All new regulations of Compulsory Motorcycle Insurance

(Baonghean.vn) - Have you not had time to buy compulsory motorbike insurance recently? Has your insurance certificate expired? This is the best time to participate in this type of insurance because the Government has just amended the regulations to best meet people's expectations.

|

Level of responsibilityinsuranceIncreased insurance, simplified paperwork, quick compensation payments, significantly increased humanitarian support... are the biggest amendments in Decree 03/2021/ND-CP on Compulsory Civil Liability Insurance of Motor Vehicle Owners, officially effective from March 1, 2021.

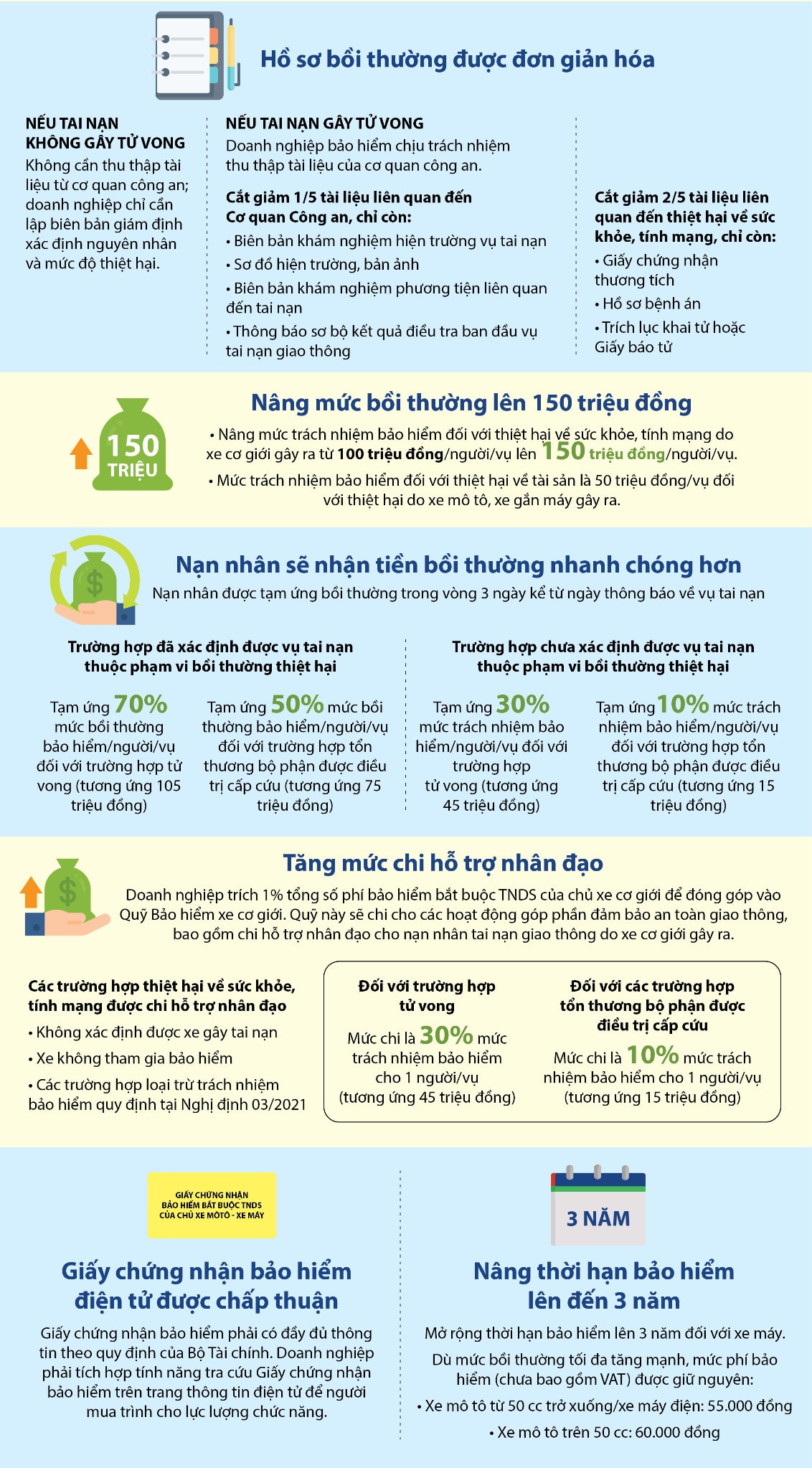

Simplified claim documentation

The compensation file is simplified in the direction that the insurance company is proactive in setting up the file and paying compensation in cases of non-fatal accidents. As for cases of fatal accidents, the company will be responsible for collecting the file from the police instead of handing all the responsibility to the vehicle owner and driver. In particular, this file is also reduced compared to current regulations to speed up the compensation process.

Increase compensation to 150 million VND

Decree increasing the level of insurance liability for damage to health and life due tomotor vehiclescaused to 150 million VND/person/incident compared to the current level of 100 million VND. The insurance liability level for property damage is 50 million VND/incident for damage caused by motorbikes and scooters.

Victims will receive compensation faster

The victim will receive advance compensation from the insurance company within 3 days from the date of notification of the accident.

In cases where the accident is determined to be within the scope of compensation for damages, the enterprise shall advance 70% of the insurance compensation/person/case when the victim dies (equivalent to 105 million VND); advance 50% of the insurance compensation/person/case when the victim is injured (equivalent to 75 million VND).

In cases where the accident is not yet determined to be within the scope of compensation for damages, the enterprise shall advance 30% of the insurance liability/person/case when the victim dies (equivalent to 45 million VND); 10% of the insurance liability/person/case when the injured victim receives emergency treatment (equivalent to 15 million VND).

Increase humanitarian aid spending

Part of the revenue from compulsory motor insurance will be used for humanitarian support for traffic accident victims. Enterprises will deduct 1% of the total compulsory motor vehicle liability insurance premiums of motor vehicle owners to contribute to the Motor Vehicle Insurance Fund. This fund is managed by the Vietnam Insurance Association (www.iav.vn) and the fund will directly disburse humanitarian assistance after receiving information and case files.

In case of death, the payment is 30% of the insurance liability for 1 person/case (equivalent to 45 million VND). In case of injury to body parts that are treated in emergency, the payment is 10% of the insurance liability for 1 person/case (equivalent to 15 million VND).

Certificate of insuranceapproved electronics

Compulsory motorcycle insurance can be purchased online and the company issues an electronic certificate with full information as prescribed by the Ministry of Finance. The company must integrate the Insurance Certificate lookup feature on the website for vehicle owners/drivers to present to the authorities when traveling on the road.