Rising from preferential loans from social policy banks

(Baonghean.vn) - In recent years, Quy Hop district, although a mountainous area, is considered to be quite dynamic in economic development, with a rapid poverty reduction rate. To achieve this result, the local Party Committee and government have synchronously implemented many solutions to create livelihoods for people, in which the most prominent is lending activities from social policy credit sources.

"Nurturing" from policy capital

After retiring from his government job, Mr. Chu Quoc Tru returned to My Dinh hamlet, Chau Dinh commune (Quy Hop) to start a farm. Initially, with the small amount of capital he had saved, combined with a loan from the district's Social Policy Bank to create jobs, he invested in 6 hectares of oranges, built a cow barn, and dug a pond to raise fish. With the experience of an agricultural officer, along with his hard-working and diligent nature, he and his wife and children were determined to develop the farm economy. Although he encountered many difficulties in the beginning, he did not give up.

Thanks to his hard work and economic development, he invested in buying a pickup truck to serve his travel and product consumption. Mr. Tru said, “In May 2017, I borrowed 50 million VND from the employment program to grow oranges. By May 2020, my family had paid off the loan. Currently, my family is continuing to borrow 50 million VND from the production and business program in difficult areas to grow more oranges and tangerines. Mr. Tru's family farm regularly creates jobs for 4 workers, not to mention seasonal workers during the orange season; each year his family earns hundreds of millions of VND.

|

| Mr. Chu Quoc Tru in My Dinh hamlet, Chau Dinh commune, Quy Hop district develops livestock farming to bring high economic efficiency. Photo: Thu Huyen |

In Quy Hop district, there are many credit sources, but the capital source of the Social Policy Bank with preferential interest rates for social security policies for poor households, near-poor households, and households with special difficulties is the most important capital source that determines hunger eradication and poverty reduction in the commune in recent years. Policy loans not only help people in Quy Hop district to be aware of rising up strongly to escape poverty, solve the worry of food and clothing, but many households have also known how to help their children escape poverty sustainably through knowledge.

The family is currently borrowing 46.75 million VND from the student loan program for the youngest child to go to school. The youngest child has graduated and found a stable job at a foreign company in Binh Duong. The child being able to study properly, have a job and an income is a great source of encouragement for Mr. Cong when he has been single-handedly taking care of his children.

Ms. Vi Thi Dao in Thai Quang hamlet, Chau Thai commune was formerly a near-poor household. After being approved for a loan and using the capital effectively, her family has now escaped near-poverty.

I have borrowed capital from the Social Policy Bank twice. In 2014, I borrowed 30 million VND to invest in 4 hectares of acacia; in 2017, I paid off the debt and continued the cycle, borrowing 40 million VND to develop the farm economy, dig ponds to raise fish, and raise buffalo and cows. I really hope that the Social Policy Bank will create more favorable conditions for loans to expand the scale of the barn and develop production.

|

| Members of the savings and loan group in Chau Thai commune (Quy Hop) look at loan information at the commune People's Committee headquarters. Photo: Thu Huyen |

The Thai Quang hamlet loan group, Chau Thai commune has 60 members, of which 90% are poor and near-poor households. However, happily, the women in the group unite and help each other develop the forest economy; plant forests together, clear land... Thanks to that, the members' lives are getting better and better, and the women care about raising their children to be educated and successful.

Focus on improving credit quality

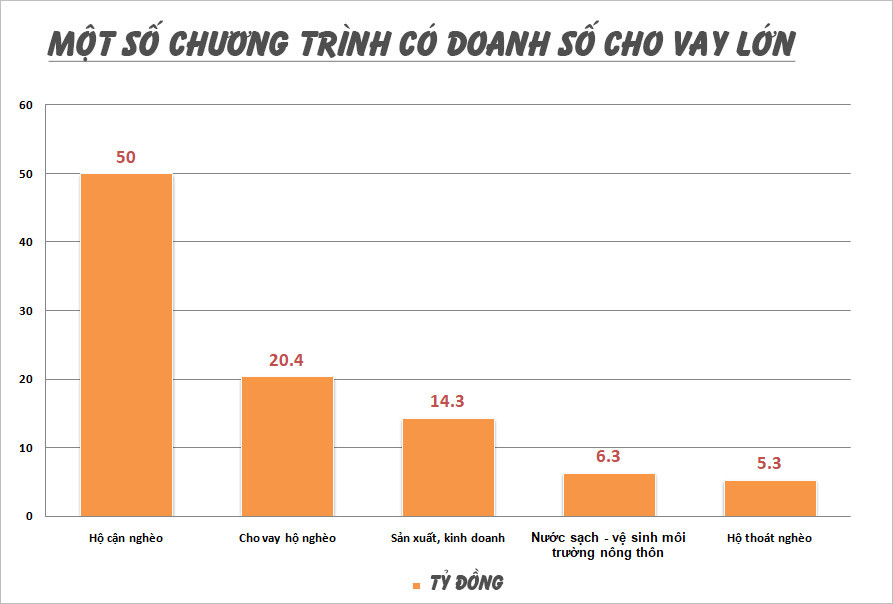

Adhering to the planning targets assigned by the Provincial Social Policy Bank since the beginning of the year, the Quy Hop District Social Policy Bank has coordinated with political and social organizations to receive the mandate to organize timely disbursement. The loan turnover in 6 months reached nearly 107 billion VND with 2,382 loan customers.

|

| Graphics: Lam Tung |

Total outstanding loans as of June 30, 2020 reached VND 530 billion, with a growth rate of 6%. Implementing loans under 16 policy credit programs with over 13,000 customers with outstanding loans.

To ensure capital sources and implement Directive No. 40 of the Secretariat, the Transaction Office of the Social Policy Bank of Quy Hop district continues to strengthen its consultation and maximize the support of local Party committees and authorities for policy credit activities in the area. Thanks to that, the local budget capital sources continue to grow.

Total capital as of June 30, 2020 reached more than 530 billion VND. Of which: Central capital is nearly 421 billion VND; local budget capital is 6,417 billion VND; locally mobilized capital reached more than 80 billion VND, an increase of more than 6 billion VND compared to the beginning of the year, completing 56.8% of the year's growth plan.

Mr. Nguyen Thanh Hai - Director of the Social Policy Bank of Quy Hop district said: The preferential credit capital loan in the first 6 months of 2020 has created jobs for 50 workers, built 630 clean water and environmental sanitation works, helped 18 workers go to work abroad for a limited period, built 43 houses for poor households and 1,949 poor, near-poor, escaped-poverty households, and ethnic minority households with capital to invest in production, business, livestock, and economic development. The credit capital in the past time has been effective, contributing to reducing the poverty rate of the whole Quy Hop district to 12.02%.

|

| With loans from the Social Policy Bank, many families have boldly built many highly effective economic models. Photo: Thu Huyen |

“Currently, we are implementing solutions to support and resolve difficulties for customers affected by the Covid-19 epidemic, such as debt extension, debt term adjustment, lending, and risk handling according to Decision 15/QD-HDQT. As a result, we have supported customers to extend debt by VND 2,575 million for 64 customers; and provided loans for production and business investment with an amount of VND 106,757 million for 2,135 borrowers. We also coordinate with the Department of Labor, Invalids and Social Affairs and the People's Committees at the commune level to propagate and disseminate the policy of lending to employers to pay for workers' suspension of work according to Decision No. 15/2020/QD-TTg dated April 24, 2020 of the Prime Minister. However, in the first 6 months of 2020, no enterprises in the area had a need for loans.”

In the coming time, in addition to mobilizing capital, disbursing credit programs; organizing debt collection, collecting interest, the Social Policy Bank of Quy Hop district will conduct inspection and supervision on all channels and levels according to the established plan. At the same time, actively coordinate with entrusted organizations to well implement the entrusted contents, in which, focusing on improving the quality of operations of the network of savings and loan groups, and directing these groups to strictly comply with the loan object evaluation process...

Social Policy Bank, Nghe An branch, strives for the goal of poverty reduction and helping to get rich

(Baonghean.vn) - During the 2015 - 2020 term, through the Provincial Social Policy Bank (PSB), many households in Nghe An have had the opportunity to access preferential loans from the State. Thereby, many production models for stable income for people have been replicated, contributing to hunger eradication and poverty reduction in the locality.