Banks continue to reduce savings interest rates after the holiday

On the first day after the holiday, a number of banks simultaneously reduced deposit interest rates.

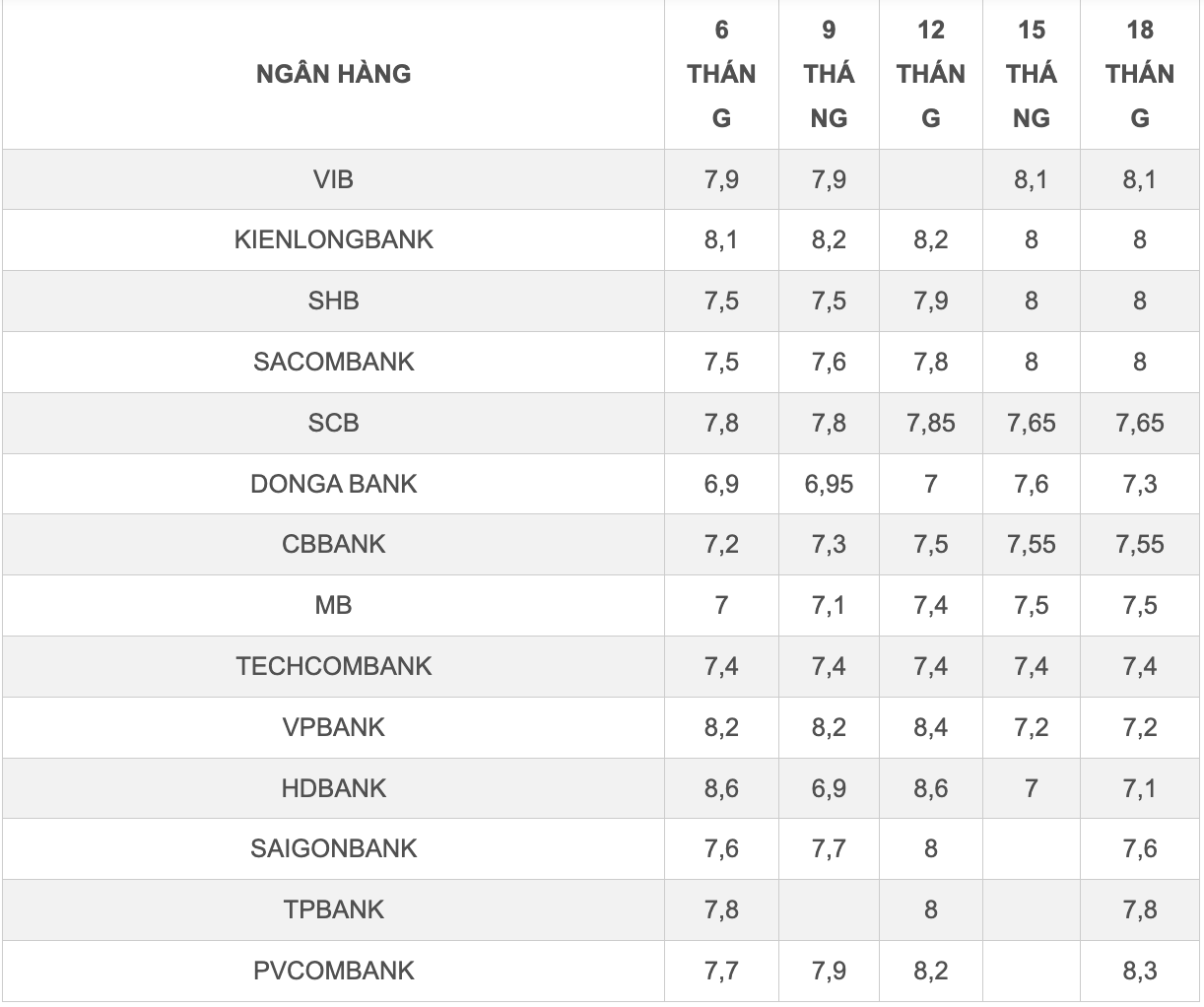

Accordingly, the online savings interest rate at NamA Bank has changed since today (May 4), in a downward direction. The 6-month term decreased by 0.1% to 8.5%/year. The 7-8 month term also decreased by 0.1% to 8.6%/year, while the 9-11 month term decreased by 0.2% to 8.4%/year.

NamA Bank has reduced the 12-month deposit interest rate by 0.2% to 8.5% per year. This is also the interest rate applied to 13-14 month terms.

For terms from 15 months onwards, NamA Bank reduced interest rates by 0.2%, all at 8.4%/year.

KienLongBank started to sharply reduce interest rates by 0.2%-0.4% for all terms right after the holiday. Interest rates for 6-month terms decreased by 0.2% to 8.1%/year, 9-12-month terms decreased by 0.3% to 8.2%/year; 15-18-month terms decreased by 0.4% to 8%/year.

Saigonbank also reduced its deposit interest rates from today, from 7.9% to 7.6%/year for terms of 6-8 months. Interest rates for terms of 9-11 months also decreased by 0.3%, from 8% to 7.7%/year.

The 12-month term deposit interest rate at Saigonbank is now at 8%/year after a long time of being listed at 8.3%. The 13-month term interest rate has decreased to 8.6%/year, which is the term with the highest interest rate for online savings at Saigonbank. Meanwhile, the interest rate for terms of 18 months or more has decreased by 0.3% to 7.6%/year.

Except for the above banks, interest rates of the remaining banks remain unchanged compared to before.

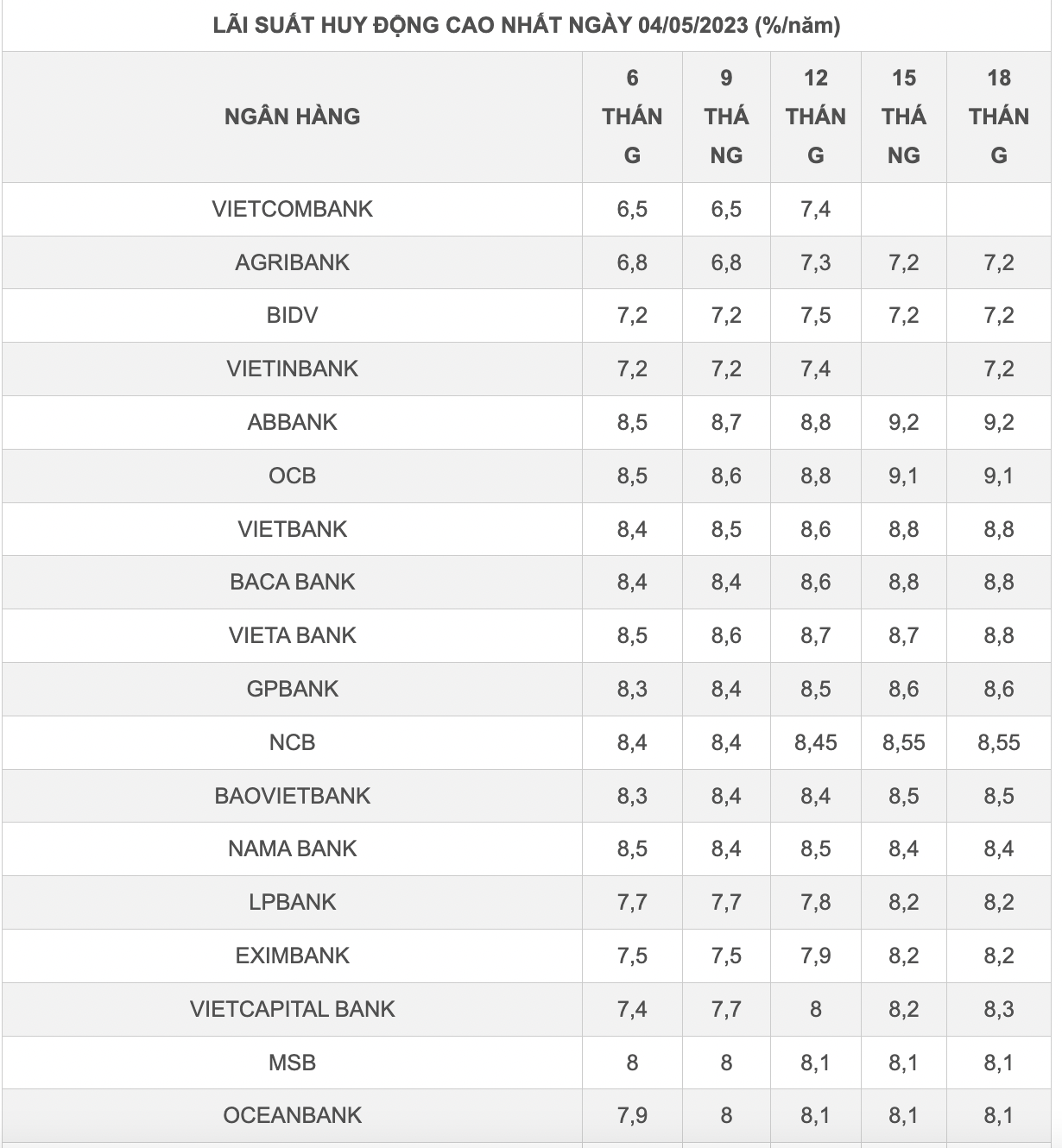

Currently, only 3 banks maintain interest rates from 9% in some terms, including HDBank, OCB, and ABBank.

|

Interest rates of some banks. |

|