Nghe An Tax Department applies electronic invoices to gold trading enterprises

Nghe An currently has 149 gold trading enterprises. In response to new management requirements, the Nghe An Provincial Tax Department has increased its monitoring of the business activities of gold trading enterprises and households.

Apply electronic invoices when buying and selling gold

Implementing the direction of the Prime Minister, the Ministry of Finance and the General Department of Taxation in the following documents: Official Dispatch No. 1426 of the Prime Minister dated December 27, 2023 on solutions to manage the gold market; Resolution No. 20/NQ-CP dated February 5, 2024, Official Dispatch No. 23 of the Prime Minister dated March 20, 2024 on strengthening measures to manage the gold market; Official Dispatch No. 01 dated May 14, 2024 of the Ministry of Finance; Official Dispatch No. 2162 dated May 22, 2024 of the General Department of Taxation on strengthening tax management of gold, silver and gemstone trading and processing activities.

In particular, in Notice No. 160 dated April 11, 2024 of the Government Office on the Prime Minister's conclusion at the meeting on solutions for managing the gold market in the coming time, the Prime Minister emphasized the need to resolutely have electronic invoices when conducting gold buying and selling transactions to enhance transparency, improve the effectiveness of supervision and management, ensure the gold market operates safely, publicly, transparently and immediately revoke the operating licenses of enterprises that do not strictly comply with the provisions of law.

In response to the attention and strong direction from the Government, ministries, branches and localities, on May 20, 2024, Nghe An Provincial Tax Department also issued Official Dispatch No. 2746 on strengthening tax management of gold trading activities, accordingly, urgently implementing a number of solutions:

Firstly, conduct a review of all businesses, households and individuals trading and processing gold, silver and precious stones in the management area, especially the trading of raw gold and gold bars. On that basis, apply the principle of risk management in tax inspection and examination activities to conduct file inspection at the tax authority's headquarters. If risks are detected, transfer the inspection and examination to the taxpayer's headquarters according to regulations. Tax inspection is carried out through electronic transactions between the tax authority and the taxpayer.

Second, focus on inspection and examination of the use of invoices in accordance with regulations and instructions and directions of the Ministry of Finance and the General Department of Taxation, proactively and actively coordinate with local authorities to step up inspection of compliance with regulations on the application of electronic invoices at enterprises, stores and gold trading locations; regularly coordinate closely with the police and market management forces to promptly detect and strictly handle violations of tax and invoices in accordance with regulations; immediately transfer files to the Police Agency to handle cases with signs of violations of criminal law.

Third, continue to direct and strengthen the implementation of propaganda work for enterprises, households and individuals trading in gold, silver and precious stones and through tax management, promptly detect enterprises, organizations, households and individuals trading in gold, silver and precious stones that buy, sell and craft gold, silver and precious stones but do not declare taxes, and have differences between actual cost price and revenue and cost price and revenue declared for VAT.

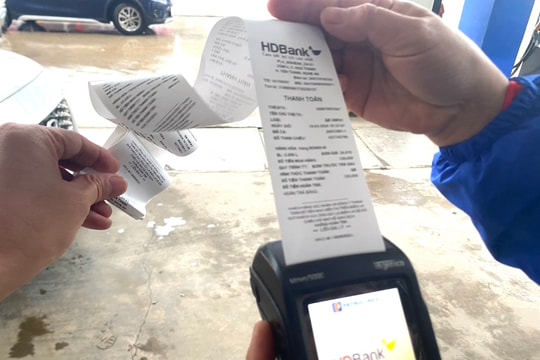

In particular, the Nghe An Provincial Tax Department focuses on accelerating the process of applying electronic invoices with codes of tax authorities generated from cash registers in the field of gold, silver and precious stone trading. This is an effective solution applied specifically to the field of direct retail to consumers, in which, actively implementing the application at stores and establishments trading in gold, silver and precious stones to encourage consumers to get invoices when purchasing goods and services through the lucky invoice program of the Tax sector. Thereby, creating civilized consumption habits, contributing to protecting the rights of buyers, helping tax authorities control the situation of tax evasion and tax evasion of gold trading enterprises and being the basis for tax authorities to determine the income tax rate for individuals investing in gold transparently and fairly.

The provisions of tax law haverelate to

Regarding tax declaration method: Pursuant to Clause 3 and Clause 4, Article 3 of Circular 119/2014/TT-BTC of the Ministry of Finance, business establishments that have activities of buying, selling, and processing gold, silver, and precious stones must separately account for these activities to pay tax according to the direct calculation method on value added tax (form 03/GTGT).

Regarding the use of invoices: According to the provisions of the Tax Administration Law No. 38/2019/QH14, Decree No. 123/2020/ND-CP and Circular No. 78/2021/TT-BTC, from July 1, 2022, electronic invoices have been deployed nationwide for enterprises and business households, including enterprises and households trading in gold, silver and precious stones.

From December 15, 2022, the Tax sector has officially deployed the electronic invoice solution generated from cash registers to support people and businesses to use electronic invoices quickly, conveniently, economically, while improving management efficiency, preventing tax losses in the retail sector, protecting consumer rights, and contributing to promoting digital transformation. In addition, the Tax Administration Law No. 38/2019/QH14 also clearly stipulates that when selling goods or providing services, sellers must issue electronic invoices to deliver to buyers.

However, in tax management of gold, silver and precious stone trading activities in Nghe An province, there are still many difficulties and problems such as: The majority of people when buying gold do not have the habit of getting invoices, the main form of payment is in cash, leading to difficulty in controlling transactions, difficulty in managing actual revenue...

-0b12a5a54ecb60ff3cefffc75aadfca9.jpg)