Nghe An: Credit balance growth over 15%

(Baonghean) - Despite the difficult economic situation, thanks to efforts to overcome difficulties and accompany businesses, outstanding debt growth in Nghe An is quite high.

One of the banks with strong growth in outstanding loans is the Industrial and Commercial Bank, Nghe An branch. Up to now, loans have reached nearly 6,000 billion VND, up 24% compared to the beginning of the year, up 42% compared to the same period in 2016. Outstanding loans of the Corporate Banking Sector have grown strongly because in the first 10 months of the year, large enterprises increased by 853 billion VND; SMEs increased by 207 billion VND; FDI enterprises increased by 95 billion VND.

Bank leaders said that the lending situation this year is generally positive; this year's plan of the branch is to reach 6,610 billion VND in outstanding loans to the economy, but by October 30 it had reached nearly 6,000 billion VND, with a profit of more than 158 billion VND.

|

| Transaction at the Joint Stock Commercial Bank for Industry and Trade, Nghe An branch. Photo: Thu Huyen |

This year, the joint stock banking sector also has quite good outstanding debt. Mr. Phan Huu Phung - Director of SCB Commercial Joint Stock Bank said: Currently, the branch's outstanding debt has reached 500 billion VND, an increase of 20% compared to the beginning of the year. In recent times, with solutions to increase customer access, reduce loan interest rates, and even pay commissions to customer referrals, the growth has been quite good. In particular, with the approach to small traders in Vinh market, lending capital to people to do business by mortgaging their stalls has brought good results, with no bad debt. Currently, in Vinh market alone, the outstanding debt at SCB Commercial Joint Stock Bank is about 80 billion VND.

Mr. Cao Song Diep - Head of General Department, State Bank of Vietnam, Nghe An branch said: Implementing the direction of the State Bank of Vietnam, from July 10, 2017, the maximum short-term lending interest rate has been adjusted down by 0.5%/year to meet the capital needs of a number of economic sectors and industries. Currently, the lending interest rate in VND for priority sectors is commonly at 6 - 6.5%/year; other production and business sectors are at 6.8 - 9%/year for short-term, 9.3 - 11%/year for medium and long-term loans. For good customers with healthy and transparent financial situation, the lending interest rate is from 4-5%/year.

Outstanding loans of some credit programs such as agricultural and rural loans under Decree 55 (excluding the Policy Bank and Development Bank) are estimated at VND60,864 billion (up 6.7% compared to the beginning of the year), accounting for 48.7% of total outstanding loans.

Export loans are estimated at VND1,750 billion (up 21.2% compared to the beginning of the year). Outstanding loans for offshore fishing according to Decree 67/2014/ND-CP of the Government and Circular 22/2014/TT-NHNN of the State Bank are estimated at VND615 billion, up 60% compared to the beginning of the year.

Outstanding loans to support housing under Resolution 02/NQ-CP dated January 7, 2013 of the Government are estimated at 387 billion VND, down 7.9% compared to the beginning of the year.

According to the State Bank of Vietnam, Nghe An branch, local banks are currently focusing on lending capital to priority sectors, while always paying attention to improving credit quality, ensuring safety and efficiency in business operations. In 2017, the credit growth target in the area reached 17-18%, which is considered feasible.

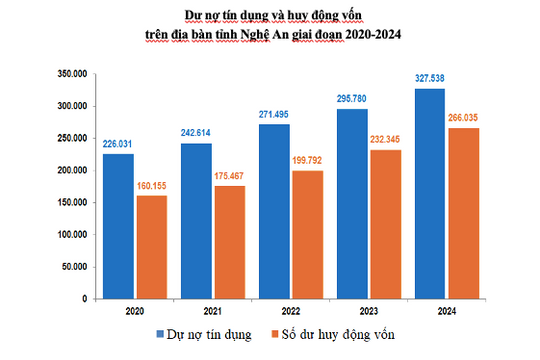

| From the beginning of the year until now, the mobilized capital of credit institutions and credit institution branches in the area is estimated at 104,482 billion VND, an increase of 11,888 billion VND compared to the beginning of the year, equal to 12.8%, higher than the growth rate of the whole country (11.75%). Total outstanding debt in the area (excluding the Development Bank) is estimated at 143,726 billion VND, an increase of 18,964 billion VND compared to the beginning of the year, equal to 15.2%, higher than the growth rate of the whole country (13.01%). Total bad debt in the area is 1,143 billion VND, accounting for 0.8% of total outstanding debt, an increase of 8 billion VND compared to the same period last year, equal to 0.7%. |

Viet Phuong

| RELATED NEWS |

|---|

.jpg)