Slow start of the year, big leap at the end of the year

That is the rhythm of "capital injection" of banks into the economy in recent years.

» Facilitate access to credit capital

|

Illustration photo. |

"Old story re-edited"

The story of credit growth in the banking industry has many things to discuss when going back in time from 2012 to 2016, credit growth in the first months of the year shared the phenomenon of "capital congestion" in the economy.

In particular, in the first 4 months of 2012, credit growth was negative and the cumulative 4 months were negative by 0.66%.

Up to the first 6 months of 2012, credit growth was at a record low, reaching only 0.76% compared to the annual credit growth target of 10% -13%.

Surprisingly, credit growth for the whole year of 2012 still reached 8.19%. Credit began to increase rapidly when it reached 5.4% in mid-November 2012, 6.45% in mid-December 2012 and 8.19% on the last day of the year, December 31, 2012.

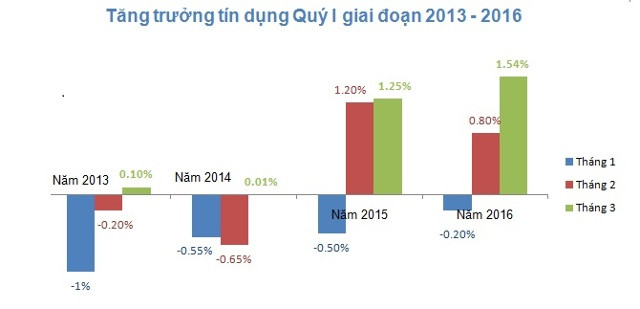

Like a “curse”, credit continues to be blocked. It can be seen that in 2013-2016, capital could not be pumped out in January when credit this month was negative every year, in January 2013 it was negative by 1%.

|

Many banking experts believe that the low credit growth in the first months of the year, even negative, is due to the economic cycle when this is the time when businesses are still feeling the aftereffects of Tet, business activities have not yet become vibrant again... The economy is slowing down, a series of businesses are dying... Capital is actually pumped out starting from March of the year and has been more balanced since 2015 when it increased by 1.25% and in 2016 it increased by 1.54%, but this number is still very low compared to the expectations and capital demand of the economy.

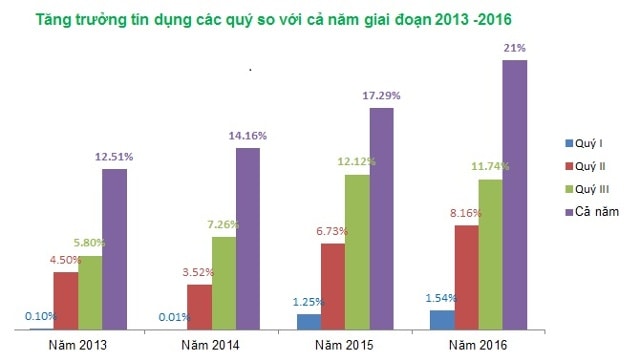

Is this really a satisfactory explanation when from 2013 to 2016, until the end of the first 9 months of the year, credit growth was very small and far from the annual target. It only reached half of the annual plan.

Specifically, by the end of the third quarter of 2013, bank capital poured into the economy increased by 5.8%, equal to half of the year's performance of 12% (equivalent to an absolute credit balance of about 3.5 million billion VND).

Also by the end of the third quarter of 2014, it reached 7.26%, equal to half of the whole year's 14.16%. The third quarter of 2015 reached 12.12%, equal to two-thirds of the whole year's 17.29% (absolute total credit of about 4.5 million billion VND) and the third quarter of 2016 reached 11.74%, equal to half of the whole year's estimate of 21.82%.

|

What caused the miraculous growth of credit in just the last 3 months of the year, with the credit volume increasing equal to that of the previous 3 quarters combined?

The “Great Leap Forward” of Credit

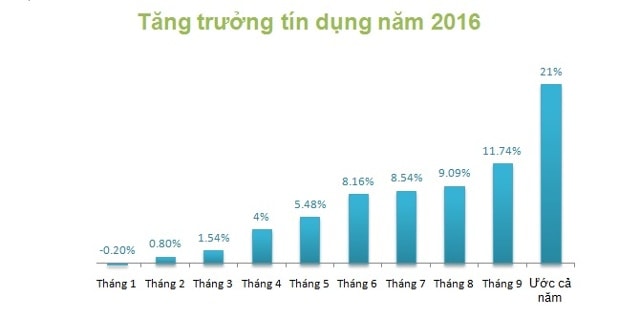

Accumulated up to September 2016, banks have lent out 5.2 million billion VND, an increase of 11.74% compared to the end of 2015.

Looking at the monthly credit growth chart of 2016, we can see that capital injection has been more steady over the months. However, the “great leap” in the last quarter of the year still occurred like previous years and exceeded the credit plan set for the whole year.

|

According to Ms. Nguyen Thi Hong, Deputy Governor of the State Bank, if the target is 18%, credit must increase by an average of at least 2% per month in the last three months of 2016, corresponding to an absolute balance increase of nearly 100,000 billion VND per month. The need to spend money for the economy is very high.

Credit accumulation in the fourth quarter is cyclical, but that does not mean that the economy's capital absorption capacity has improved so much that credit "jumps". At many banks, credit often increases sharply in November and December, then declines in January and February of the following year.

A member of the board of directors of a large bank admitted that there was a phenomenon of short-term lending to businesses to meet credit quotas. The loan term was usually less than three months, so businesses had to pay off the debt at the beginning of the following year, causing credit to drop. In addition, some loans were rolled over at the end of the year in various forms, causing credit to increase in real but virtual ways.

According to a banking expert, there are many ways of calculating that cause credit growth figures to vary. If calculated by total credit (including loans to the residential market and economic organizations; corporate bonds; debt purchases), it will be different from the outstanding credit figure for only the residential market and economic organizations.

Although the economy is consuming huge amounts of credit, pumping in an additional 400,000 - 600,000 billion VND each year (corresponding to the annual credit growth rate) and increasing with the size of the economy, it is one of the important tools to boost GDP growth to achieve the 2016 target of 6.3-6.5%.

However, the question here is where will such rapidly increasing capital be poured into when bad debt is a barrier, banks are narrowing credit in some areas, in which recently the Governor of the State Bank Le Minh Hung requested commercial banks to strictly control capital in BOT, BT traffic projects...

Linh Lan/bizlive

| RELATED NEWS |

|---|

.png)