Gold price today April 13, 2025: Domestic and world gold prices increased to a new record

Gold price today April 13, 2025: Domestic gold price and world gold price increased to a new peak ever. Specifically, the price of gold bars set a new record at 106.5 million.

Domestic gold price today April 13, 2025

At the time of survey at 4:30 a.m. on April 13, 2025, domestic gold prices increased sharply, breaking yesterday's record peak. Specifically:

DOJI Group listed the price of SJC gold bars at 103-106.5 million VND/tael (buy - sell), an increase of 800 thousand VND/tael for buying - an increase of 1.3 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 103-106.5 million VND/tael (buy - sell), an increase of 800 thousand VND/tael in buying - an increase of 1.3 million VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 103.3-104.7 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 800 thousand VND/tael for buying and 200 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 103-106.5 million VND/tael (buying - selling), up 800 thousand VND/tael in buying - up 1.3 million VND/tael in selling compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 102.5-106.5 million VND/tael (buy - sell), gold price increased 500 thousand VND/tael in buying direction - increased 1.3 million VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 101.2-104.8 million VND/tael (buy - sell); an increase of 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 101.6-105.1 million VND/tael (buy - sell); increased 700 thousand VND/tael for buying - increased 600 thousand VND/tael for selling.

The latest gold price list today, April 13, 2025 is as follows:

| Gold price today | April 13, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 103 | 106.5 | +800 | +1300 |

| DOJI Group | 103 | 106.5 | +800 | +1300 |

| Mi Hong | 103.3 | 104.7 | +800 | +200 |

| PNJ | 103 | 106.5 | +800 | +1300 |

| Vietinbank Gold | 106.5 | +1300 | ||

| Bao Tin Minh Chau | 103 | 106.5 | +800 | +1300 |

| Phu Quy | 102.5 | 106.5 | +500 | +1300 |

| 1.DOJI- Updated: 4/13/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 103,000▲800K | 106,500▲1300K |

| AVPL/SJC HCM | 103,000▲800K | 106,500▲1300K |

| AVPL/SJC DN | 103,000▲800K | 106,500▲1300K |

| Raw material 9999 - HN | 101,000▲500K | 103,900▲500K |

| Raw materials 999 - HN | 100,900▲500K | 103,800▲500K |

| 2.PNJ- Updated: 4/13/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 101,200▲400K | 104,900▲600K |

| HCMC - SJC | 103,000▲800K | 106,500▲1300K |

| Hanoi - PNJ | 101,200▲400K | 104,900▲600K |

| Hanoi - SJC | 103,000▲800K | 106,500▲1300K |

| Da Nang - PNJ | 101,200▲400K | 104,900▲600K |

| Da Nang - SJC | 103,000▲800K | 106,500▲1300K |

| Western Region - PNJ | 101,200▲400K | 104,900▲600K |

| Western Region - SJC | 103,000▲800K | 106,500▲1300K |

| Jewelry gold price - PNJ | 101,200▲400K | 104,900▲600K |

| Jewelry gold price - SJC | 103,000▲800K | 106,500▲1300K |

| Jewelry gold price - Southeast | PNJ | 101,200▲400K |

| Jewelry gold price - SJC | 103,000▲800K | 106,500▲1300K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 101,200▲400K |

| Jewelry gold price - Kim Bao Gold 999.9 | 101,200▲400K | 104,900▲600K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 101,200▲400K | 104,900▲600K |

| Jewelry gold price - Jewelry gold 999.9 | 101,200▲400K | 103,700▲400K |

| Jewelry gold price - 999 jewelry gold | 101,100▲400K | 103,600▲400K |

| Jewelry gold price - 9920 jewelry gold | 100,470▲400K | 102,970▲400K |

| Jewelry gold price - 99 jewelry gold | 100,260▲390K | 102,760▲390K |

| Jewelry gold price - 750 gold (18K) | 75,430▲300K | 77,930▲300K |

| Jewelry gold price - 585 gold (14K) | 58,320▲240K | 60,820▲240K |

| Jewelry gold price - 416 gold (10K) | 40,790▲170K | 43,290▲170K |

| Jewelry gold price - 916 gold (22K) | 92,590▲370K | 95,090▲370K |

| Jewelry gold price - 610 gold (14.6K) | 60,910▲250K | 63,410▲250K |

| Jewelry gold price - 650 gold (15.6K) | 65,060▲260K | 67,560▲260K |

| Jewelry gold price - 680 gold (16.3K) | 68,170▲280K | 70,670▲280K |

| Jewelry gold price - 375 gold (9K) | 36,540▲150K | 39,040▲150K |

| Jewelry gold price - 333 gold (8K) | 31,870▲130K | 34,370▲130K |

| 3. SJC - Updated: April 13, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 103,000▲800K | 106,500▲1300K |

| SJC gold 5 chi | 103,000▲800K | 106,520▲1300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 103,000▲800K | 106,530▲1300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 101,400▲300K | 104,900▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 101,400▲300K | 105,000▲500K |

| 99.99% jewelry | 101,400▲300K | 104,400▲500K |

| 99% Jewelry | 99,566▲495K | 103,366▲495K |

| Jewelry 68% | 67,349▲340K | 71,149▲340K |

| Jewelry 41.7% | 39,889▲208K | 43,689▲208K |

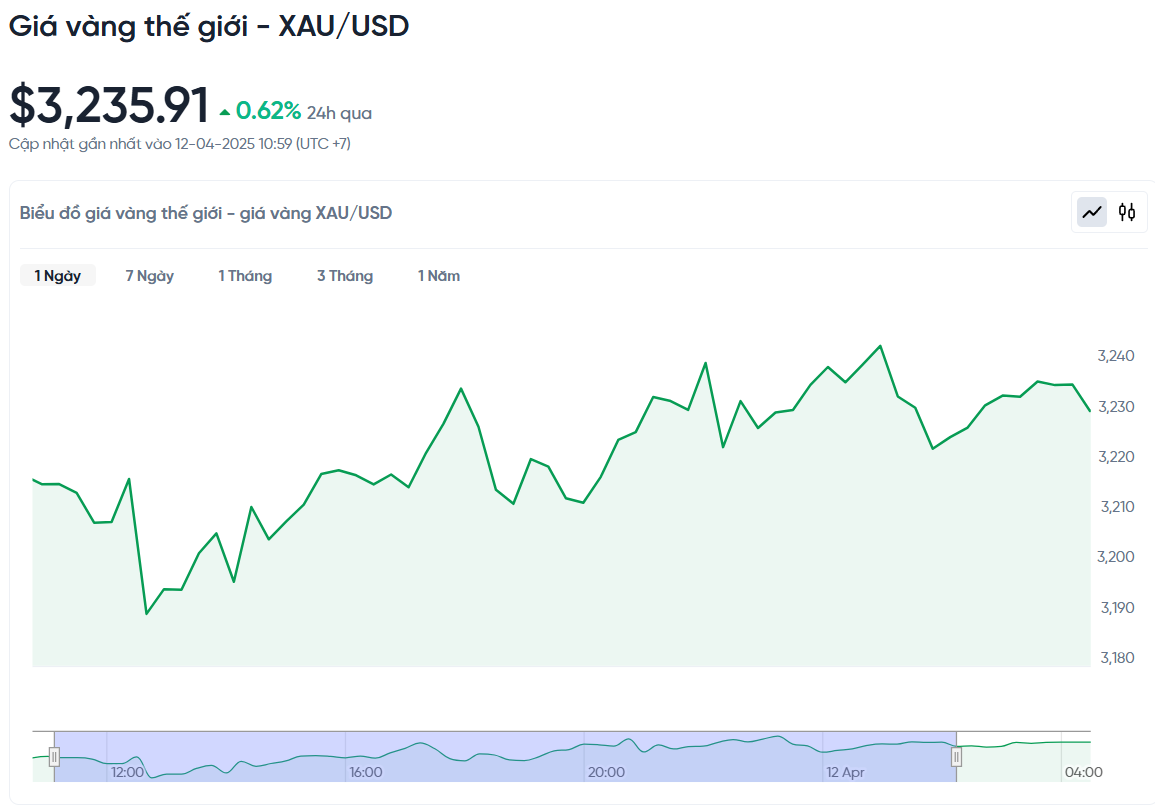

World gold price today April 13, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,235.91 USD/ounce. Today's gold price increased by 19.9 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (25,920 VND/USD), the world gold price is about 102.17 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 4.33 million VND/tael higher than the international gold price.

The world gold price increased sharply, surpassing the threshold of 3,200 USD yesterday, as the USD weakened and the escalating US-China trade tensions raised fears of an economic recession. This caused many investors to rush to gold as a safe haven.

The world gold price has increased sharply in the last three trading days, with the June futures contract increasing by about 254 USD. Since the end of last week, the gold price has increased by more than 6%, marking the strongest weekly increase since March 2020. Although the gold price increase is showing signs of overshooting, many experts say it is difficult to determine a reasonable price in the context of the falling USD and rising bond yields.

Investors flocked to gold because there were no viable safe havens left, according to analyst David Morrison of Trade Nation. After the crash of US bonds – considered a “traditional haven” – gold became an alternative destination, although prices have risen more than 8% since mid-week alone.

Nitesh Shah, commodity strategist at WisdomTree, said: "Gold is being seen as the top safe-haven asset amid Mr. Trump's trade war causing global turmoil. The dollar has lost value and US bonds have sold off sharply as confidence in the US trade position has declined."

The dollar has fallen against other currencies, making gold cheaper for foreign investors. In addition, factors such as central bank buying, expectations of Fed rate cuts, geopolitical instability and money flowing into gold ETFs have also contributed to the sharp rise in gold prices this year.

Although the US producer price index (PPI) unexpectedly fell 0.4% in March, tariffs are expected to push inflation higher in the coming months. Markets now expect the Fed to start cutting interest rates in June and could reduce them by a total of 0.9 percentage points by the end of 2025.

The University of Michigan’s consumer confidence index showed growing pessimism, hitting its lowest level since mid-2022. Inflation expectations over the next year jumped to 6.7% – the highest since 1981 – and 5-10 year expectations also far exceeded the Federal Reserve’s 2% target.

Gold prices typically benefit in a low-interest-rate environment. However, UBS experts warn that the upside could be limited if geopolitical tensions ease, trade relations improve or the US economy shows signs of a strong recovery.

Besides gold prices, silver prices increased 3.2% to 32.18 USD/ounce, platinum decreased slightly 0.2% to 936.36 USD, and palladium increased 0.7% to 914.87 USD.

Gold price forecast

Jerry Prior of Mount Lucas Management said the market is too volatile to be accurate. Meanwhile, independent analyst Jesse Colombo said there is still a lot of room for gold to rise, especially when the US dollar has been overvalued for many years.

Naeem Aslam, chief investment officer at Zaye Capital Markets, also said gold is overbought, but market fears are the main driver of the price increase. When panic prevails, gold is often the only place investors can feel safe.

Lukman Otunuga of FXMT said factors such as slowing global growth, expectations of a Fed rate cut and a weaker US dollar will continue to support gold. Technically, if gold closes firmly above $3,200, a path to $3,250 and even $3,300 is possible.

Alex Kuptsikevich from FxPro is even more optimistic, saying the current rally could take gold prices above $3,500, especially with gold mining ETFs at multi-year highs.

Markets will continue to closely monitor announcements from the White House, new developments in the trade war and responses from central banks. A speech by Fed Chairman Jerome Powell next Wednesday at the Economic Club of Chicago will be of particular interest.

Financial expert Peter Schiff believes that the sharp increase in gold prices is not just a temporary wave of refuge but a deep restructuring of global capital flows. Schiff said he had predicted that gold would reach $5,000 from the period of 2009-2011 when the price was only at the threshold of $1,000/ounce. But with the huge amount of money and debt that has been created so far, he believes that $5,000 is now just a "stopover" on a much longer journey.

One sign of systemic change is that central banks around the world are buying gold at a record pace, which Schiff says reflects preparations for a future where the US dollar no longer plays a central role in the global monetary system.

Citi Research forecasts an average of $2,900 in 2025 and $2,800 in 2026. However, they are also optimistic that in the short term, gold prices could reach $3,200 within 3 months and $3,000 in the next 6–12 months. In the long term, Citi expects gold prices to reach $3,500 by the end of 2025.

Next week, important economic data will be released, including the New York manufacturing survey on Tuesday, jobless claims and US homebuilding figures on Thursday, all of which could influence the short-term price trend of gold.