 50%.

In parallel with implementing professional measures and tax management functions, the industry effectively carries out propaganda work to support taxpayers; effectively organizes the implementation of tax declaration and accounting management, and strictly controls value-added tax refunds in accordance with regulations.

In addition, the Tax sector also implements the following:tax extension, exemption and reduction policies, land rent to support businesses and people to overcome difficulties, restore and develop production and business; continue to build and perfect institutions, policies and tax laws; promote electronicization and digitalization of tax management, develop information technology applications to meet new requirements of tax management...

At the conference, representatives of local Tax Departments and a number of departments and offices reported on outstanding results of tax work in the first 6 months of the year in their localities and units; at the same time, presented lessons learned from practical implementation.

At the conference, the representative of Nghe An Tax Department reported on a number of solutions to improve the prevention and control of the buying and selling of electronic invoices.

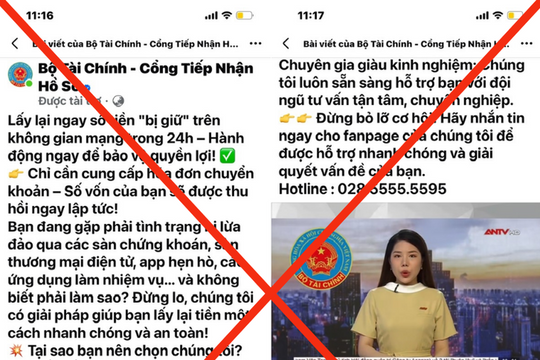

Accordingly, based on the assessment of the current status of the implementation of the electronic invoice system in Nghe An (from July 1, 2022), the Provincial Tax Department pointed out a number of limitations and causes in current policies and legal regulations, such as the penalties for buying and selling invoices are still light and not deterrent enough; the reception and processing of registration for the use of electronic invoices by newly established taxpayers has potential risks.

In fact, Nghe An has temporarily suspended invoice registration for 91 newly established enterprises. Therefore, at this conference, Nghe An Tax Department proposed a number of solutions on policies and management methods toprevent the buying and selling of electronic invoicestight, effective

According to the report of Nghe An Provincial Tax Department, the total domestic revenue in the first 6 months of 2023 reached 7,898 billion VND, equal to 54% of the estimate and 82% compared to the same period. To complete the budget revenue target, from now until the end of the year, Nghe An Tax Department has proposed 7 tax tasks and 16 groups of solutions to implement.

Based on the assessment report and comments from the Tax Departments of localities, Comrade Cao Anh Tuan - Deputy Minister of Finance gave a speech to acknowledge the efforts of the entire sector in the first 6 months of the year; at the same time, based on the situation and forecast of socio-economic development and factors affecting the budget collection in the last 6 months of the year, thereby, requesting the Tax sector to closely follow the directions of the Government and the Ministry of Finance in the past time to develop more specific solutions in the coming time; strengthen propaganda work to support taxpayers to both "collect taxes but must gain the hearts of the people" as Uncle Ho taught the Tax sector; ensure to both exceed the budget collection target, but also actively support people and businesses, overcome difficulties, and recover the economy.

Next, on the basis of receiving the direction of the representative of the Ministry of Finance, the representative of the General Department of Taxation concluded and proposed a number of requirements and solutions for the entire industry and local Tax Departments to implement; the industry strives to resolutely and drastically complete and exceed the set budget revenue target, at the same time, continue to effectively implement support policies and extensions on tax exemption and reduction in general and land tax in particular./.