Carrying a debt of more than 13 million VND even though he never borrowed money

(Baonghean) - Having been issued a credit card by a financial company, Mr. Bui Duc Thanh (residing in Quynh Luu district) had not yet used it when he suddenly received a debt of more than 13 million VND "falling from the sky".

No loan but still have to pay

More than a month has passed but Mr. Bui Duc Thanh (residing in Quynh Thach commune, Quynh Luu district) is still upset because he suddenly received a debt that fell from the sky.

Talking to reporters, Mr. Thanh recounted that on October 16, 2019, he was supported by Vietnam Prosperity Bank Finance Company Limited to issue a credit card for consumer loans. The reason was that Mr. Thanh had previously purchased goods by installment loan from the company and had terminated the contract. After that, the company's staff informed him that they would support him in issuing a card so that he could buy goods by installment, borrow money... so Mr. Thanh agreed.

|

| Mr. Bui Duc Thanh is upset because he did not borrow money but still had to pay a debt of more than 13 million VND. Photo: PB |

After receiving the card, almost every week someone introduced himself as a finance company employee called Mr. Thanh and informed him that he could borrow money, buy goods on installments... "They called in the morning, at noon and in the evening, regardless of the time. On January 8, 2020, while I was at work, someone called my phone number again. I had registered this number when I borrowed money from the company before and let the company contact me to deliver the card," Mr. Thanh recounted.

This person introduced himself as an employee of Vietnam Prosperity Bank Finance Company Limited and announced:“Are you Mr. Bui Duc Thanh? Your card has not been used for a long time for shopping, borrowing money... To avoid card maintenance fees, please provide your information so I can block your card for you...”.

Because he was subjective and did not want to be bothered any longer, Mr. Thanh read the code from the text message sent to the phone to this person. After that, a text message was sent back and informed that his card account had been deducted 13,190,000 VND.

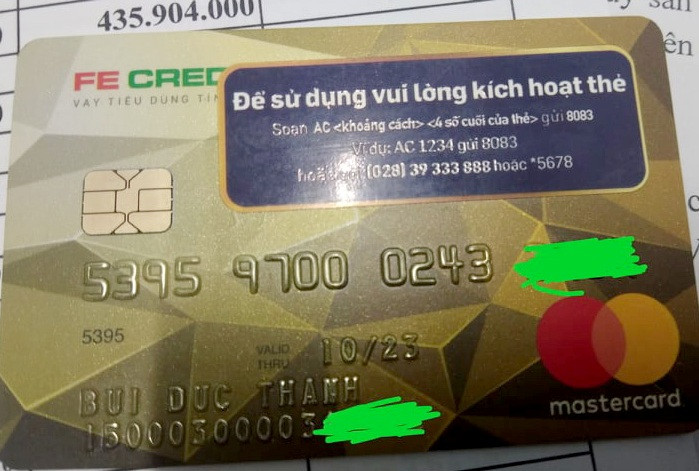

|

| Credit card issued by Vietnam Prosperity Bank Finance Company Limited to Mr. Thanh. Photo: PB |

“Because I have never made a purchase or made a payment transaction by card, I do not know much about OTP codes. But after reading the card code to this person, I suspected that I was being scammed. Immediately after that, this phone number continued to contact me and asked me to continue providing information so that he could block the card for me, but I did not provide it and instead tried to contact Vietnam Prosperity Bank Finance Company Limited via the hotline number for support. However, I called many times but could not get in touch with them,” Mr. Thanh recounted.

On January 9, 2019, Mr. Thanh contacted the call center of Vietnam Prosperity Bank Finance Company Limited and was told by the company staff that he had to wait 2 more working days because his transaction was stuck on the system. Currently, the company only helped him lock the card and could not provide any further support. Also on that day, a subject continued to use the phone number 0392243319 to contact him to ask him to provide the OTP code to lock the transaction card.

“On January 11, 2019, an employee of Vietnam Prosperity Bank Finance Company Limited informed me that the system had recorded my purchase and online payment at the Mobile World store. At the same time, he said that because I had provided the OTP code to someone else, I was responsible for this transaction and owed the company 13,190,000 VND. Now, every month, I have to pay nearly 2.2 million VND even though I did not buy anything.”

People need to be vigilant

In fact, the form of fraud that Mr. Thanh fell into is not new. On its website, Vietnam Prosperity Joint Stock Commercial Bank (VPBank) said that in recent times, high-tech criminals have continuously used sophisticated fraud methods to exploit information and trick customers into providing OTP codes to steal customers' accounts and damage the reputation of banks. According to VPBank, among the fraud methods is the method of impersonating VPBank employees.

“Banks and credit institutions never ask customers to provide personal information or security information such as bank account numbers, ATM card PIN numbers, access codes, OTP codes and Internet Banking passwords via email or phone. Therefore, if you receive such requests, it means that criminals are trying to steal customers' assets deposited at the bank,” VPBank warned.

To avoid risks, VPBank recommends that customers absolutely do not lend, use, and manage their bank cards to others; do not enter their username, Internet Banking/Mobile Banking login password, OTP code, account number... into a website or link other than VPBank's website or other VPBank Online applications; do not provide account information (login account, password, OTP code); do not deposit, transfer money, provide card information, OTP code upon request from strange calls claiming to be bank employees or banking partners, or request access to a strange website.

In Nghe An, Mr. Thanh's case is not unique. According to Mr. Thanh, when he went to the Quynh Luu District Police to report, the investigator told him that the unit had also received many reports of money being appropriated by the above method, some people were cheated out of nearly 50 million VND.

“Although I know that this incident is my fault, I am still wondering why my credit card information could be leaked to bad guys. Is there a situation where customer information is leaked from the bank or the unit that issued the card to me?” Mr. Thanh said.

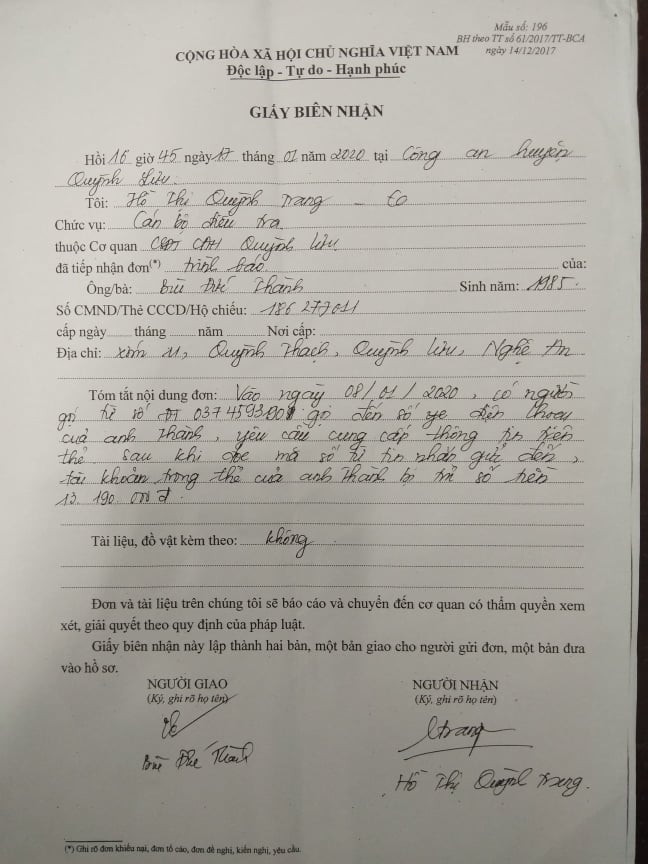

|

| Mr. Thanh went to Quynh Luu District Police to report the incident. Photo: PB |

The leader of the Criminal Police Department of Nghe An Province Police said that the explosion of information technology has created conditions for high-tech criminals to increase in number, with increasingly sophisticated methods and tricks, making them more difficult to prevent and combat.

“Along with the rapid development of modern banking services, fraud and high-tech crimes are also increasing in both quantity and form. The subjects are using sophisticated and daring fraud methods, especially taking advantage of customers' gullibility to steal confidential information and then appropriate money in customers' accounts,” said the leader of the Criminal Police Department.

Along with VPBank, other banks such as Vietcombank, BIDV, Techcombank... have also sent notices to customers to warn about tricks and forms of impersonating bank employees to defraud customers of money. But in reality, there are still many customers who "fall into the trap" of scammers because they are gullible and partly because they ignore warnings from the bank.