Gold price today August 13: Domestic and international gold ring prices increased slightly but were sold at a loss of more than 3 million VND

Gold price today August 13, 2025: Domestic and world gold ring prices increased slightly after the US inflation report, many investors still had to sell off after losing more than 3 million

Gold pricedomestic today 13/8/2025

As of 4:30 a.m. today, August 13, 2025, the domestic gold bar price has not changed compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 122.7-123.9 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 122.7-123.9 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 8 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 123-123.9 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 122.7-123.9 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 121.9-123.9 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 4:30 a.m. on August 13, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.8-119.3 million VND/tael (buy - sell); the price decreased by 200,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell); down 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, August 13, 2025 is as follows:

| Gold price today | August 13, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 122.7 | 123.9 | - | - |

| DOJI Group | 122.7 | 123.9 | - | - |

| Mi Hong | 123 | 123.9 | - | - |

| PNJ | 122.7 | 123.9 | - | - |

| Bao Tin Minh Chau | 122.7 | 123.9 | - | - |

| Phu Quy | 121.9 | 123.9 | - | - |

| 1.DOJI- Updated: 13/8/2025 4:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 122,700 | 123,900 |

| AVPL/SJC HCM | 122,700 | 123,900 |

| AVPL/SJC DN | 122,700 | 123,900 |

| Raw material 9999 - HN | 109,500 | 110,500 |

| Raw materials 999 - HN | 109,400 | 110,400 |

| 2.PNJ- Updated: 13/8/2025 4:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 122,700 | 123,900 |

| PNJ 999.9 Plain Ring | 116,800 | 119,300 |

| Kim Bao Gold 999.9 | 116,800 | 119,300 |

| Gold Phuc Loc Tai 999.9 | 116,800 | 119,300 |

| PNJ Gold - Phoenix | 116,800 | 119,300 |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 gold jewelry | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3.SJC- Updated: 13/8/2025 4:30 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 122,700 | 123,900 |

| SJC gold 5 chi | 122,700 | 123,920 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 122,700 | 123,930 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,500▼100K | 119,000▼100K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,500▼100K | 119,100▼100K |

| 99.99% jewelry | 116,100▼400K | 118,100▼400K |

| 99% Jewelry | 112,430▼396K | 116,930▼396K |

| Jewelry 68% | 73,266▼272K | 80,466▼272K |

| Jewelry 41.7% | 42,202▼167K | 49,402▼167K |

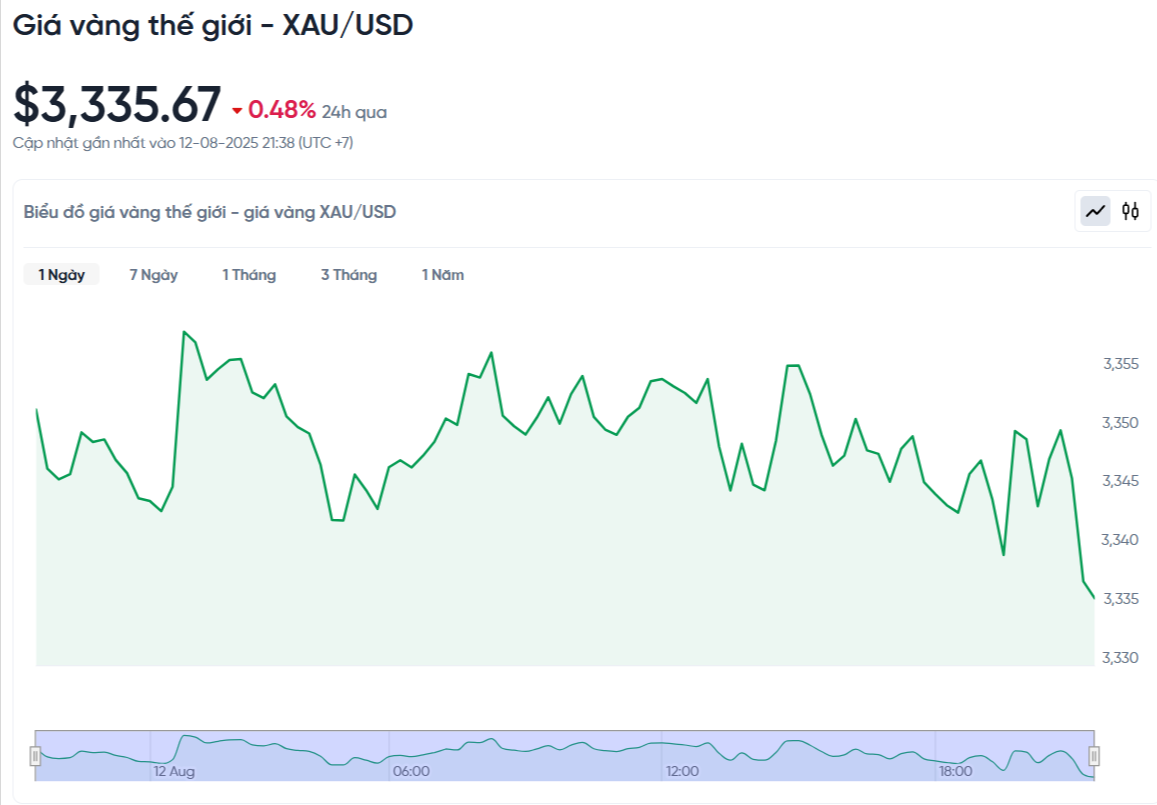

World gold price today August 13, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on August 13, Vietnam time, was 3,335.67 USD/ounce. Today's gold price decreased by 16.07 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,450 VND/USD), the world gold price is about 106.3 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 17.6 million VND/tael higher than the international gold price.

Due to the high difference between buying and selling, although the domestic gold price increased slightly, investors still rushed to sell off to cut losses. Specifically, after 1 week, gold bar buyers lost about 1.1 million VND/tael, gold ring buyers sold at a loss of 3 to 3.7 million VND/tael.

Gold prices continued to fall but showed signs of a slight recovery after US inflation data reinforced expectations that the Federal Reserve (Fed) will cut interest rates. The market is now focused on other important economic data to be released this week.

Specifically, spot gold price decreased by 0.48%, while US gold futures contract price for December decreased by 0.2% to 3,397.50 USD/ounce.

Gold prices fell more than 2% from the beginning of the week after US President Donald Trump tweeted that he would not impose tariffs on imported gold. Earlier, a report that Washington would impose tariffs on imported 1kg gold bars had pushed gold prices to a record high last Friday.

The US Consumer Price Index (CPI) for July rose 2.7% year-on-year, below the 2.8% forecast. Core inflation (excluding food and energy) rose 3.1%, above the 3% forecast and up from 2.9% in June. Some investors believe the benign inflation data could pave the way for the Fed to cut by as much as 0.5%

Bob Haberkorn, chief market strategist at RJO Futures, said the mixed inflation numbers still supported expectations for a rate cut. Traders remained cautious as the market was at a critical juncture and were awaiting further economic indicators.

Following the CPI data, investors continued to expect the Fed to cut interest rates in September and December. Low interest rates increase the appeal of gold because the metal does not yield interest. This week, the market awaits other data such as the producer price index (PPI), weekly jobless claims and retail sales.

Haberkorn added that the biggest negative for gold prices would be if Fed Chairman Jerome Powell said they have no plans to cut interest rates. The US-China trade situation is not the top concern right now as the two countries postponed the tariff deadline for another 90 days.

Besides gold prices, spot silver prices increased 0.4% to $37.74/ounce, platinum decreased 0.2% to $1,324.47 and palladium decreased 0.6% to $1,128.75.

Gold price forecast

Gold prices have rebounded from their lows and are trading steady as consumer inflation continues to bite into the economy. The latest data from the US Bureau of Labor Statistics showed that the consumer price index (CPI) rose 0.2% in July, lower than June's 0.3% but still in line with market expectations.

Typically, high inflation would put pressure on gold as the Fed may tighten monetary policy. However, the market still strongly expects a rate cut in September, as weak labor market data continues to overshadow inflation concerns.

Larry Tentarelli, Technical Strategist at Blue Chip Daily Trend Report, said that while July inflation rose less than expected, the current high level still puts the Fed in a difficult position. "Two consecutive months of high inflation will make it harder for the Fed to justify a rate cut in September. We only expect this to happen if the labor market weakens significantly over the next 45 days."

On the other hand, Jeffrey Roach, chief economist at LPL Financial, believes the Fed will still cut interest rates despite rising core inflation. 'The economy is facing a situation of high inflation coupled with slow growth - a form of 'mild stagflation'. The Fed may prioritize supporting a weakening labor market over fighting inflation.'

After a series of strong increases exceeding the threshold of 3,400 USD/ounce last week, the world gold price has adjusted down back to the range of 3,350-3,400 USD. However, experts say this is just a technical adjustment in the long-term uptrend.

Gold prices are receiving strong support from the Fed's monetary policy. The US central bank's ability to cut interest rates at its meeting on September 17 is weakening the USD, creating favorable conditions for gold prices to grow. In particular, every time the gold price falls below $3,350, buying power from central banks and large investors immediately appears, pushing the price back up.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said that despite short-term volatility, gold has maintained a key support level above $3,300 an ounce since April. He said the key factor helping gold break through the $4,000 mark could come from the correction in the US stock market, as the S&P 500 index is showing signs of slowing down at its historical peak.

In addition to financial market factors, geopolitical instability led by the US is still considered an important supporting factor for gold prices. President Trump's recent statements refuting US statistics and the independence of the Fed could become a new driving force for the gold market in the coming time.

According to experts, in the current context, gold still maintains its role as a safe haven asset. The support level around 3,300 USD is considered an attractive price range for investors to consider buying, while the possibility of breaking out to the 4,000 USD zone is still completely possible if the stock market shows signs of weakness.