Nghe An: 3,500 businesses not operating at registered address, what do the industries say?

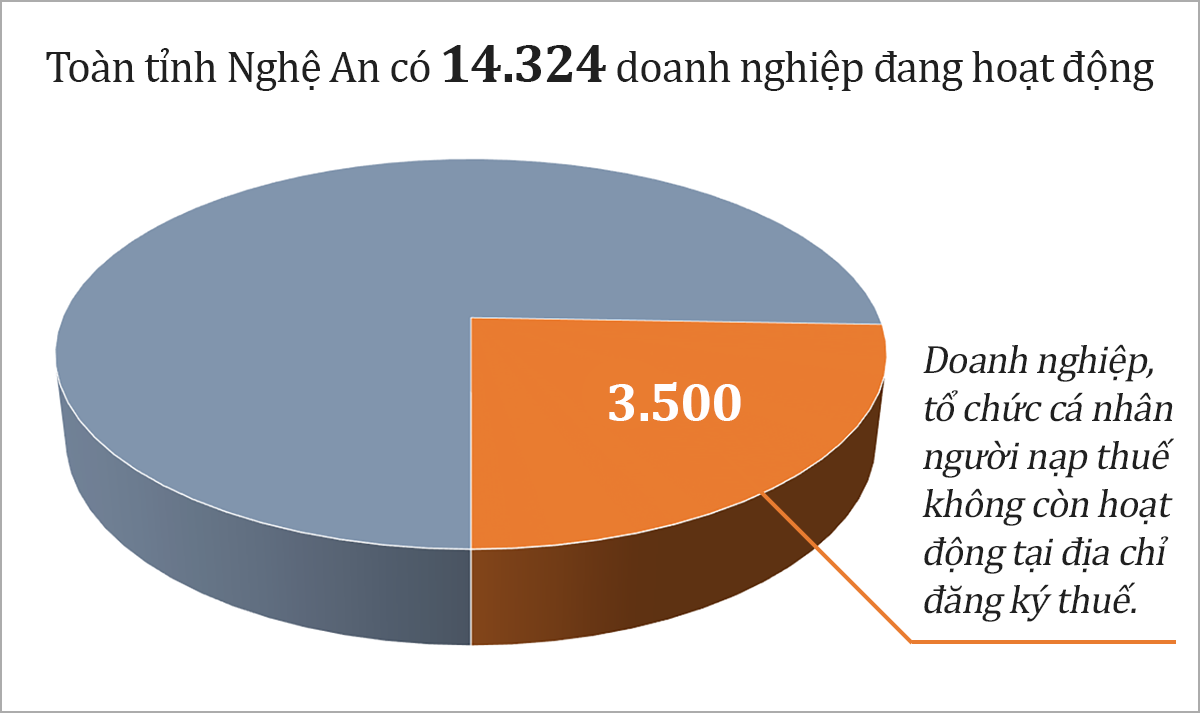

(Baonghean.vn) - A representative of Nghe An Tax Department said: Up to now, the whole province has 14,324 enterprises operating and registered to pay taxes, of which, there are over 3,500 enterprises, organizations, and individual taxpayers who are not operating at the registered address and are in debt to taxes.

In recent years, due to the impact of the Covid-19 pandemic and the internal difficulties of businesses, thousands of businesses in Nghe An have abandoned their business addresses and changed jobs while still owing taxes. This has caused difficulties for tax management in the area.

As Nghe An Newspaper has reported, not only Song Lam II Tax Department and Vinh Tax Department have many enterprises abandoning their business locations, but Song Lam I Tax Department (managing Do Luong and Thanh Chuong areas) also has 26 enterprises and establishments abandoning their business addresses, owing 780 million VND. Tax-debt-ridden enterprises include Nguyen Van Khuong Private Enterprise, Trang Son Commune; Duc Truong Trading Joint Stock Company, Giang Son Tay Commune; Giang Son Sun Company Limited, all company signs have been removed, and most of the company directors have changed jobs.

|

| Tay Truong Son Investment and Construction Joint Stock Company, with its registered tax address at Km31, National Highway 46, Xuan Hoa Commune, Nam Dan District, has ceased operations and currently owes the State budget 3.9 billion VND. Photo: Van Truong |

Representative of Nghe An Tax Department said: Up to now, the whole province has 14,324 enterprises operating and registered to pay taxes, of which,There are over 3,500 businesses, organizations, and individual taxpayers not operating at the registered address., the taxpayer has ceased operations and has terminated the tax code and has not terminated the tax code.

|

Graphic on the number of businesses abandoning tax registration addresses. Graphic: Huu Quan |

The difficulty for the Tax sector is that: Enterprises, taxpayers, abandon their business addresses when they still owe taxes. Therefore, the Tax authorities have difficulty in contacting them to guide them in declaring and paying taxes, or carrying out procedures to terminate the validity of their tax codes. Not to mention the situation where some enterprises today put up signs with their business names and addresses, but when they come for inspection later, the signs have been removed and the procedures for the registered invoices have not been completed, causing the risk of losing tax revenue due to the use of illegal invoices.

If a business does not operate at its registered address, the tax authority wants to send them a document, notice, or request an explanation, but if the business is not there, the two parties cannot coordinate, and it is also difficult for the local government to work when necessary.

To promptly control business fluctuations and collect tax debts, the Provincial Tax Department directs departments and tax branches to regularly review tax codes and taxpayer information on the application, and promptly supplement tax management information. Tax debts are regularly monitored and tax enforcement measures are implemented according to regulations.

The Tax Department coordinates with banks, credit institutions, and security agencies to collect tax debts for cases of abandoning business addresses to evade tax debts; conduct procedures to notify temporary suspension of exit for legal representatives of units that are dragging on tax debts and have applied coercive measures but have not been able to collect tax debts according to regulations.

The representative of the Tax Department said: Based on the provisions of law on the termination of tax codes for taxpayers in cases where the tax authority has issued a Notice of non-operation at the registered address, the Tax Department sends a list of tax-indebted enterprises that have abandoned their registered tax business addresses to request the Provincial Department of Planning and Investment to revoke the Business Registration Certificate that has been notified by the tax authority.

Mr. Nguyen Quang Loi - Head of the Business Registration Department of the Department of Planning and Investment added: Every year, the Tax Department sends a list of businesses that owe taxes and abandon their business locations, about 700 - 800 businesses, requesting the Department of Planning and Investment to revoke their business registration certificates. On that basis, the business registration office sends a warning letter to the businesses on the list. After a period of time without receiving a response or the business does not pay taxes, the Department of Planning and Investment will revoke the business registration certificate if the business still does not fulfill its tax obligations.

Article 15, Circular 105/2020/TT-BTC stipulates:

- Taxpayers' obligations must be fulfilled before the tax code expires;

- Taxpayers submit reports on invoice usage according to the provisions of law on invoices;

- Taxpayers fulfill their obligations to submit tax declarations, pay taxes and handle excess tax payments and undeducted value added tax (if any) in accordance with the Law on Tax Administration with tax authorities;

- In case the parent unit has dependent units, all dependent units must complete the procedure to terminate the tax code before terminating the tax code of the parent unit.

Nghe An: 220 businesses owe over 827 billion VND in taxes

29/12/2022

Tax debt management is increasingly clear and transparent.

12/10/2022