Gold price update on the morning of June 16: Strong increase towards record peak

Gold price update on the morning of June 16: Domestic and world gold prices increased strongly, heading straight to a record peak of 3,500 USD/ounce.

SJC gold bar price

As of 8:40 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.5-120.5 million VND/tael (buy - sell). The difference between the buying and selling prices was at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy - sell). The difference between the buy and sell prices was at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.8-120.3 million VND/tael (buy - sell). The difference between the buy and sell prices is 2.5 million VND/tael.

Phu Quy Gold and Gemstone Group listed the price of SJC gold bars at 117.3-120.3 million VND/tael (buy - sell), the difference between buying and selling prices is at 3 million VND/tael.

9999 gold ring price

As of 8:40 a.m., the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115.5-117.5 million VND/tael (buy - sell). The difference between the buy and sell prices was at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Gemstone Group listed the price of gold rings at 114.2-117.2 million VND/tael (buy - sell). The difference between buying and selling is 3 million VND/tael.

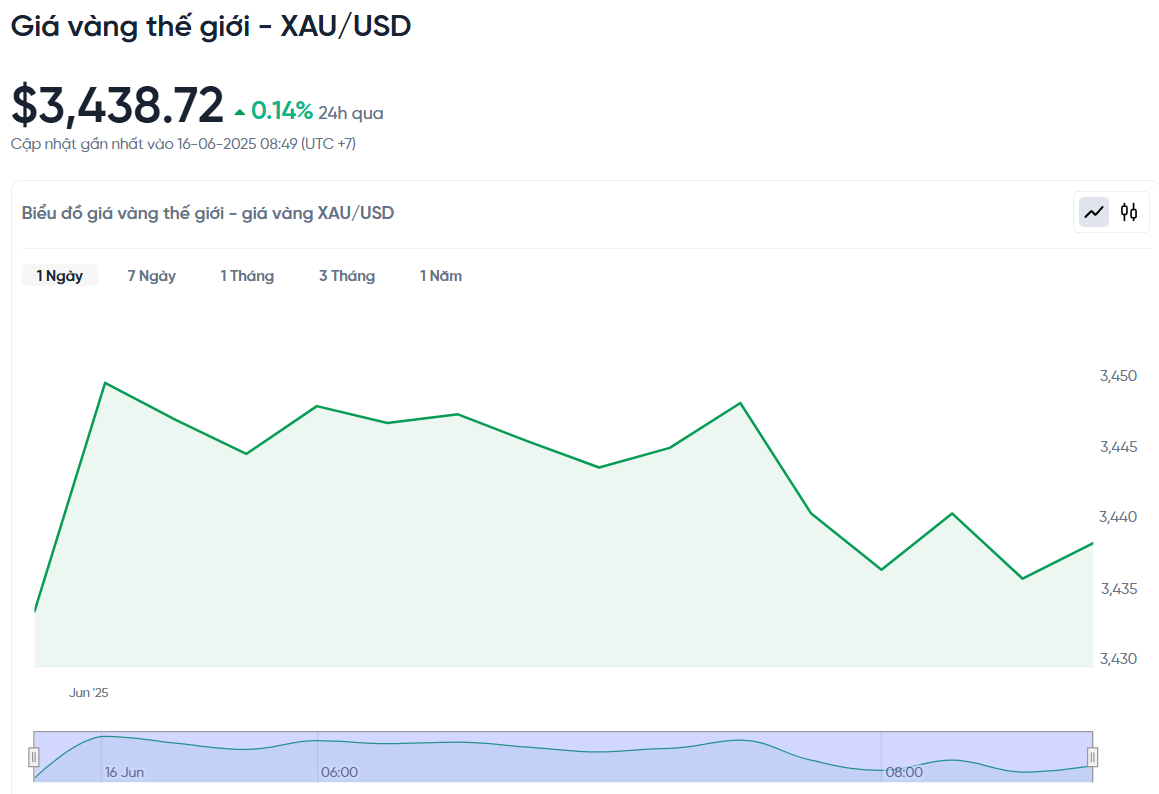

World gold price

World gold price listed at 8:42 am was at 3,438.72 USD/ounce, up 4.84 USD/ounce compared to the previous day.

Gold price forecast

Michael Brown, Senior Research Strategist at Pepperstone, said he remains bullish on gold, even as geopolitical risk premiums cool. He said long-term structural factors continue to underpin the bullish gold trend.

“The overnight moves have once again highlighted why gold is a worthy hedge against the current uncertainty. I remain bullish on gold from here, especially as institutional investors are actively diversifying their portfolios,” he said.

Sharing the same positive view, Michele Schneider, Chief Market Strategist at MarketGauge, warned that the market could see volatility this week due to profit-taking after the recent rally. However, she still believes that the long-term trend for both gold and silver remains upward.

“The developments in the Middle East could increase inflation risks and have other negative consequences. We may be nearing a peak, but I don’t see any signs that a peak has formed yet,” Schneider said.

From a more cautious perspective, Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank commented that the conflict between Israel and Iran could support gold prices to stay above the threshold of 3,400 USD/ounce, but it would be difficult to create momentum to push prices higher if tensions do not continue to escalate.

“Over the past three years, several geopolitical events have caused gold to rise in the short term, but have struggled to sustain high prices,” he said.

In the long term, experts believe that the upward trend of gold prices is still reinforced by structural factors. Mr. Adrian Day - Chairman of Adrian Day Asset Management emphasized that the process of diversifying reserves of central banks, declining confidence in the USD, global financial concerns and defensive demand from wealthy investors will continue to keep gold in a stable position.

According to him, in Asian economies, especially China, central banks are accelerating gold purchases to reduce dependence on the US dollar. Meanwhile, real estate or cryptocurrency investment channels are becoming less attractive in the current environment, making gold stand out as an effective alternative asset.

In North America, gold investment is also returning. Gold funds such as GDX and GDXJ have seen new inflows after months of stagnation, along with increased private investment in gold and silver mining stocks, a sign that a sustainable recovery is taking shape for the entire precious metals industry.

Three main factors driving gold prices: geopolitics, monetary policy and defensive flows

Gold prices are being driven by three main drivers: geopolitical tensions, monetary policy expectations and defensive investment trends in an uncertain global environment.

In the short term, the conflict between Israel and Iran continues to make investors seek gold as a safe haven. This is an important factor pushing the spot gold price to about 3,432 USD/ounce, up 3.47% compared to the beginning of the week.

In addition, major central banks such as the US Federal Reserve (Fed), Bank of England (BOE), Bank of Japan (BOJ) and Swiss National Bank (SNB) are all preparing to announce interest rate decisions this week.

Although the Fed is expected to keep interest rates unchanged, analysts are closely watching the possibility of easing policy from September.

Another important support is strong demand from central banks, especially in Asia. According to Alex Kuptsikevich of FxPro, global gold reserves are approaching the 36,000 ton mark – close to the record set in 1965.

At the same time, the share of the US dollar in global foreign exchange reserves has fallen below 50%, leaving gold emerging as a strategic alternative.

Analysts from CPM Group predict gold prices could hit $3,500 an ounce this week and move towards $3,600 in September if risk factors persist.

However, some experts such as Daniel Pavilonis warn of the possibility of a double top forming if geopolitical tensions do not escalate further and investors start taking profits at high prices.

As gold prices surge, money is also starting to shift to other precious metals such as silver, platinum and palladium. Silver is getting special attention with the expectation that it could reach $50 an ounce, a high not seen since 2011.

Schedule of important economic data releases this week

Monday: Empire State manufacturing survey, Bank of Japan monetary policy meeting.

Tuesday: US retail sales.

Wednesday: Weekly jobless claims, US housing starts and Federal Reserve policy meeting.

Thursday: US markets are closed for Juneteenth, while the Swiss National Bank and Bank of England hold policy meetings.

Friday: Philly Fed manufacturing survey released.

.png)

.png)