Gold price today August 29: Gold bar and gold ring prices continuously increase, breaking records, world gold price increases strongly

Gold price today August 29, 2025: Gold bar and gold ring prices increased continuously, breaking records of 128.5 million and 123.3 million respectively. World gold increased sharply, surpassing the 3400 USD mark.

Gold pricedomestic today 8/29/2025

As of 4:00 a.m. today, August 29, 2025, the price of domestic gold bars has increased continuously, breaking a new record. Specifically:

DOJI Group listed the price of SJC gold bars at 127 - 128.5 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying - an increase of 500 thousand VND/tael for selling compared to yesterday.

At the same time, the price of gold bars was listed by Saigon Jewelry Company Limited - SJC at 127 - 128.5 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying - an increase of 500 thousand VND/tael for selling compared to the closing price on August 28 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 127.2-128.2 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 400 thousand VND/tael for buying and 200 thousand VND/tael for selling.

The price of gold bars at Bao Tin Minh Chau Company Limited is traded by businesses at 127 - 128.5 million VND/tael (buy - sell), an increase of 1.2 million VND/tael in buying - an increase of 500 thousand VND/tael in selling compared to the same period yesterday.

The price of SJC gold bars at Phu Quy is traded by businesses at 126-128.5 million VND/tael (buy - sell), the gold price increased by 600 thousand VND/tael in buying - increased by 500 thousand VND/tael in selling compared to yesterday.

As of 4:00 a.m. on August 29, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 120.2-123.2 million VND/tael (buy - sell); an increase of 400,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 120.3-123.3 million VND/tael (buy - sell); an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, August 29, 2025 is as follows:

| Gold price today | August 29, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 127 | 128.5 | +1000 | +500 |

| DOJI Group | 127 | 128.5 | +1000 | +500 |

| Mi Hong | 127.2 | 128.2 | +400 | +200 |

| PNJ | 127 | 128.5 | +1000 | +500 |

| Bao Tin Minh Chau | 127 | 128.5 | +1000 | +500 |

| Phu Quy | 126 | 128.5 | +600 | +500 |

| 1.DOJI- Updated: 8/29/2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 127,000▲1000K | 128,500▲500K |

| AVPL/SJC HCM | 127,000▲1000K | 128,500▲500K |

| AVPL/SJC DN | 127,000▲1000K | 128,500▲500K |

| Raw material 9999 - HN | 112,200▲200K | 113,000▲200K |

| Raw materials 999 - HN | 112,100▲200K | 112,900▲200K |

| 2. PNJ - Updated: August 29, 2025 04:00 - Website supply time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 127,000▲1000K | 128,500▲500K |

| PNJ 999.9 Plain Ring | 120,100▲200K | 123,000▲400K |

| Kim Bao Gold 999.9 | 120,100▲200K | 123,000▲400K |

| Gold Phuc Loc Tai 999.9 | 120,100▲200K | 123,000▲400K |

| PNJ Gold - Phoenix | 120,100▲200K | 123,000▲400K |

| 999.9 gold jewelry | 119,200▲300K | 121,700▲300K |

| 999 gold jewelry | 119,080▲300K | 121,580▲300K |

| 9920 gold jewelry | 118,330▲540K | 120,830▲540K |

| 99 gold jewelry | 118,080▲290K | 120,580▲290K |

| 916 Gold (22K) | 109,080▲280K | 111,580▲280K |

| 750 Gold (18K) | 83,930▲230K | 91,430▲230K |

| 680 Gold (16.3K) | 75,410▲210K | 82,910▲210K |

| 650 Gold (15.6K) | 71,760▲200K | 79,260▲200K |

| 610 Gold (14.6K) | 66,890▲190K | 74,390▲190K |

| 585 Gold (14K) | 63,840▲170K | 71,340▲170K |

| 416 Gold (10K) | 43,280▲130K | 50,780▲130K |

| 375 Gold (9K) | 38,290▲110K | 45,790▲110K |

| 333 Gold (8K) | 32,810▲100K | 40,310▲100K |

| 3.SJC- Updated: 8/29/2025 04:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 127,000▲1000K | 128,500▲500K |

| SJC gold 5 chi | 127,000▲1000K | 128,520▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 127,000▲1000K | 128,530▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 120,100▲200K | 122,700▲200K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 120,100▲200K | 122,600▲200K |

| 99.99% jewelry | 119,600▲200K | 121,600▲200K |

| 99% Jewelry | 115,396▲198K | 120,396▲198K |

| Jewelry 68% | 75,346▲136K | 82,846▲136K |

| Jewelry 41.7% | 43,362▲83K | 50,862▲83K |

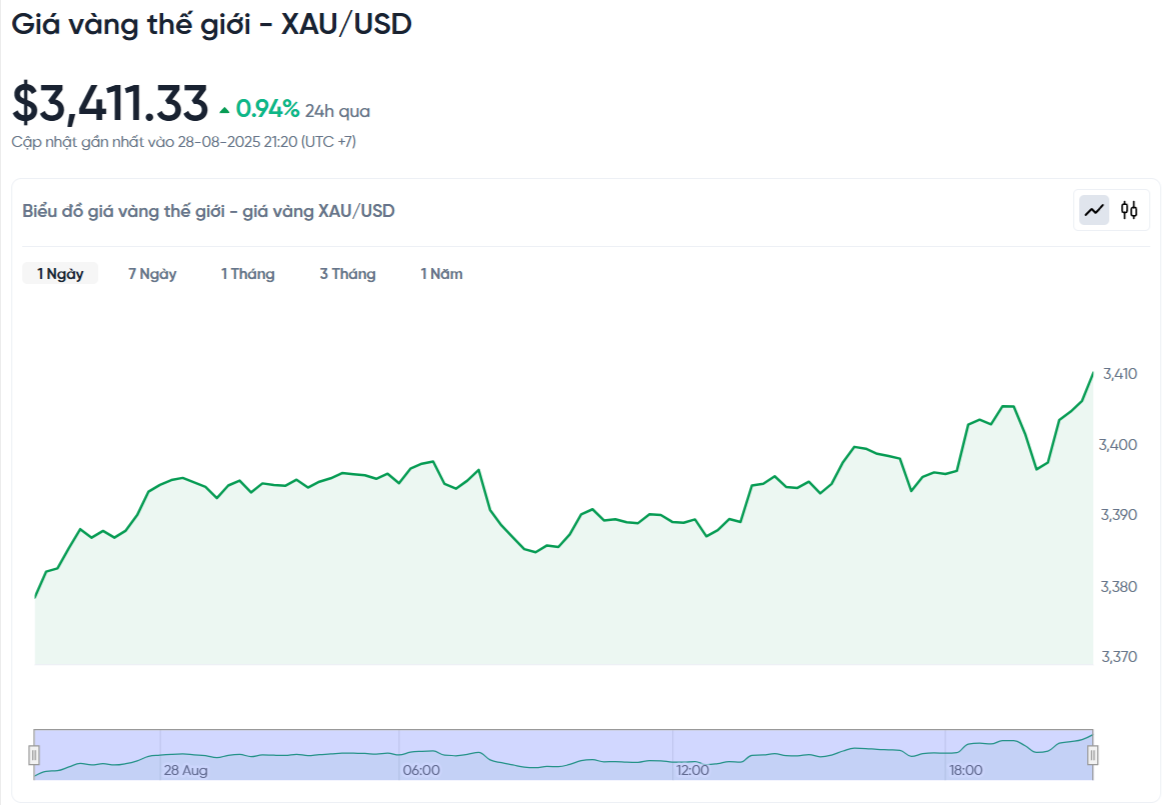

World gold price today August 29, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on August 29, Vietnam time, was 3,411.33 USD/ounce. Today's gold price increased by 31.91 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,531 VND/USD), the world gold price is about 108.97 million VND/tael (excluding taxes and fees). Thus, the gold bar price is 19.53 million VND/tael higher than the international gold price.

World gold prices rose sharply to their highest level in more than a month. The main reason was the depreciation of the USD, while investors were cautiously waiting for inflation data from the US to be released on Friday to find clues on the policy path of the Federal Reserve (Fed).

Specifically, spot gold prices increased by 0.94%. Earlier in the day, gold prices reached 3,408.62 USD, this is the highest level since July 23. US gold futures for December also increased by 0.5% to 3,466.30 USD/ounce.

The US dollar fell 0.3% against other currencies, making gold more attractive to investors holding other currencies.

The National Association of Realtors (NAR) said its pending home purchase contract index fell 0.4% in July, following a 0.8% decline in June. The renewed weakness in the U.S. housing sector has further highlighted the demand for gold as a safe investment.

The focus of the market will be on Friday's Personal Consumption Expenditures Price Index (PCE) report, the Fed's preferred measure of inflation. Economists polled by Reuters expect the index to rise 2.6% in July, matching June's gain.

If inflation figures come in higher than expected, it could strengthen the dollar and push Treasury yields higher, putting downward pressure on gold prices. Conversely, if the figures come in lower, it could fuel expectations of a more dovish Fed, weakening the dollar and supporting gold prices, said Ricardo Evangelista, senior analyst at ActivTrades.

The market now expects a more than 87% chance that the Fed will cut interest rates by 25 basis points at its policy meeting next month. Gold is a non-yielding asset, so it tends to do well in low-interest-rate environments.

In addition, the market is also closely watching US President Donald Trump's moves to impose control over the Fed. Earlier this week, Trump announced the firing of Fed Governor Lisa Cook. Many see this controversy as a threat to the independence and credibility of the Fed, which is a factor supporting gold prices.

Besides gold prices, silver prices increased 1.2% to 39.08 USD/Ounce, platinum increased 0.2% to 1,349.22 USD/Ounce and palladium increased 1.1% to 1,103.82 USD/Ounce.

Gold price forecast

The world gold price is rising sharply, very close to the threshold of 3400 USD/Ounce. Schroders Group, a large British asset management company, believes that this price increase is likely to continue. The reason given is that inflationary pressure still exists and many investors are showing a lack of confidence in the USD.

Experts from Schroders share an optimistic view on gold, seeing it as an effective tool to diversify risks in the context of volatile monetary policy, unstable national budgets, and declining confidence in US government bonds and the US dollar.

Schroders also warned that global equity markets are currently under-valuing risks, particularly growth and inflation, leaving the investment environment fragile and vulnerable to unexpected volatility in the coming period.

Jim Luke, a fund manager specializing in metals at Schroders, praised the gold price's stability at around $3,300 an ounce in the past quarter. He said it was an impressive achievement, especially when gold faced a lot of pressure from tighter immigration policies and disappointing US employment figures.

The big question now is whether the negative news has been fully priced in, with gold up almost 30% since the start of the year. While investment demand for gold in the first half of the year was the strongest since 2020, Schroders believes there is huge potential for growth in the second half.

Mr. Luke expects investment demand for gold to be much higher than in previous cycles. He also predicts that demand from investors in North America and Europe will soon catch up with the record levels set in Asia.

Gold prices are now clearly reflecting the cautious sentiment of investors in the face of global political and economic uncertainties. President Trump’s recent criticism of the Fed’s interest rate policy, along with the dismissal of a governor, has raised concerns about the agency’s independence, further pushing investors to seek safe assets such as gold.

In addition to the Fed-related factors, the market is also paying attention to the second-quarter business results of the technology corporation Nvidia. As the company with the largest market capitalization in the world, Nvidia's results will have a strong impact on the general sentiment of the financial market, and potentially indirectly affect the price of gold.

Investors will focus today on the US personal income and spending report. The personal consumption expenditures (PCE) price index, the Fed's preferred inflation measure, is expected to rise 2.6% year-on-year. The core PCE index (which excludes food and energy prices) is forecast to increase 2.9%. These figures provide important clues about the path of the Fed's interest rate adjustment, and thus directly affect the movement of gold prices.