Nghe An: Strongly handle illegal credit activities

(Baonghean.vn) - After 3 years of implementing Directive No. 12/CT-TTg of the Prime Minister, along with the drastic participation of the entire political system, Nghe An has achieved positive results in preventing and fighting crimes related to "black credit" activities.

Solved many major cases

To improve the effectiveness of State management in the fight against crimes and law violations related to "black credit" activities, the People's Committee of Nghe An province has directed the main functional force, Nghe An Police, to deploy peak campaigns to crack down and investigate special projects and cases related to black credit. Many cases "Loan sharking in civil transactions" be prosecuted, investigated, prosecuted, and tried strictly.

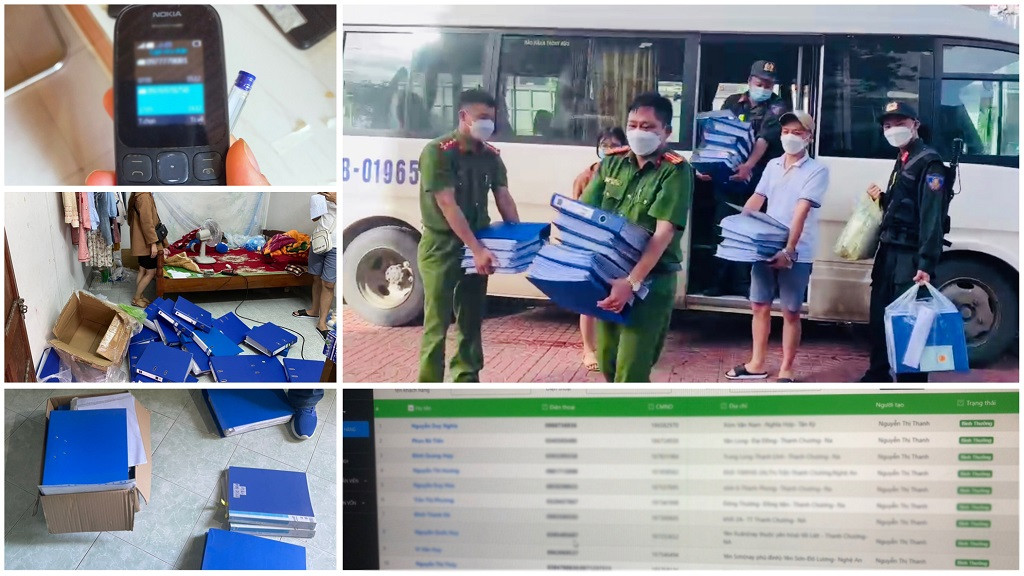

|

| Police seized many pieces of evidence and materials related to the 1,000 billion VND illegal credit line. Photo: Binh Minh |

Typically, on July 11, 2021, Vinh City Police presided over and coordinated with the Provincial Police's professional departments, the police of Dien Chau, Yen Thanh, Quynh Luu, Quy Hop, Nam Dan, Tan Ky, Do Luong districts, Cua Lo town, Hoang Mai town to mobilize more than 300 officers and soldiers to simultaneously arrest and urgently search the residences of 4 groups and 52 subjects residing in Vinh City, some districts in Nghe An and Huong Son district, Ha Tinh province. They collected more than 5 billion VND, 960 vehicle purchase contracts (loan contracts), 3 cars, 20 motorbikes, 96 mobile phones, 50 computers, 20 USBs, 24 seals, 158 car license plates; and froze 24 bank accounts.

The initial investigation determined that the above groups had lent a total of about 500 billion VND, with interest rates ranging from 3,000 - 8,000 VND/1 million/1 day, illegally profiting tens of billions of VND. The authorities have initiated a case, arresting 52 suspects, of whom 43 have been detained.

|

| Nghe An Provincial Police simultaneously arrested and searched 51 Tan Tin Dat agents in 28 provinces and cities across the country. Photo: Binh Minh |

Then, on December 15, 2021, Vinh City Police presided over and coordinated with the Police of units and localities to mobilize 500 officers and soldiers to coordinate with the Police of provinces and cities to urgently search 51 representative offices of Tan Tin Dat General Service Company Limited in 28 provinces and cities across the country; arrested 22 subjects for the act of "Lending at high interest rates in civil transactions".

During the investigation, the Investigation Agency initially proved and clarified that the amount of money used by the subjects for lending was more than 1,000 billion VND, with more than 10,000 victims across the country, the highest interest rate was 5,000 VND/1 million/day, equivalent to nearly 200%/year, 56 bank accounts were frozen, thousands of documents and related evidence were seized.

|

| Nghe An Provincial Police simultaneously arrested and searched 51 Tan Tin Dat agents in 28 provinces and cities across the country. Photo courtesy of Trong Dai. |

Particularly in Dien Chau district, from April 21, 2022 to May 9, 2022, the police successfully broke up a special case, arrested 11 cases, 11 subjects for the act of "Lending money at high interest rates in civil transactions"; confiscated 12 mobile phones and many documents and contracts related to the lending of money by the subjects. During the investigation, the authorities determined that from mid-2021 to the time of arrest, the 11 subjects mentioned above had lent to many people a total amount of about 30 billion VND, with interest rates from 3,000 - 5,000 VND/1,000,000 VND/day (equivalent to 108 - 180%/year); illegally profited more than 8 billion VND.

|

| 11 subjects were arrested for "loan sharking in civil transactions" at the Investigation Police Agency of Dien Chau District Police. Photo: Hong Ngoc |

From April 15, 2019 to April 14, 2022, the whole province discovered, arrested, and prosecuted 121 cases, 227 defendants for the act of "Lending at high interest rates in civil transactions"; handled 21 cases, 23 subjects for administrative violations. Arrested and prosecuted 5 cases, 6 defendants for acts related to black credit such as intentionally causing injury, illegal detention. At the end of the investigation, 109 cases, 138 defendants were transferred to the People's Procuracy at all levels for prosecution (102 cases, 184 defendants have been prosecuted). The People's Court has accepted 112 cases, 198 defendants; brought 107 cases, 191 defendants to trial.

In addition to directing the implementation of projects, the Provincial People's Committee has issued many directive documents; established interdisciplinary inspection teams at establishments with conditional business activities on security and order, banking and credit activities. In 3 years of implementing Directive No. 12, Nghe An has established 54 teams, inspected 377 times, inspected 408 establishments, and sanctioned administrative violations against 99 establishments. The State Bank of Vietnam, Nghe An branch, conducted 91 inspections and examinations at credit institutions. Through inspections and examinations, 533 recommendations related to credit activities and 42 decisions on sanctioning administrative violations in the field of currency and banking activities against credit institutions in the area were issued with a total amount of 371.1 million VND.

Thanks to the drastic intervention of the authorities, the subjects of "black credit" activities no longer operate openly, recklessly, and widely as before. Many pawnshops and financial service establishments have stopped operating or changed their business locations. The situation of hanging signs, distributing and pasting leaflets and advertisements related to lending activities in public places, walls, trees, on websites and social networks has significantly decreased. In addition, thanks to the promotion of propaganda in many forms, people's awareness and vigilance have also been raised, many financial support programs of the State Bank system and credit institutions have been deployed to meet people's needs, so the number of people seeking "black credit" to borrow money to serve production and business needs has decreased.

Still lurking complexities

Through review, Nghe An province currently has 265 pawnshops and 49 financial support businesses (compared to the same period in 2019, a decrease of 261 pawnshops and 72 financial support businesses).

|

| Police conduct a search at a financial services company. Photo courtesy of Xuan Bac. |

However, according to the forecast of the authorities, due to economic difficulties caused by the prolonged impact of the Covid-19 epidemic, subjects continue to take advantage of the lack of knowledge, lack of information and greed of a part of the population to mobilize capital at high interest rates for the purpose of defrauding large amounts of money in the forms of financial mobilization, multi-level marketing, participating in savings and credit associations, etc. In addition, the number of borrowers using borrowed money to invest in business or participate in social evils continues to seek out subjects operating "black credit" to borrow money, which is still potentially large.

In addition to using traditional forms such as: Disguising lending by using property lease contracts, paying interest through rent payments; cutting interest in advance, not recording interest in contracts... The subjects will increase the use of the internet, management software to carry out and conceal criminal acts. Borrowing money is done through applications on the internet through online lending, borrowing via mobile phone applications (Apps)... Besides, recently there has been a situation where many subjects have set up hundreds of wards for everyone to participate, the time of 1 ward is short with a large amount of money paid per period leading to the collapse of the hui causing many social consequences.

Resolute and synchronous

Faced with the above situation, the Provincial People's Committee has thoroughly implemented synchronous solutions to combat crimes and law violations related to "black credit" activities. Requires functional agencies to focus on reviewing and grasping the situation of organizations, individuals, and establishments operating in financial business, pawning, mobilizing capital with unusually high interest rates, participating in savings and credit associations, groups, and wards that show signs of fraud, abuse of trust, and appropriation of property. Do a good job of receiving and handling denunciations and reports of crimes and recommending prosecution. Organize investigation, prosecution, and trial of cases related to "black credit" activities, ensuring strict handling and no criminals are left out.

|

| Dien Chau District Police officers inspect the evidence seized in the case related to black credit. Photo courtesy of Hong Ngoc |

Select a number of cases related to “black credit” activities, especially cases that cause public outrage, to identify key cases, organize mobile trials for deterrence, education, and general prevention. Implement social security policies, diversify types of loans, banking products and services, with quick and convenient services, meeting the legitimate and legal borrowing needs of the people to contribute to preventing “black credit”.

Nghe An province also proposed to the National Assembly: Reassess the nature and level of danger to society of this crime and increase the penalty for the crime of "Lending at high interest rates in civil transactions". Because currently, according to the provisions of Article 201, the Penal Code 2015, the highest penalty for the crime of "Lending at high interest rates in civil transactions" is imprisonment for up to 3 years, so this is a less serious crime. Applying temporary detention measures for subjects is still difficult and light sentences do not create a deterrent for criminals (meanwhile, many subjects operating "black credit" are notorious criminals).

- Propose that the Government add a form of administrative sanction for the case of lending money without collateral (credit form). Because to handle administratively the act of lending money at high interest rates, it is required to have 2 factors: "Lending money with collateral" and "loan interest rate exceeding 150% of the basic interest rate announced by the State Bank of Vietnam at the time of lending". However, according to State regulations, there are currently 2 forms of lending: mortgage and credit, in which, the mortgage form has the element of collateral, while credit does not. In reality, the subjects implementing "black credit" often lend in the form of credit without collateral. Therefore, administrative handling of the act of lending money at high interest rates for subjects operating "black credit" is still difficult.

- Propose clearer instructions on participating in wards and hui, especially instructions on handling violations of this behavior to serve as a deterrent; propose specific regulations on the amounts collected in pawn lending activities to avoid the situation of pawn lending being an illegal credit activity (in addition to collecting interest on pawn lending, there are also fees for asset management, asset leasing, etc.).

- Recommend that the State Bank of Vietnam advise the Government to develop a policy to develop a credit rating mechanism for individuals as a basis for assessing the creditworthiness of customers and individuals, effectively supporting credit institutions in implementing unsecured loan products.