Gold consumption in China shows signs of recovery

China's domestic gold market saw significant improvements in January 2025, with the central bank continuing to buy gold for three consecutive months, according to a report from the World Gold Council (WGC).

Although gold imports have decreased and cash flow into gold ETFs has turned negative, market signals show that gold consumption demand is likely to increase in the coming time.

China's Central Bank's gold reserves increase continuously

According to a report from the World Gold Council (WGC), the People's Bank of China (PBoC) continued to buy gold in January 2025, marking the third consecutive month of increasing reserves. Specifically, PBoC bought an additional 5 tons of gold, bringing China's total official gold reserves to 2,285 tons, accounting for 5.9% of total foreign exchange reserves.

China bought a total of 44 tonnes of gold in 2024, despite a six-month pause in the middle of the year. The continued gold purchases by the central bank are believed to have had a positive impact on the sentiment of domestic gold investors, as this is often seen as a positive signal for the value of gold.

Gold imports decreased compared to last year.

Although official gold import data for January 2025 has not been released, 2024 ended with lower gold imports than 2023. According to data from China Customs, China imported 84 tonnes of gold in December 2024, bringing the total imports for the fourth quarter to 270 tonnes.

However, compared to the same period in 2023, imports in the fourth quarter of 2024 decreased by 14%, although they increased by more than 160% compared to the third quarter. In 2024, China imported 1,225 tons of gold, down 14% compared to 2023 and 16% lower than the 5-year average before the COVID-19 pandemic (1,460 tons). This decrease reflects a 10% decrease in domestic gold consumption demand in 2024 compared to 2023.

Signs of recovery in gold consumption demand

However, the Lunar New Year holiday (late January to early February 2025) has brought positive signals for gold consumption demand. According to Ray Jia, box office revenue during the holiday reached a record high, and spending on dining and travel also increased compared to the same period in 2024.

In particular, demand for gold has also increased sharply, with many gold jewelry stores reporting high sales. The increase in gold prices has also caused consumers to switch to lighter, lower-priced products.

Although wholesale gold demand in January increased by 3% compared to the previous month, it was still significantly lower compared to the same period last year. Specifically, 125 tons of gold were released from the SGE (Shanghai Gold Exchange), but wholesale demand was still down 54% compared to January 2024 and 37% lower than the 10-year average. The main reason was that gold jewelry retailers reduced inventory reserves before the Lunar New Year, due to concerns about high gold prices and weak consumption demand over the past year.

Gold investment continues to attract interest

The gold investment situation in China is also improving. The sharp rise in gold prices, along with the continuous gold purchases by the Central Bank and the fluctuations in the domestic currency, have attracted the attention of investors.

Ray Jia, Head of Research at WGC, said gold prices have started 2025 strongly, with both the London LBMA and Shanghai benchmarks hitting multi-year highs. Specifically, the LBMA gold price in USD rose 8%, while the Shanghai gold price in RMB (Chinese Yuan) rose 5%.

According to Jia, there were three main factors contributing to the record gold price in January:

Rising geopolitical risks: The Trump administration's tariff policies have raised concerns about global economic instability.

Cash flow into gold ETFs increases: Many investors have turned to gold as a safe investment channel.

Inflation fears return: Rising inflation makes gold an attractive asset to protect asset value.

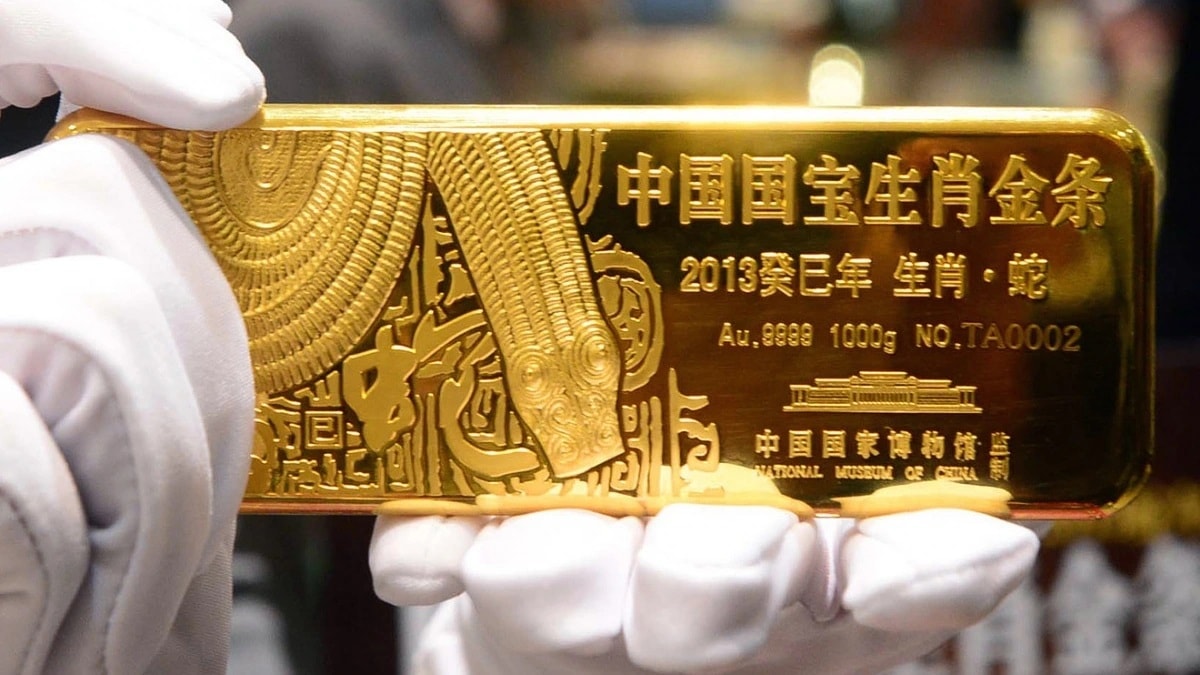

Online searches for gold have already surpassed the previous peak in 2013, when demand for gold in China was at its highest on record. Discussions with market participants also suggest that sales of gold bars and bullion will continue at the same impressive pace as in 2024, even leading to shortages in some places.

Future prospects

The World Gold Council predicts that this positive trend will continue in the near term. Although demand for gold jewelry is likely to remain weak, the drive to preserve value will provide some support. Meanwhile, sales of gold bars and bullion are expected to continue to rise, and any correction in gold prices could be seen as a good investment opportunity. In addition, a new policy allowing 10 insurance companies in China to purchase up to 1% of their assets in physical gold (on a pilot basis) will also provide long-term support for domestic gold investment demand.