Nghe An: Bank credit growth is strong

(Baonghean.vn) - From the beginning of the year to the end of June 2022, credit in Nghe An increased by 11.1%. Compared to the 3.4% increase in the same period in 2021, the above figure is a positive signal, proving that the economy is recovering positively. In order for credit capital to continue to contribute positively to supporting businesses and business households, many banks have proposed to consider loosening the credit growth target, which currently has shortcomings...

Strong credit growth

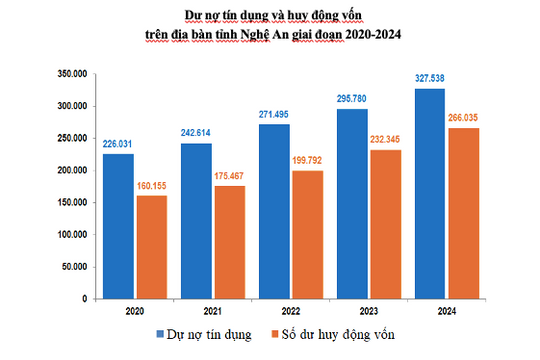

According to a report fromState Bank of Vietnam, Nghe An branch, as of June 30, 2022, mobilized capital is estimated at 192,566 billion VND, an increase of 17,100 billion VND compared to the beginning of the year, equal to 9.7%. Total outstanding loans of credit institutions and credit institution branches in the area are estimated at 266,479 billion VND, an increase of nearly 24,000 billion VND compared to the beginning of the year, equal to 9.8%. Excluding the Development Bank, outstanding loans are estimated at more than 254,000 billion VND, an increase of 25,519 billion VND compared to the beginning of the year, equal to 11.1%, higher than the same period in 2021 (3.4%).

Of which: Outstanding loans for the agricultural sector and rural areas in the whole area are 118,121 billion VND, accounting for 44% of outstanding loans in the whole area; Outstanding loans for high-tech agricultural development and clean agriculture under Resolution 30 are 20,295 billion VND, accounting for 8%; Outstanding loans for exports are 2,700 billion VND, an increase of 2.6% compared to the beginning of the year. Outstanding loans under Decree 67 are 210 billion VND; outstanding loans for housing support under Decree 02 are 170 billion VND. Outstanding loans for policy programs through the Bank for Social Policies are 10,420 billion VND, accounting for 4% of outstanding loans in the whole area.

|

| Bank capital is creating conditions for people and businesses to recover after the pandemic and develop production and business. Photo: Thu Huyen |

Credit institutions and credit institution branches strictly implement the State Bank's directives on interest rates. The VND mobilization interest rate fluctuates slightly, the maximum interest rate applied to non-term deposits and deposits with terms of less than 1 month is 0.2%/year; the maximum interest rate applied to deposits with terms from 1 month to less than 6 months is 4%; only People's Credit Funds and Microfinance Institutions apply the maximum interest rate for deposits with terms from 1 month to less than 6 months is 4.5%/year.

The maximum short-term lending interest rate in Vietnamese Dong of credit institutions for borrowers to meet capital needs for a number of economic sectors and industries as prescribed in Circular No. 39 is 4.5%/year; People's Credit Funds and Microfinance Institutions is 5.5%/year. For other sectors, up to now, the common interest rate applied by banks for short-term loans is from 6% to 9%, for medium and long-term loans is from 9% to 10.8%.

According to the leader of the State Bank of Nghe An branch, thestrong credit growthhas supported the economic recovery. And conversely, the strong recovery of the economy increases the demand for credit to serve the development of production and business of enterprises and consumption of households. Currently, banks are focusing on lending with a 2% interest rate support (Decree 31/2022/ND-CP of the Government, Circular 03/2022/TT- State Bank guiding the implementation of Decree 31) from the state budget for priority sectors, including those severely affected by the pandemic such as transportation, aviation, accommodation services, tourism... with a total scale of 40,000 billion VND and effective until the end of 2023.

In addition, the banking industry is also implementing the Digital Transformation Plan for the banking industry; Accelerating the implementation of the Cashless Payment Project in the area; Ensuring security and safety of information technology operations, electronic payments, and card payments. Promoting the application of technology in banking operations, promoting the development of digital banking, digital payments, payments via card acceptance devices at points of sale and applying modern technology and payment methods such as QR codes and mobile payments.

Continue to improve credit quality, support economic recovery

According to Mr. Cao Song Diep - Head of General Department, State Bank of Nghe An branch, currently, domestic and international prices of gasoline and oil tend to increase, conflicts in some countries and high inflation in some countries have directly impacted monetary policy management. Although under pressure from the trend of monetary easing and interest rate increases globally, in interest rate management, the State Bank continues to maintain the operating interest rates, in order to create conditions for credit institutions to access capital from the State Bank at low costs, thereby creating conditions to reduceLoan interest rates to support customers in restoring production and business.

|

| The State Bank will continue to strengthen monitoring of outstanding debt growth, especially in high-risk areas. Photo: Thu Huyen |

Credit growth was higher than expected and higher than the same period last year, reflecting the positive recovery of the economy, the effectiveness of the Government's epidemic prevention and economic recovery measures, and the efforts of businesses and credit institutions in the province. However, some banks said they had met their credit growth targets and were proposing to loosen credit "room" to remove difficulties in lending activities.

The leader of Vietinbank Nghe An branch said: Currently, credit growth is quite good, reaching 15-17% this year. Along with implementing credit growth solutions, we focus on controlling credit quality; prioritizing credit in production sectors, priority sectors; strictly controlling credit in potentially risky sectors. This year, the capital demand of the economy is very high, the affected sectors are starting the recovery phase. There is not much room for banks to lend, so we hope to loosen the credit growth limit.

|

| Loosening the credit "room" helps create conditions for people and businesses to access bank capital, especially the support packages being implemented. Photo: Thu Huyen |

Regarding the issue of credit limit allocation - the mechanism of assigning credit targets that has been implemented by the State Bank for many years, many banks believe that this mechanism has the appearance of a subsidized management style of "request - grant", which is no longer suitable for the current context and they want to remove the credit "room" for banks. "The government needs to study and limit, and eventually eliminate the management of credit growth target allocation for each bank" - said a bank representative.

It is known that recently, the National Assembly passed the Resolution of the 3rd session of questioning, in which, for the banking and finance sector, it requested the Government to study and limit and eventually eliminate the management of credit growth targets for each bank. Instead, the Government will develop criteria and methods to determine credit growth targets for each bank based on the operational situation, financial capacity, governance and ability to expand credit healthily of each bank. This is to ensure publicity, transparency, and compliance with the Capital Adequacy Ratio standard (calculated according to Basel II) and international standards in the banking sector. Strengthen solutions to closely monitor the growth rate of outstanding loans and credit quality in areas with high potential risks, especially investment, real estate business, securities and corporate bonds; at the same time, ensure capital supply for the securities and real estate markets to develop healthily and sustainably.

.jpg)