Official instructions on making a receipt for holding vehicle registration mortgaged to the bank

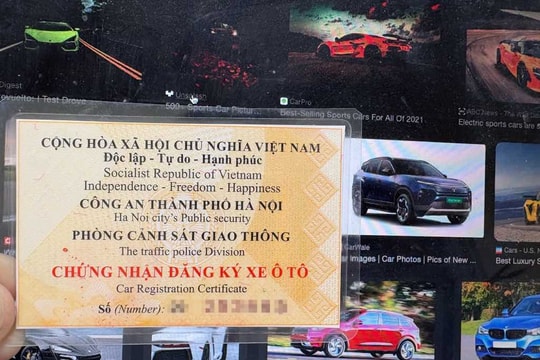

The State Bank of Vietnam has just issued instructions on issuing a Receipt for keeping the original copy of the Vehicle Registration Certificate mortgaged at a credit institution.

On August 31, 2017, the State Bank issued Document No. 7000/NHNN-PC guiding the issuance of Receipt of keeping the original copy of the Certificate of Registration of a vehicle mortgaged at a credit institution or foreign bank branch (Mortgage Receipt).

|

According to document 7000/NHNN-PC, the issuance of Mortgage Receipts by credit institutions and bank branches is carried out as follows:

On the responsibility of issuing Mortgage Receipts

According to document 7000/NHNN-PC, the credit institution or foreign bank branch receiving the mortgage (hereinafter referred to as the credit institution receiving the mortgage) is responsible for providing the mortgagor with one (1) original copy of the Mortgage Receipt when the credit institution receives the mortgage of a vehicle.

In case the customer violates the obligation to repay the debt secured by the means of transport, the issuance of the Mortgage Receipt shall be agreed upon by the mortgagee receiving credit institution and the mortgagor.

On the content of the Mortgage Receipt

Regarding the content of the Mortgage Receipt, according to document 7000/NHNN-PC, the Mortgage Receipt must include at least the following contents: (i) Name: Mortgage Receipt; (ii) Mortgage Receipt Number; (iii) Name and address of the credit institution receiving the mortgage; (iv) Name of the mortgagor; ID card number or citizen identification number or passport number or military identification number for the mortgagor being an individual; business registration certificate number or investment license number or investment certificate number or establishment decision number for the mortgagor being a legal entity; (v) Vehicle registration certificate number, vehicle type, chassis number, engine number, vehicle license plate number; (vi) Validity period of the Mortgage Receipt; (vii) Re-issuance time, replaced Mortgage Receipt number in case of re-issuance of the Mortgage Receipt.

About the time limit for issuing Receipt

According to the guidance of the State Bank, the credit institution accepting the mortgage is responsible for issuing one (1) original copy of the Mortgage Receipt to the mortgagor within no more than 7 working days: (i) From the date the credit institution receives the vehicle registration certificate in case of new issuance; or (ii) From the date of receiving the request of the mortgagor in case of re-issuance or re-issuance of the Mortgage Receipt.

On the validity period of the Mortgage Receipt

According to document 7000/NHNN-PC, the validity period of the Mortgage Receipt is agreed upon by the parties but does not exceed the validity period of the mortgage contract.

Regarding the issuance and exchange of mortgage receipts

In document No. 7000/NHNN-PC, the issuance and exchange of Mortgage Receipts is carried out in two cases:The first, when the Mortgage Receipt is damaged;Monday, when it is necessary to change the information on the Mortgage Receipt.

To be issued a new Mortgage Receipt, the mortgagor is responsible for returning the original Mortgage Receipt that was issued and the mortgage receiving credit institution is responsible for collecting the original old Mortgage Receipt and issuing one (1) new original Mortgage Receipt.

Regarding re-issuance of Mortgage Receipt

According to the guidance of the State Bank, re-issuance of Mortgage Receipt is carried out in the following two cases: (i) When there is an agreement to change the mortgage term; (ii) When the Mortgage Receipt is lost.

In case the mortgagee credit institution and the mortgagor agree to change the mortgage term, resulting in a mortgage term shorter than the effective period of the Mortgage Receipt, the mortgagor shall be responsible for returning the original Mortgage Receipt that has been issued; the mortgagee credit institution shall be responsible for re-issuing one (1) new original Mortgage Receipt.

In case of loss of Mortgage Receipt, re-issuance of Mortgage Receipt is carried out as follows: (i) The mortgagor must have a written notice clearly stating the loss of the Mortgage Receipt with a request for re-issuance of the Mortgage Receipt. The mortgagor must commit and be solely responsible for the truthfulness and accuracy of the notice; (ii) The credit institution receiving the mortgage shall re-issue one (01) original copy of the Mortgage Receipt.

About the transition instructions

For cases of vehicle mortgages before September 1, 2017, according to the guidance of the State Bank, the issuance of Mortgage Receipts for these cases is carried out as follows:

The first, within a maximum period of 30 days from August 31, 2017, the mortgage receiving credit institution is responsible for notifying the mortgagor about the mortgage receiving credit institution issuing a Mortgage Receipt for the vehicle being mortgaged at the credit institution;

MondayWithin a maximum period of 7 working days from the date of receipt of the mortgagor's request, the mortgagee credit institution shall be responsible for issuing one (1) certified copy of the vehicle registration certificate and one (1) original copy of the Mortgage Receipt to the mortgagor according to the instructions in this document.

At the same time, the State Bank also clearly stipulates that the Confirmation Document of the credit institution accepting the mortgage on the credit institution holding the original vehicle registration certificate issued before September 1, 2017 is no longer valid from December 1, 2017.

On responsibility for implementation

The State Bank requires credit institutions accepting mortgages to be responsible for: (i) Organizing the issuance of Mortgage Receipts to mortgagors throughout the system in accordance with instructions; (ii) Coordinating with the Ministry of Public Security in the process of exchanging information related to the issuance of Mortgage Receipts when requested./.

According to Economic Pulse

| RELATED NEWS |

|---|

.jpg)