Gold price today March 23, 2025: Domestic and world gold prices increased for 3 consecutive weeks

Gold price today March 23, 2025: Domestic and world gold prices experienced 2 days with the sharpest decline in 2025. However, gold prices still had the 3rd consecutive week of price increase this March.

Domestic gold price today March 23, 2025

At the time of survey at 4:30 a.m. on March 23, 2025, domestic gold prices decreased slightly. However, domestic gold prices still had a week of price increase due to the increase from the beginning of the week. Specifically:

DOJI Group listed the price of SJC gold bars at 94.4-97.4 million VND/tael (buy - sell), down 300,000 VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 94.4-97.4 million VND/tael (buy in - sell out), down 300 thousand VND/tael in both buying and selling directions compared to yesterday. Currently, the price of gold bars at SJC and Doji increased by 100 thousand VND/tael compared to last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 96-97.4 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1 million VND/tael for buying and decreased by 100 thousand VND/tael for selling compared to yesterday.

The price of SJC gold at Bao Tin Minh Chau Company Limited was traded by the enterprise at 94.8-97.4 million VND/tael (buying - selling), down 400 thousand VND/tael in buying direction - down 300 thousand VND/tael in selling direction compared to yesterday. The price of gold bars at Bao Tin Minh Chau increased 300 thousand VND/tael compared to last week.

SJC gold price at Phu Quy is traded by businesses at 94.6-97.4 million VND/tael (buy - sell), gold price decreased 300 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI is listed at 95.6-98.2 million VND/tael (buy in - sell out); down 300 thousand VND/tael in both buying and selling directions compared to yesterday. The price of Hung Thinh Vuong 9999 round gold rings increased by 1.7 million VND/tael compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 96.1-98.6 million VND/tael (buy - sell); down 300 thousand VND/tael in both buying and selling directions. BTMC plain gold ring price increased 1.1 million VND/tael compared to last week.

The latest gold price list today, March 23, 2025 is as follows:

| Gold price today | March 23, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 94.4 | 97.4 | -300 | -300 |

| DOJI Group | 94.4 | 94.4 | -300 | -300 |

| Mi Hong | 96 | 97.4 | +1000 | -100 |

| PNJ | 94.4 | 94.4 | -300 | -300 |

| Vietinbank Gold | 94.4 | -300 | ||

| Bao Tin Minh Chau | 94.8 | 94.4 | -400 | -300 |

| Phu Quy | 94.6 | 94.4 | -300 | -300 |

| 1.DOJI- Updated: 23/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 94,400▼300K | 97,400▼300K |

| AVPL/SJC HCM | 94,400▼300K | 97,400▼300K |

| AVPL/SJC DN | 94,400▼300K | 97,400▼300K |

| Raw material 9999 - HN | 95,600▼300K | 97,300▼300K |

| Raw materials 999 - HN | 95,500▼300K | 97,200▼300K |

| AVPL/SJC Can Tho | 94,400▼300K | 97,400▼300K |

| 2.PNJ- Updated: 23/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 95,700▼300K | 98,300▼200K |

| HCMC - SJC | 94,400▼300K | 97,400▼300K |

| Hanoi - PNJ | 95,700▼300K | 98,300▼200K |

| Hanoi - SJC | 94,400▼300K | 97,400▼300K |

| Da Nang - PNJ | 95,700▼300K | 98,300▼200K |

| Da Nang - SJC | 94,400▼300K | 97,400▼300K |

| Western Region - PNJ | 95,700▼300K | 98,300▼200K |

| Western Region - SJC | 94,400▼300K | 97,400▼300K |

| Jewelry gold price - PNJ | 95,700▼300K | 98,300▼200K |

| Jewelry gold price - SJC | 94,400▼300K | 97,400▼300K |

| Jewelry gold price - Southeast | PNJ | 95,700▼300K |

| Jewelry gold price - SJC | 94,400▼300K | 97,400▼300K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 95,700▼300K |

| Jewelry gold price - Jewelry gold 999.9 | 95,700▼200K | 98,200▼200K |

| Jewelry gold price - 999 jewelry gold | 95,600▼200K | 98,100▼200K |

| Jewelry gold price - 99 jewelry gold | 94,820▼200K | 97,320▼200K |

| Jewelry gold price - 916 gold (22K) | 87,550▼180K | 90,050▼180K |

| Jewelry gold price - 750 gold (18K) | 71,300▼150K | 73,800▼150K |

| Jewelry gold price - 680 gold (16.3K) | 64,430▼130K | 66,930▼130K |

| Jewelry gold price - 650 gold (15.6K) | 61,480▼130K | 63,980▼130K |

| Jewelry gold price - 610 gold (14.6K) | 57,550▼120K | 60,050▼120K |

| Jewelry gold price - 585 gold (14K) | 55,100▼110K | 57,600▼110K |

| Jewelry gold price - 416 gold (10K) | 38,500▼80K | 41,000▼80K |

| Jewelry gold price - 375 gold (9K) | 34,480▼70K | 36,980▼70K |

| Jewelry gold price - 333 gold (8K) | 30,060▼60K | 32,560▼60K |

| 3. SJC - Updated: 3/23/2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 94,400▼300K | 97,400▼300K |

| SJC 5c | 94,400▼300K | 97,420▼300K |

| SJC 2c, 1C, 5 phan | 94,400▼300K | 97,430▼300K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 94,300▼300K | 97,000▼300K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 94,300▼300K | 97,100▼300K |

| 99.99% Jewelry | 94,300▼300K | 96,700▼300K |

| 99% Jewelry | 92,742▼297K | 95,742▼297K |

| Jewelry 68% | 62,912▼204K | 65,912▼204K |

| Jewelry 41.7% | 37,477▼125K | 40,477▼125K |

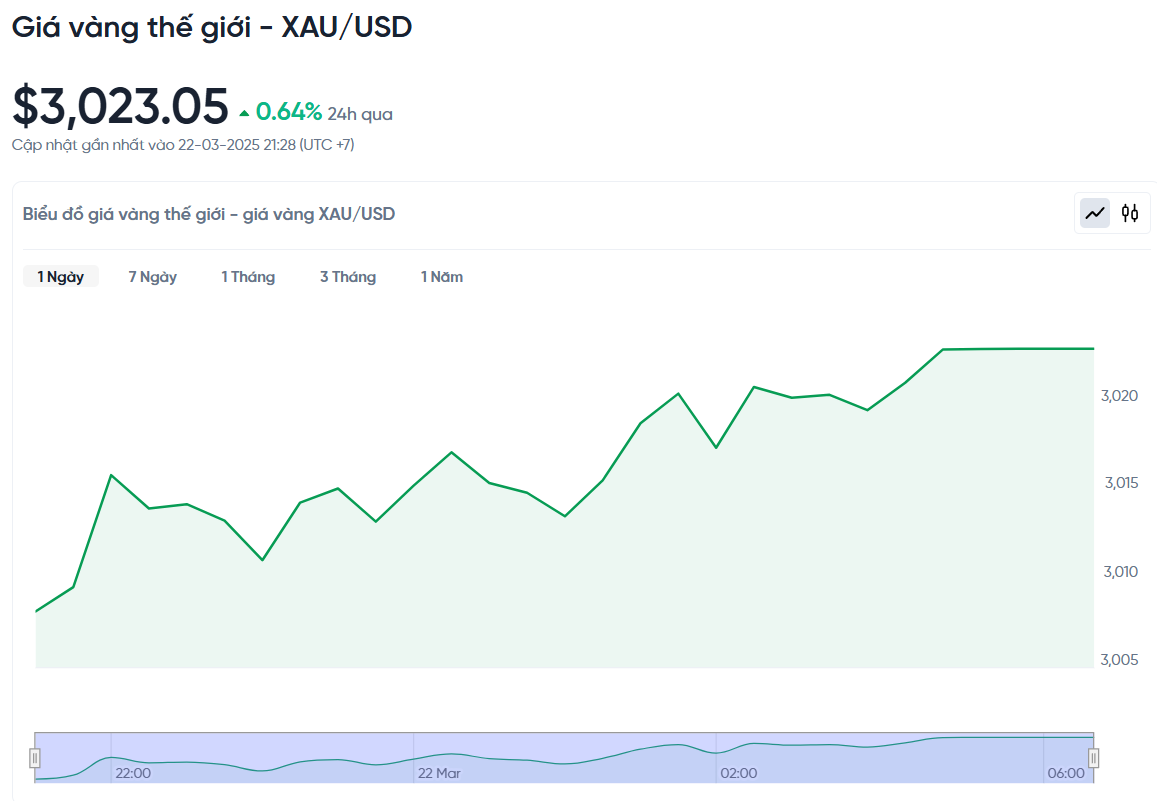

World gold price today March 23, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3023.05 USD/ounce. Today's gold price increased by 19.17 USD/ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,910 VND/USD), the world gold price is about 95.47 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 1.93 million VND/tael higher than the international gold price.

World gold prices have increased for the third consecutive week, despite a slight correction at the end of the week. The increase of about 1%, largely due to market concerns about US President Donald Trump's new tariff policy and the economic impact it could cause.

Recently, after a series of strong increases, the gold market has shown signs of slowing down. Many experts believe that gold prices may be entering a period of pause and accumulation before establishing a new direction. However, the general sentiment in the market is still very positive. Despite short-term adjustments, there is no sign that investors want to sell off.

The main reason why gold has remained above $3,000 an ounce is because many fundamental factors have not changed. Central banks continue to buy, especially when they want to reduce their dependence on the USD. At the same time, in the context of global economic instability and rising inflation, investors still see gold as a safe asset.

According to expert George Milling-Stanley, the current time should focus on investment demand through gold-linked ETFs. He believes that money is starting to flow strongly into this channel and will continue to be a major driving force for gold prices in the rest of the year.

Inflation is considered the main reason why investors return to gold. Previously, many people chose to buy short-term financial products such as money market funds because of the attractive real yields. But when inflation started to rise due to the impact of the trade war, real yields fell, making gold more attractive.

Since the beginning of the year, the amount of gold held by the SPDR Gold Shares ETF – the world’s largest gold fund – has increased by more than 37 tons, reaching 910 tons. However, this figure is still much lower than the peak of nearly 1,278 tons in 2020 and 28% lower than the record set in 2012.

It is worth noting that gold prices are still rising strongly, even though the amount of gold in ETFs has not fully recovered. Over the past 12 months, the price has increased by nearly 62%, showing that the real demand is still coming from factors other than ETFs.

The difference between this rally and 2012 and 2020 is clear. Previously, when prices peaked, investors tended to sell to lock in profits. But now, despite the strong price increase, ETFs have not attracted the capital expected, proving that the growth potential is still very large.

In 2020, gold also benefited from the massive money injection by governments and central banks to deal with the pandemic. However, most of the money then flowed into stocks. Now, the trend is gradually changing as many investors start to return to gold as a hedge against risks, especially in the context of trade tensions and unpredictable monetary policy.

Gold price forecast

During the weekend trading session, the world gold price barely fluctuated due to no notable news appearing, while the market recorded profit-taking pressure from investors. However, as soon as the gold price decreased slightly, many people quickly bought in, showing that the market sentiment was still quite positive.

Most experts believe that the prospect of gold prices continuing to increase remains, but some also emphasize that a temporary price pause is necessary for the market to maintain a sustainable upward momentum in the long term.

Gold could trade around $3,000 an ounce in the coming months, and holding above that level could signal that the current rally is more than temporary, according to strategist George Milling-Stanley of State Street Global Advisors.

Some experts also believe that a drop of a few hundred dollars in gold will not affect the upward trend too much. Ole Hansen of Saxo Bank said that if the price of gold falls by about $100, it could be a good buying opportunity, especially for investors who want to shift assets from stocks to gold due to concerns about inflation and recession.

David Morrison of Trade Nation agrees, saying a mild correction would help the market become healthier and create opportunities for new investors to enter. He believes the $3,000/ounce mark will remain an important support level in the near future.

This week’s Kitco News survey shows that sentiment among experts and investors is beginning to diverge. Of the 18 experts surveyed, only 39% expect gold prices to rise, while 28% expect prices to fall and 33% believe the market will move sideways. On the individual investor side, 59% still believe gold prices will continue to rise, but that number is down from last week.

Meanwhile, experts from Commerzbank warn that inflation remains a factor that could put pressure on gold. After the US Federal Reserve (Fed) kept interest rates unchanged, they raised their 2025 inflation forecast to 2.8%, higher than their previous forecast. This makes investors more cautious.

Gold is still considered a safe haven asset, especially in the context of rising risks of stagflation. The combination of high inflation and slow economic growth is something that investors are very afraid of.

Key economic data releases next week include manufacturing and services PMIs, consumer confidence, durable goods orders, unemployment figures and fourth-quarter GDP. But the most closely watched data will be the PCE index – the Fed’s preferred inflation measure – due Friday morning.