Gold price today March 13: Gold price increases rapidly to create new peak

Gold price today March 13, 2025: World gold price increased sharply to nearly 2940 USD. Domestic gold price increased continuously to create new peaks, reaching an unprecedented record high.

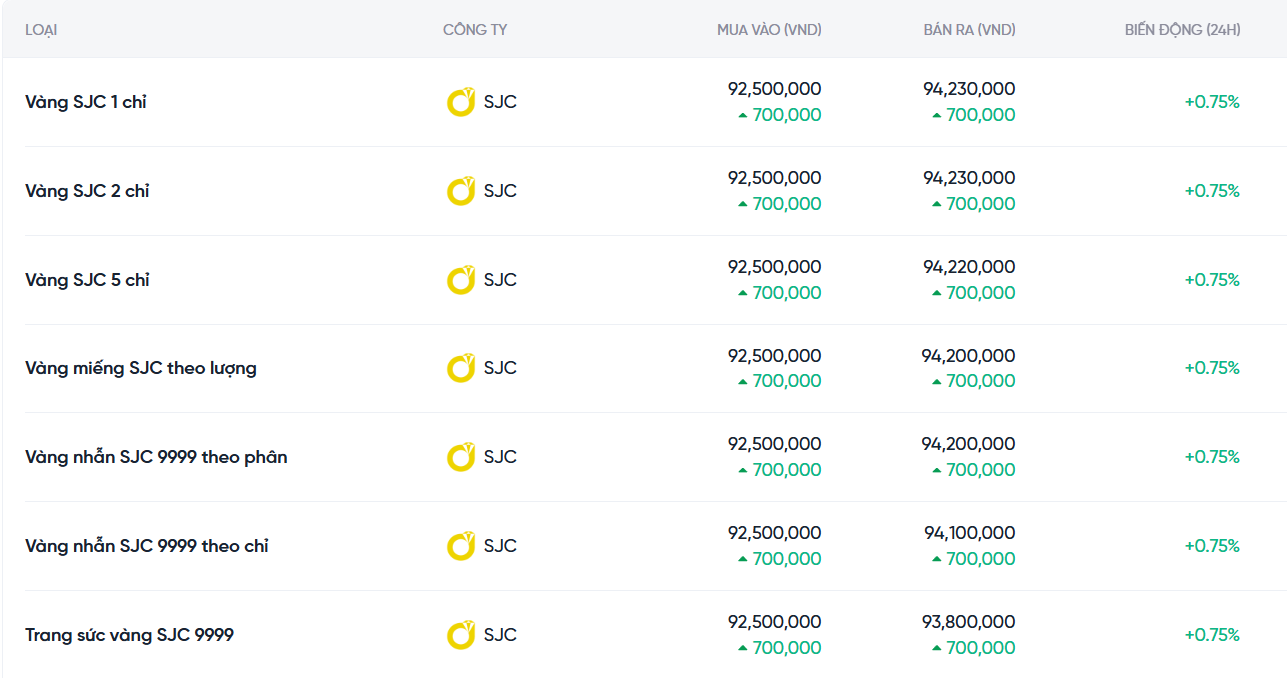

Domestic gold price

As of 8:30 this morning, SJC gold price hit a new peak, while gold ring price continuously reached an unprecedented record high.

Specifically, at SJC Company, the price of gold bars is currently listed at 92.5 - 94.2 million VND/tael (buy - sell), a sharp increase of 700 thousand VND/tael in both buying and selling directions compared to the previous session.

DOJI Group also recorded prices of 92.5 - 94.2 million VND/tael, a sharp increase of 700 thousand VND/tael in both buying and selling directions compared to the closing price yesterday.

At Bao Tin Minh Chau, the price of SJC gold bars is also listed at 92 - 93.5 million VND/tael, an increase of 1 million VND/tael for buying - an increase of 700 thousand VND/tael for selling compared to the closing price yesterday.

The price of 9999 round gold rings also increased simultaneously today. At DOJI, Hung Thinh Vuong gold rings were listed at 93 - 94.5 million VND/tael, an increase of 400 thousand VND/tael for buying - 500 thousand VND/tael for selling compared to the previous session. The difference between buying and selling prices was 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 92.55-94.1 million VND/tael (buy - sell); the price increased by 650 thousand VND/tael for buying and 700 thousand VND/tael for selling. The difference between buying and selling prices is 1.55 million VND/tael.

The latest gold price list today, March 13, 2025 is as follows:

| Today (March 13, 2025) | Yesterday (March 12, 2025) | |||

| Purchase price | Selling price | Purchase price | Selling price | |

| SJC | 92,500 700 700 | 94,200 700 700 | 91,800 | 93,500 |

| DOJI Hanoi | 92,500 700 700 | 94,200 700 700 | 91,800 | 93,500 |

| DOJI SG | 92,500 700 700 | 94,200 700 700 | 91,800 | 93,500 |

| BTMC SJC | 92,000 | 93,500 | 92,000 | 93,500 |

| Phu Quy SJC | 92,500 500 500 | 94,200 700 700 | 92,000 | 93,500 |

| PNJ HCMC | 92,700 400 400 | 94,200 300 300 | 92,300 | 93,900 |

| PNJ Hanoi | 92,700 400 400 | 94,200 300 300 | 92,300 | 93,900 |

.png)

World gold price today March 13, 2025

On the international market, as of 8:30 a.m., the world gold price was listed at 2,937.89 USD/ounce, an increase of 23.9 USD/ounce compared to the beginning of the previous trading session.

Gold prices are on a strong upward trend in the context of inflation in the US showing signs of cooling down. Specifically, SJC gold prices have reached a new peak, while gold rings have also continuously reached record highs. This is a signal that gold is becoming a safe destination for many investors.

World gold prices today increased significantly and reached the highest level in the past three weeks. The main reason is that inflation data in the US showed that the consumer price index (CPI) in February 2025 increased by only 2.8%, slightly down from 3% in the previous month.

This shows that inflationary pressures are easing, leading many to expect that the US Federal Reserve (Fed) may cut interest rates sooner than expected to support the economy.

In addition, the weakening US dollar is also a factor supporting the increase in gold prices. Investors are concerned that trade wars could drag down the US economy, while the US stock market has fallen for two consecutive sessions, making gold a more attractive choice.

The DXY index, which measures the strength of the USD against a basket of six major currencies, fell 0.2% to 103.62 points, contributing to the increase in gold prices.

Gold price forecast

Regarding the forecast of gold prices in the coming time, many experts believe that gold can continue to increase strongly. Although inflation is showing signs of decreasing, the possibility of the Fed cutting interest rates soon will create favorable conditions for gold. The reason is that gold does not generate interest, so when interest rates are low, the opportunity cost of holding gold also decreases, making it more attractive.

After the CPI data was released, the market adjusted expectations for the Fed to cut interest rates by about 70-76 basis points between now and the end of the year.

Expert Neils Christensen from Kitco predicts that with the current inflation situation, spot gold prices could reach $3,000/ounce in the future.

However, for now, gold prices are still heavily influenced by global trade issues. The US imposition of tariffs on steel and aluminum, along with the response from Europe, is raising concerns about the risk of escalating trade tensions. This could continue to support gold prices to maintain high levels.

Geopolitical factors also play an important role in guiding gold prices. Investors are waiting for the results of negotiations between US President Donald Trump and Russian President Putin on a 30-day ceasefire between Russia and Ukraine.

If geopolitical tensions ease, gold could lose some of its upward momentum. However, in the current context, gold is still considered a safe asset and has the potential to increase in price in the long term.