After this morning, experts predict that gold prices will soon set a new record.

According to ING bank, it is only a matter of time before gold prices break out of the accumulation zone and will soon set new records.

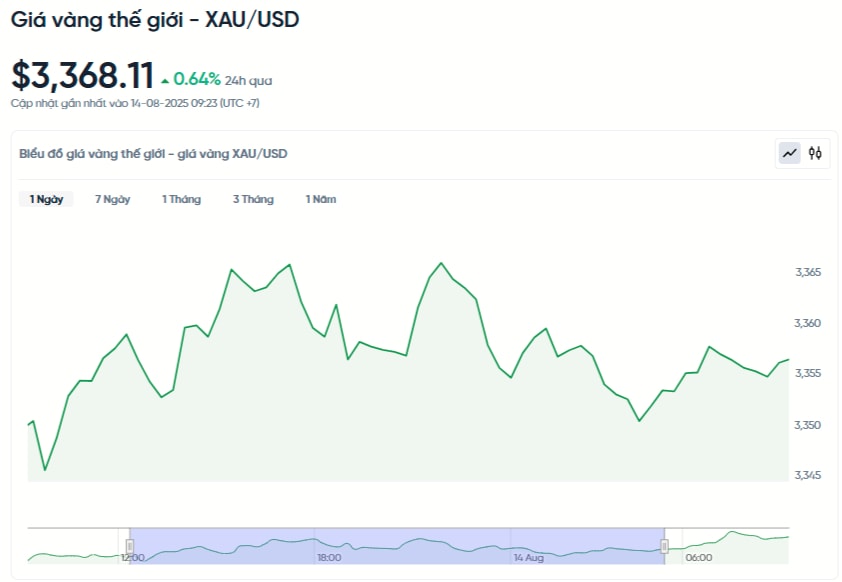

Gold price remains steady above 3,300 USD

Gold prices are currently strongly supported above $3,300 an ounce, and according to ING bank, it is only a matter of time before prices break out of the accumulation zone and retest record highs.

In her monthly gold report, Ewa Manthey, commodity strategist at ING, revised up her gold price forecasts as the U.S. labor market loses momentum and inflation pressures persist. She now expects gold prices to average $3,400 an ounce in the third quarter and $3,450 in the fourth quarter, up from $3,200 for both periods in her previous forecast.

Manthey predicts gold prices could top $3,500 as early as 2025, up 9% from her previous estimate. In the long term, she raised her 2026 average to $3,512 from $3,175 previously. The adjustment comes on the back of expectations that the Fed will cut interest rates sharply in the second half of 2025.

Fed rate cut expectations - Main driver of gold price increase

According to Manthey, the market’s growing expectation of a Fed rate cut could push gold prices to new record highs. “Our team of economists forecasts three Fed cuts this year and two more by early 2026, which is more than the market generally expects. Lower interest rates are generally good for gold, as it is a non-yielding asset compared to other investments.”

The CME FedWatch tool shows the market is pricing in a 90% chance of a Fed rate cut next month and a 50% chance of three cuts this year. Manthey also said concerns about the Fed’s independence could continue to support demand for gold as a safe haven.

US monetary policy uncertainty supports gold prices

Ms. Manthey pointed out that Governor Adriana Kugler's resignation could create an opportunity for President Trump to appoint someone more in line with his policy of lowering interest rates.

"Mr. Trump does not support Chairman Powell, and his term will end next May. This raises concerns about the independence of the Fed, and continues to push gold prices higher."

Last week, Trump nominated Stephen Miran - Chairman of the Council of Economic Advisers to replace Kugler.

Demand from central banks and investors remains strong

“We believe central banks will continue to add gold to their reserves given the uncertain economic environment and the trend of diversification away from the US dollar,” she said.

She also noted that investment demand for gold ETFs in the first half of the year grew at the fastest pace since early 2020, although total holdings remain about 300 tonnes below the record level five years ago.

Gold price outlook remains optimistic

“Central bank buying, Trump’s trade war, geopolitical risks at high levels, and ETF holdings continuing to expand – all support gold at current levels. A Fed rate cut could be the missing catalyst to send gold prices soaring to record levels again,” Manthey concluded.

With these factors, the medium and long-term prospects of gold are still assessed very positively.