Gold price this afternoon June 30, 2025: Domestic and world gold prices increased slightly, experts made surprising predictions

Gold price this afternoon June 30, 2025: Domestic and world gold prices increased slightly from 300 to 500 thousand VND/tael. Interest rates are considered the main factor determining the direction of gold prices in the coming time.

Domestic gold price today June 30, 2025

As of 4:30 p.m. on June 30, 2025, the domestic gold bar price increased slightly compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 117.5-119.5 million VND/tael (buy - sell), an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 117.5-119.5 million VND/tael (buy - sell), an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118.7-119.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for buying and 300 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 117.5-119.5 million VND/tael (buy - sell), the price increased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 116.8-119.5 million VND/tael (buy - sell), gold price increased 300 thousand VND/tael in both buying and selling directions compared to yesterday.

As of the afternoon of June 30, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 114.3-116.3 million VND/tael (buy - sell); the price increased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 114.4-117.4 million VND/tael (buy - sell); the price increased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today June 30, 2025 is as follows:

| Gold price today | June 30, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 117.5 | 119.5 | +300 | +300 |

| DOJI Group | 117.5 | 119.5 | +300 | +300 |

| Mi Hong | 118.7 | 119.5 | +200 | +300 |

| PNJ | 117.5 | 119.5 | +300 | +300 |

| Bao Tin Minh Chau | 117.5 | 119.5 | +300 | +300 |

| Phu Quy | 116.8 | 119.5 | +300 | +300 |

| 1.DOJI- Updated: 6/30/2025 4:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 117,500▲300K | 119,500▲300K |

| AVPL/SJC HCM | 117,500▲300K | 119,500▲300K |

| AVPL/SJC DN | 117,500▲300K | 119,500▲300K |

| Raw material 9999 - HN | 108,300▲700K | 111,300▲300K |

| Raw materials 999 - HN | 108,200▲700K | 111,200▲300K |

| 2.PNJ- Updated: 6/30/2025 4:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 999.9 gold bar | 11,750 | 11,950 |

| PNJ 999.9 Plain Ring | 11,380 | 11,630 |

| Kim Bao Gold 999.9 | 11,380 | 11,630 |

| Gold Phuc Loc Tai 999.9 | 11,380 | 11,630 |

| 999.9 gold jewelry | 11,300 | 11,550 |

| 999 gold jewelry | 11,289 | 11,539 |

| 9920 gold jewelry | 11,218 | 11,468 |

| 99 gold jewelry | 11,195 | 11,445 |

| 750 Gold (18K) | 7,928 | 8,678 |

| 585 Gold (14K) | 6,022 | 6,772 |

| 416 Gold (10K) | 4,070 | 4,820 |

| PNJ Gold - Phoenix | 11,380 | 11,630 |

| 916 Gold (22K) | 10,340 | 10,590 |

| 610 Gold (14.6K) | 6,311 | 7,061 |

| 650 Gold (15.6K) | 6,773 | 7,523 |

| 680 Gold (16.3K) | 7,119 | 7,869 |

| 375 Gold (9K) | 3,596 | 4,346 |

| 333 Gold (8K) | 3,077 | 3,827 |

| 3.SJC- Updated: 6/30/2025 4:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 117,500▲300K | 119,500▲300K |

| SJC gold 5 chi | 117,500▲300K | 119,520▲300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 117,500▲300K | 119,530▲300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,500▲300K | 116,000▲300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,500▲300K | 116,100▲300K |

| 99.99% jewelry | 113,500▲300K | 115,400▲300K |

| 99% Jewelry | 109,757▲297K | 114,257▲297K |

| Jewelry 68% | 71,729▲204K | 78,629▲204K |

| Jewelry 41.7% | 41,376▲125K | 48,276▲125K |

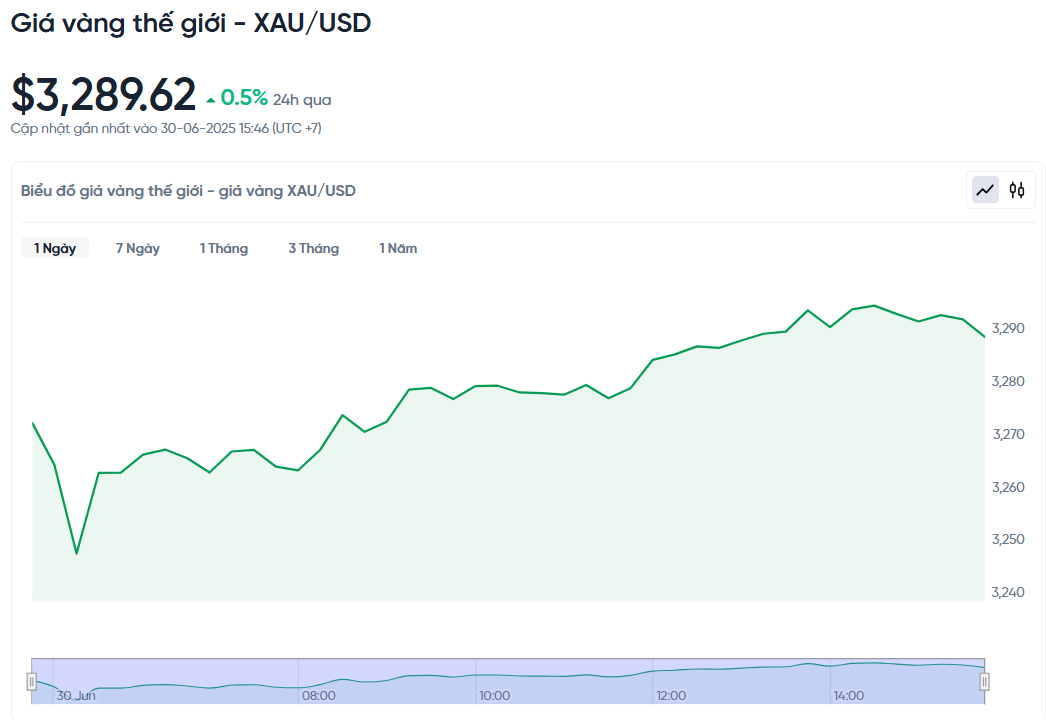

World gold price today June 30, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 p.m. on June 30, Vietnam time, was 3,289.62 USD/ounce. Today's gold price increased by 16.2 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,270 VND/USD), the world gold price is about 107.61 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.89 million VND/tael higher than the international gold price.

Gold prices rose slightly as the US dollar fell to its lowest level in more than three years. The market is now waiting for a series of US employment data to be released this week, as this information may influence the decision of the US Federal Reserve (Fed) to cut interest rates.

Specifically, gold prices increased 0.5% after hitting their lowest level since May 29. In the second quarter of 2025, gold prices increased 5.4%. Meanwhile, gold futures in the US also increased 0.6%, to 3,305.5 USD.

The US dollar continued to weaken, holding at its lowest level since March 2022. As the greenback fell, gold became cheaper for investors using other currencies, thereby boosting buying demand.

According to UBS analyst Giovanni Staunovo, there are two main factors supporting gold prices today. First is the weak US dollar, and second is the pressure from President Donald Trump on the Fed to lower interest rates. Trump said that he would not appoint anyone to the Fed's leadership position if they did not support cutting interest rates.

The market is also awaiting important US employment reports, including ADP data on Wednesday and Non-Farm Payrolls on Thursday. These figures will help predict the Fed's next move on interest rates. Staunovo said that if the data shows the US economy continues to slow, the Fed will have grounds to cut interest rates.

Investors now expect the Fed to cut interest rates by a total of 65 basis points this year, starting in September. Gold prices tend to become more attractive in low-interest-rate environments because it does not offer a yield like other assets.

Besides gold, silver prices also increased by 0.5% to 36.16 USD/ounce. Platinum increased sharply by 1.9% to 1,364.72 USD, while palladium increased by 1.5% to 1,150.30 USD.

Gold price forecast

Kevin Grady, President of Phoenix Futures and Options, said that recent inflation figures suggest the US Federal Reserve (Fed) is likely to cut interest rates in July. The reason is that inflation is approaching the 2% target set by the Fed.

Interest rates are seen as a key factor in determining the direction of gold prices in the coming period, especially as previous geopolitical factors have eased. Bond markets are also reflecting expectations of lower interest rates, with the 10-year Treasury yield currently at 4.2%.

According to Mr. Grady's prediction, even if there is a downward adjustment, gold prices will still be supported at the level of 3100 to 3200 USD/ounce. He believes that in the context of falling interest rates, gold prices will have the opportunity to increase in the long term.

Analysts at Commerzbank remain positive on the outlook for gold, despite a slight dip in prices due to easing tensions in the Middle East. They say a weaker US dollar and expectations of a Fed rate cut will help limit the decline in gold.

If the US June jobs report shows signs of weakness, this will further strengthen the case for the Fed to continue cutting interest rates, thereby supporting gold prices.

A recent survey of the gold market shows that experts are becoming more cautious about the short-term prospects of the precious metal, while individual investors remain optimistic.

Of the 17 Wall Street experts surveyed, only 35% expect gold prices to rise next week, while 53% expect prices to fall and 12% predict flat prices. The main reason is that the market's risk-on sentiment has reduced the appeal of gold.

Meanwhile, Kitco's online survey of 233 individual investors showed a more positive sentiment, with 51% expecting prices to rise, 27% predicting a fall and 21% saying prices will stabilize.

.jpg)

.jpg)