How many credit cards should Vietnamese people have?

Trying to open multiple cards will easily make you a "king of cards", but if you know how to use them, two cards from different issuers will help you maximize your costs.

» Payment via POS in Nghe An: Sales are still low

How many credit cards should a person have? Currently, the world record belongs to an American with nearly 1,500 credit cards - Mr.Walter Cavanagh is from Santa Clara, California. The total credit limit for Cavanagh's nearly 1,500 credit cards, born in 1943, is up to 1.7 million USD.

As for Vietnamese people, according to banking experts, 2 credit cards per person may be a good suggestion.

|

Credit cards, if used wisely, can save you a lot of money. |

The general director of a joint stock bank said he has 4 credit cards. "Of course, none of them are issued by my bank because according to regulations, general directors are not allowed to open cards. However, the reason I need 4 is to experience the services of other banks and more importantly, I want to take advantage of all the incentives of major international card organizations such as Visa, Master, Amex, JCB...", he said.

According to this CEO, if there is no need for an "excuse" to see what services other banks offer, a normal individual customer should still have two credit cards (from two different international card organizations).

The reason is that when traveling abroad, in some countries, some types of cards issued by some specialized international organizations that are designated by the store or payment acceptance point are accepted or given priority. This general director said that, like in the US, Amex credit cards are highly preferred and similar to JCB cards in Japan.

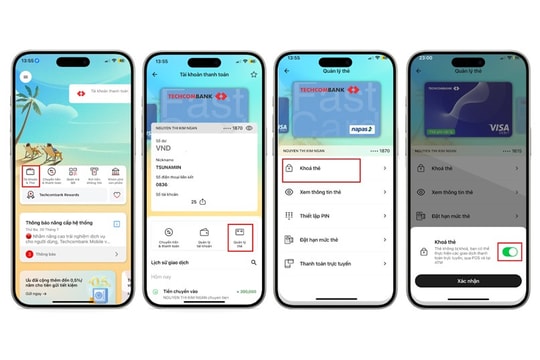

Sharing this view, Mr. Dang Cong Hoan - Director of Retail Product Development and Director of Card Business - Vietnam Technological and Commercial Joint Stock Bank (Techcombank) also said that it is advisable to have two credit cards at the same time. "From the experience of developing cards in some countries with developed card services, I think customers should have a regular credit card and a card for specialized needs that accumulate points such as a Co-branded card for air travel, a golf card, etc. I still advise people who often travel by plane for work to have a Techcombank Vietnam Airlines Visa co-branded card," said Mr. Hoan.

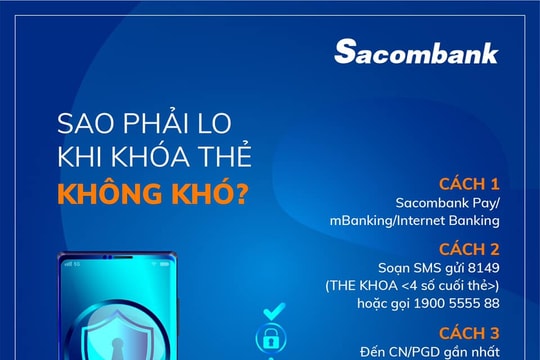

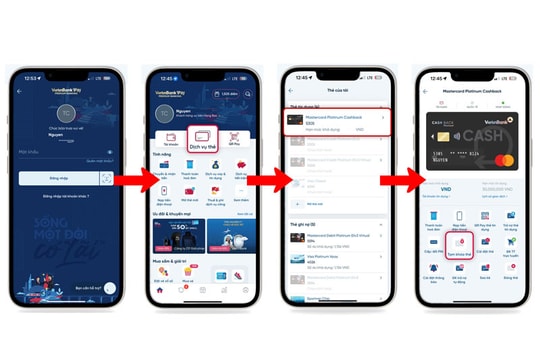

Explaining further, the Director of Retail Product Development and Director of Card Business of Techcombank said that when you have these two types of cards at the same time, you will enjoy the maximum interest-free period and control the risks during use. In fact, it is inevitable that when making payments, no matter where in the world, there will still be cases where the credit card, for some reason, does not work or is not compatible with the swiping device. Therefore, having another card to replace it will solve the urgent need for spending.

In fact, Mr. Hoan also acknowledged that there is no standard suggestion for how many credit cards a person should have. This depends on each person's spending needs for purchasing goods and services and the frequency of using cards for spending for consumption and life.

In addition, the factor of how many cards are enough is also related to the income level and the conditions for being granted a card for each customer because each income level will only be granted a credit card at a certain limit. "When the income is higher, the actual ability to spend on shopping is also higher and the need to use credit cards is also greater. For example, currently, on average, each adult in Korea can use about 2.8-3.1 credit cards while in our country, this ratio is only about 0.15 cards per person," Mr. Hoan cited the data.

According to VNE

| RELATED NEWS |

|---|

.png)