Difficulties and obstacles in tax collection authorization in mountainous areas

(Baonghean.vn) - That is the information stated at the working session between the Provincial People's Council's Supervisory Delegation and the People's Committee of Quy Hop town on the morning of April 19 according to the supervision program on budget collection in Nghe An province from 2016 to 2018.

|

| Attending the meeting were Ms. Cao Thi Hien - Member of the Provincial Party Standing Committee, Vice Chairman of the Provincial People's Council and members of the Provincial People's Council's monitoring delegation. Photo: Phuong Thuy |

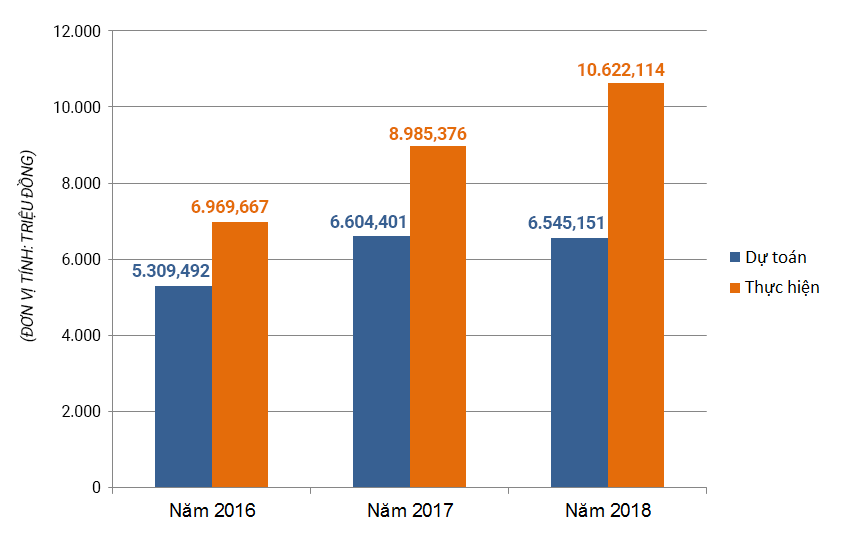

According to the report, the budget revenue from 2016-2018 of the People's Committee of Quy Hop town met and exceeded the set plan. However, based on actual monitoring and listening to the opinions of the People's Committee of Quy Hop town, the members of the monitoring delegation raised some concerns.

Specifically, the Tax Advisory Council as well as the People's Committee of Quy Hop town need to clarify the debt situation in the past 3 years; the situation of business development in the town; the difficulties and shortcomings in tax collection for individual business households; the situation of business households that are qualified to establish a business but do not establish it to avoid paying state taxes; fees and charges (including business license fees) tend to decrease...

|

| Total budget revenue of Quy Hop Town People's Committee in the period of 2017 - 2018. Graphics: Huu Quan |

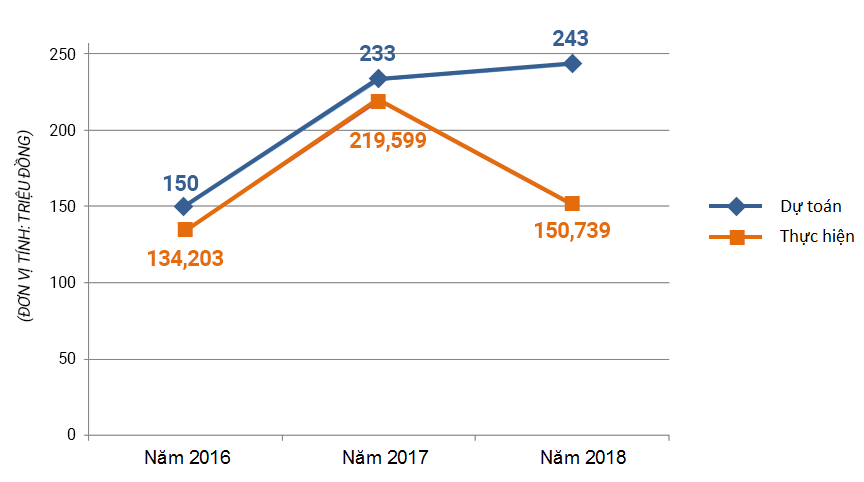

Regarding budget collection, Mr. Nguyen Thanh Quynh, Chairman of the Town People's Committee, admitted that the current business tax collection in the area from 2016 to 2018 has tended to decrease. Explaining this issue, the Chairman of the Town People's Committee said that from 2016 onwards, the Town People's Committee implemented business tax collection according to Decree No. 75/2002/ND-CP dated August 30, 2002 of the Government on adjusting the business tax rate applied in practice, which is very easy to manage, business households ensure their obligations as citizens, and revenue increases.

However, from 2017 to present, according to Decree 139/2016/ND-CP, business households with revenue of 100 million or less do not have to pay taxes, causing revenue to decrease. Therefore, it is recommended to adjust regulations and policies to suit the local situation.

|

| Collection of fees and charges (including business license fees) of Quy Hop Town People's Committee in the period of 2016 - 2018. Photo: Huu Quan |

Regarding the issue of tax collection authorization in the area, Deputy Head of Quy Hop District Tax Department Quan The Vuong said that the pilot implementation of tax collection authorization via post office for business individuals paying tax according to the lump sum method has been implemented since the fourth quarter of 2017. Although the staff of all parties have made great efforts, it is inevitable that there will be some initial difficulties and problems.

|

| Public announcement of tax payers and tax debts at Quy Hop Town People's Committee. Photo: Phuong Thuy |

In addition, the staff working on tax collection at the Post Office undertake many tasks such as collecting electricity bills, paying social policy and social security fees, receiving and packing, delivering postal items and parcels, etc., which makes the time for tax collection not guaranteed. On the other hand, Quy Hop is a mountainous district with uneven educational levels, so people's self-declaration and self-payment of taxes face many difficulties.

Therefore, it is recommended that superiors consider the delegation of tax collection as follows: Authorizing and establishing a tax collection delegation at the commune level so that local authorities can grasp difficulties and problems in the process of implementing budget collection in the management area.

Concluding the monitoring session, Comrade Cao Thi Hien acknowledged the efforts of Quy Hop town in tax management and collection such as the work of establishing, implementing and publicly posting the list of business households... In the coming time, she requested the town's advisory council to coordinate and advise the tax department on tax rates of business households in the area to ensure proper procedures, democracy, fairness and publicity according to regulations; promote propaganda work and grasp the grassroots, closely follow the regulations of superiors to successfully implement the set goals...