Nghe An: Low credit growth in the first 6 months of the year

(Baonghean.vn) - Although credit institutions have launched many large-scale preferential interest rate loan programs, customers' demand for loans to expand production, business and consumption during the Covid-19 pandemic tends to decrease, so credit growth is low.

According to the State Bank of Vietnam, Nghe An branch, as of June 30, 2020, the total outstanding debt of credit institutions in the province is estimated at VND 209,729 billion, an increase of VND 1,043 billion compared to the beginning of the year, equal to 0.5%.

Excluding the Development Bank, the estimated outstanding loan balance is 191,940.8 billion VND, an increase of 1,337 billion VND, equal to 0.7%, of which: Short-term loan balance is 97,009 billion VND, accounting for 50.5%; medium and long-term loan balance is 94,931 billion VND, accounting for 49.5%.

|

| Cashiering activities at a commercial bank in Vinh city. Photo by Thu Huyen |

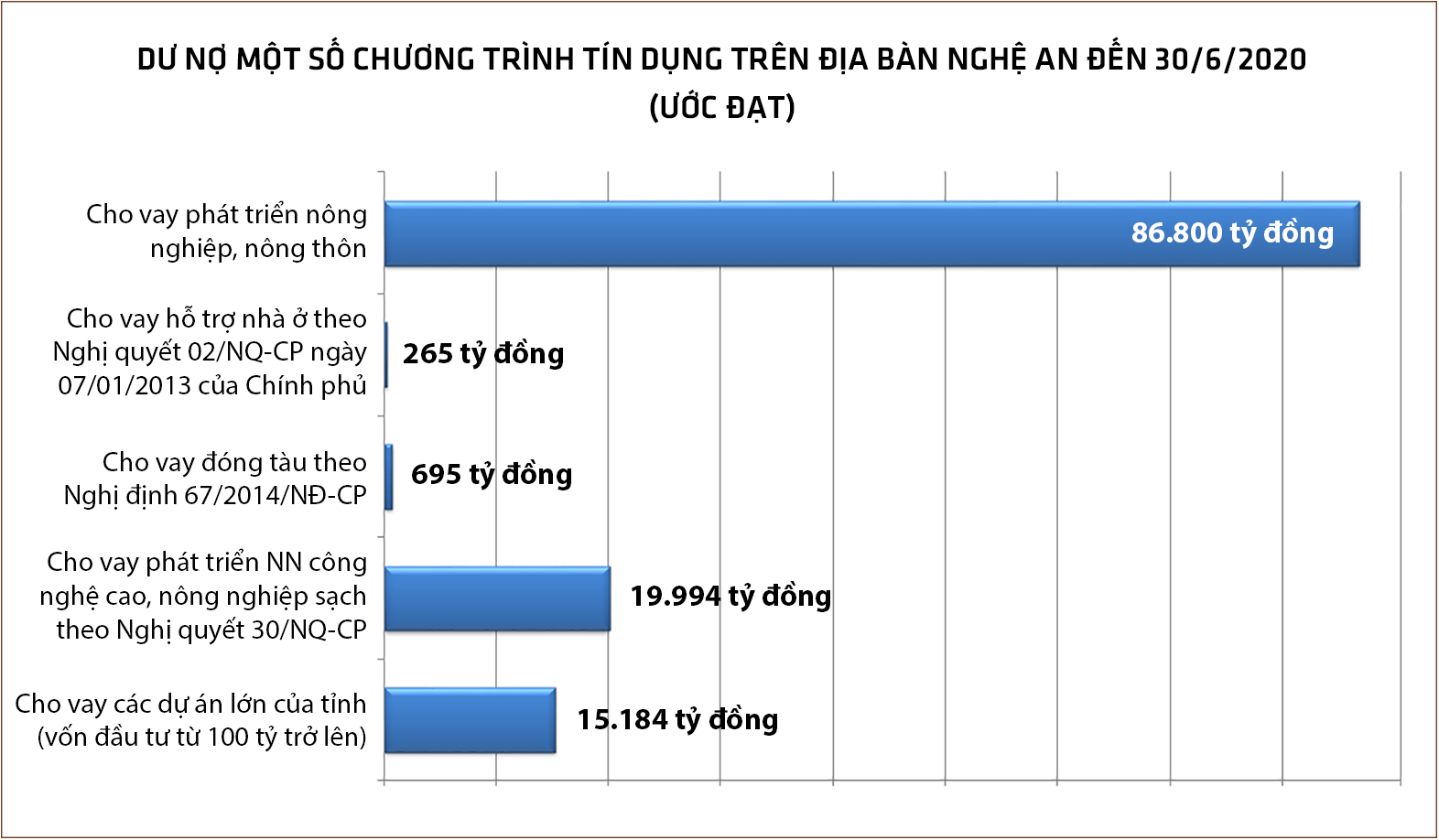

Outstanding balance of some credit programs:

- Outstanding loans for agricultural and rural development are estimated at nearly VND86,800 billion, up 0.2% over the beginning of the year.

- Outstanding loans for housing support under Resolution 02/NQ-CP dated January 7, 2013 of the Government are estimated at 265 billion VND. Outstanding preferential loans for implementing social housing policies under Decree 100/ND-CP and Circular 25/2015/TT-NHNN are estimated at 39.3 billion VND.

- Outstanding loans for shipbuilding under Decree 67/2014/ND-CP are estimated at 695 billion VND.

- Outstanding loans for high-tech agricultural development and clean agriculture according to Resolution 30/NQ-CP are estimated at 19,994 billion VND, accounting for 9.5% of total outstanding loans in the whole area.

- Outstanding loans for major projects of the province (investment capital from 100 billion or more) that banks are funding (as of May 31, 2020): Currently, there are 56 major projects of the province being lent by 21 banks in the area, with a total committed funding amount of more than 28,898 billion VND; 25,208 billion VND has been disbursed, outstanding debt is 15,184 billion VND.

|

| Graphics: Huu Quan |

As of June 30, 2020, the mobilized capital of the whole Nghe An province is estimated at 149,344 billion VND, an increase of 9,115 billion VND compared to the beginning of the year, equal to 6.5%, and an increase of 563 billion VND compared to the previous month, equal to 0.38%.

According to a report from the State Bank of Vietnam, Nghe An branch, as of May 28, implementing credit support measures for customers affected by the Covid-19 epidemic, banks in the province have exempted and reduced interest and interest rates for 25,037 customers with outstanding debt of 32,622 billion VND. Restructuring debt repayment terms and maintaining debt groups for 5,457 customers with outstanding debt of 1,592 billion VND. New disbursement turnover for 13,745 customers(Accumulated from January 23, 2020)with new disbursement turnover of 22,053.5 billion VND.

.jpg)