Doing business in traditional markets is difficult to compete with supermarkets and shopping malls.

(Baonghean.vn) - That was one of the opinions raised at the working session between the Provincial People's Council's Supervisory Delegation at the People's Committee of Hong Son Ward, Vinh City according to the program of supervising budget collection in the province.

Difficulties in tax management

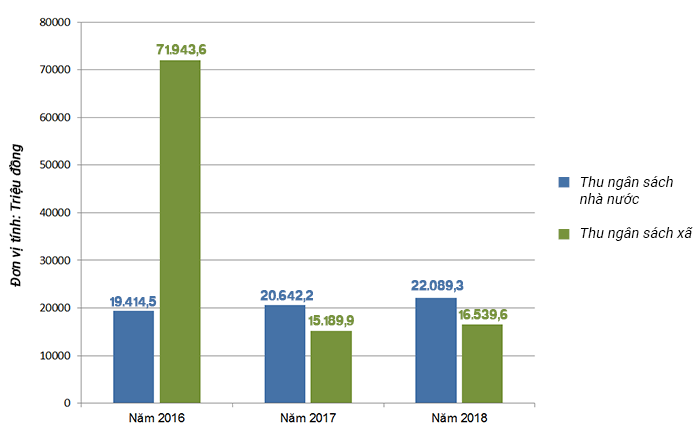

According to the report of the People's Committee of Hong Son Ward, the budget revenue in the period of 2016 - 2018 in the ward has increased, however, there were 2 years when the assigned plan was not completed.

|

| Total budget revenue of Hong Son Ward People's Committee in the period 2016 - 2018. Technique: Huu Quan |

The Provincial People's Council's monitoring delegation raised many issues, such as the need to clarify the number of business households in the area, including how many individual business households, how many business households have collected taxes; the existing problems and difficulties in the issue of monitoring and checking tax collection authorization through the post office; the issue of public tax payment...

According to the local government, there are two markets in the ward with different management models (under the City People's Committee and managed by private enterprises), so there is no uniformity in the tax collection levels. In addition, the coordination between the market management board and the tax agency and local government is still limited and inconsistent, making tax management difficult.

|

| Comrade Hoang Viet Duong - Member of the Provincial Party Executive Committee, Vice Chairman of the Provincial People's Council chaired the meeting. Photo: Phuong Thuy |

On the other hand, the number of business households in the area is decreasing, because doing business in traditional markets is facing many difficulties, it is difficult to compete with supermarkets and large commercial centers, which is also one of the reasons why budget revenue tends to decrease every year.

Currently, the owners of transport businesses operate on the move and are not present at their place of residence, leading to difficulties in establishing a management team and urging tax collection. In many cases, tax arrears are lingering for a long time. Therefore, the representative of Hong Son ward also requested the City Police to direct the traffic police force, police of wards and communes, People's Committees of wards and communes to actively coordinate with the Tax Department to review, inspect, handle and manage tax collection for individuals doing transport businesses in the area better.

|

| The Inter-ward and Commune Tax Team at the People's Committee of Hong Son Ward recommended that superiors pay attention to, invest in, and upgrade infrastructure to make tax management more effective. Photo: Phuong Thuy |

Speaking at the meeting, Vice Chairman of the Provincial People's Council Hoang Viet Duong highly appreciated the leadership and direction of the People's Committee of Hong Son ward in urging and managing taxes in the area.

The Vice Chairman of the Provincial People's Council suggested that localities should pay attention to the inspection and review of organizations and individuals doing business in the area to comply with legal regulations, ensure fairness among taxpayers, contribute to increasing budget revenue and nurturing revenue sources; need to pay attention to the issue of dialogue, receiving people and propagating to the masses about tax collection and payment...

|

| The monitoring team worked at Tan Hung Company Limited. Photo: Phuong Thuy |

The working group also conducted supervision at Tan Hung Company Limited, which operates in the field of investment and construction of civil, industrial, traffic, road and bridge works... located in Vinh Tan ward, Vinh city.

According to the production and business situation report, Tan Hung Company Limited, in addition to the extended tax amount, up to now, the enterprise has no debt to the state budget. Specifically, in 2016: the tax paid was over 3.3 billion VND, the extended tax amount was over 4.6 billion VND; in 2017: the tax paid was over 6.8 billion VND, the tax amount to be extended was over 4.1 billion VND. In 2018: the tax paid was over 5.7 billion VND; the tax amount to be extended was over 4 billion VND.

The company representative said that up to now, the total amount of money that project management boards still owe the company is more than 128 billion VND, making it difficult for the company to implement key projects.

Vice Chairman of the Provincial People's Council Hoang Viet Duong shared the difficulties of enterprises, and at the same time, requested the Company to be more accurate in cost management; to evaluate the quality of business performance each year... to ensure the harmony of interests between enterprises, the State and employees.

.jpg)

![[Trực tiếp] Phiên bế mạc, Kỳ họp thứ 31, Hội đồng nhân dân tỉnh Nghệ An khóa XVIII [Trực tiếp] Phiên bế mạc, Kỳ họp thứ 31, Hội đồng nhân dân tỉnh Nghệ An khóa XVIII](https://bna.1cdn.vn/thumbs/540x360/2025/07/10/z6789996770615_dd674c18f435b3832766f4bb423c7bfb(1).jpg)

![[Trực tiếp] Phiên chất vấn và trả lời chất vấn, Kỳ họp thứ 31, Hội đồng Nhân dân tỉnh Nghệ An khóa XVIII [Trực tiếp] Phiên chất vấn và trả lời chất vấn, Kỳ họp thứ 31, Hội đồng Nhân dân tỉnh Nghệ An khóa XVIII](https://bna.1cdn.vn/thumbs/540x360/2025/07/10/z6788966906184_c4fcf742cb54b169f79f1fd8e742be73.jpg)