Gold price today August 1, 2025: Domestic increase, world decrease sharply in July

Gold price today August 1, 2025: Domestic gold price and world gold price increased slightly compared to yesterday. In July, the price of gold rings and gold bars increased from 2 to 3 million VND/tael.

Domestic gold price today August 1, 2025

As of 10:30 today, August 1, 2025, the domestic gold bar price increased slightly. Specifically:

DOJI Group listed the price of SJC gold bars at 119.9-121.4 million VND/tael (buy - sell), an increase of 200 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.9-121.4 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120.4-121.4 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 200 thousand VND/tael for buying - unchanged for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119.9-121.4 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 119.4-121.4 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 10:30 a.m. on August 1, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116-118.5 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell); down 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, August 1, 2025 is as follows:

| Gold price today | August 1, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 119.9 | 121.4 | - | - |

| DOJI Group | 119.9 | 121.4 | +200 | +200 |

| Mi Hong | 120.4 | 121.4 | -200 | - |

| PNJ | 119.9 | 121.4 | - | - |

| Bao Tin Minh Chau | 119.9 | 121.4 | - | - |

| Phu Quy | 119.4 | 121.4 | - | - |

| 1.DOJI- Updated: 1/8/2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,900▲200K | 121,400▲200K |

| AVPL/SJC HCM | 119,900▲200K | 121,400▲200K |

| AVPL/SJC DN | 119,900▲200K | 121,400▲200K |

| Raw material 9999 - HN | 108.50▲200K | 109.50▲200K |

| Raw materials 999 - HN | 108.40▲200K | 109.40▲200K |

| 2.PNJ- Updated: 1/8/2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 115,100 | 118,100 |

| Hanoi - PNJ | 115,100 | 118,100 |

| Da Nang - PNJ | 115,100 | 118,100 |

| Western Region - PNJ | 115,100 | 118,100 |

| Central Highlands - PNJ | 115,100 | 118,100 |

| Southeast - PNJ | 115,100 | 118,100 |

| 3.SJC- Updated: 1/8/2025 04:30 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,900 | 121,400 |

| SJC gold 5 chi | 119,900 | 121,420 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,900 | 121,430 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,600 | 117,100 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,600 | 117,200 |

| 99.99% jewelry | 114,600 | 116,500 |

| 99% Jewelry | 110,846 | 115,346 |

| Jewelry 68% | 72,478 | 79,378 |

| Jewelry 41.7% | 41,835 | 48,735 |

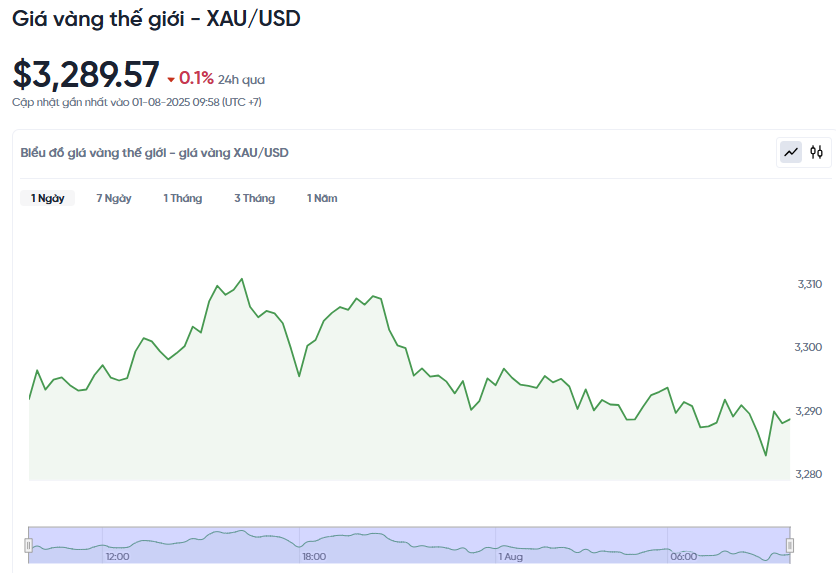

World gold price today August 1, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 10:30 on August 1, Vietnam time, was 3,289.57 USD/ounce. Today's gold price decreased by 22.41 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,380 VND/USD), the world gold price is about 108 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 13.4 million VND/tael higher than the international gold price.

World gold prices continued to fall again after a short period of slight increase from the lowest level in 1 month recorded in the previous session. As the slight increase in inflation pressure as forecasted along with new tariff announcements from the US has boosted demand for gold as a safe investment channel.

Specifically, spot gold prices decreased by 0.1%. Gold futures prices in the US also decreased by 0.1% to 3,302.70 USD. In July, the world gold price decreased sharply by 40.47 USD/Ounce compared to the beginning of the month.

The dollar fell from a two-month high, making gold cheaper for investors using other currencies. A slight weakening of the dollar is supporting gold prices today, after sharp moves related to the tariff announcement and the decision by the US Federal Reserve, said UBS commodities analyst Giovanni Staunovo.

Gold prices opened lower early on August 1 due to inflation pressures rising slightly as expected. The US core PCE inflation index rose 0.3% in June, after rising 0.2% in May. This is an important index measuring personal spending, excluding volatile factors such as food and energy prices. Compared to the same period last year, inflation increased 2.8%, slightly higher than the expected 2.7%.

The US announced new tariffs on a number of products ahead of the August 1 deadline, including copper and goods from Brazil, South Korea, and India, while ending tariff exemptions for some small shipments from overseas. President Donald Trump also announced a 15% tariff on imports from South Korea as part of a deal to avoid higher tariffs. He expressed optimism about trade negotiations with China, hoping the two sides would reach a fair deal.

The Fed kept interest rates unchanged as expected, but Chairman Jerome Powell said it was too early to say whether the Fed would cut rates in September. Gold tends to rise in a low-interest-rate environment.

Compared to the beginning of July, DOJI gold bar price increased sharply by 2.2 million VND/tael for buying - increased by 1.7 million VND/tael for selling. Meanwhile, SJC and BTMC gold bars had a stronger increase of 2.4 million VND/tael for buying - 1.9 million VND/tael for selling, respectively.

Furthermore, the price of SJC gold bars at Phu Quy in July increased by 2.6 million VND/tael for buying - increased by 1.9 million VND/tael for selling. The price of Mi Hong gold bars in July had the lowest increase of 1.6 million VND/tael for buying - increased by 1.9 million VND/tael for selling.

In July, Bao Tin Minh Chau gold ring price increased sharply by 1.8 million in both buying and selling compared to the beginning of the month. DOJI gold ring price increased by 1.5 million VND/tael in buying price and 2 million VND/tael in selling price.

Besides gold price, silver price decreased 1.6% to 36.53 USD/ounce, platinum price decreased 0.6% to 1,318.20 USD, and palladium price increased 0.9% to 1,215.94 USD.

Gold price forecast

Technically, December gold still has the near-term advantage but has lost momentum. The bulls’ next target is a break above the strong resistance at the July high of $3,509. The bears are aiming to push prices below the support level of $3,300.

Immediate resistance is at Wednesday's high of $3,389.30 and $3,400. Immediate support is at this week's low of $3,319.20 and June low of $3,307.40.

Fed Chairman Jerome Powell recently said the US central bank is not ready to cut interest rates in September. The labor market and consumer activity remain strong, and the Fed needs more data before making a policy decision. These comments reduced expectations for an early round of monetary easing, leading to a sell-off in gold.

According to the CME FedWatch tool, as of 6 a.m. on August 1 (Vietnam time), the market only predicted a 45.7% chance that the Fed would cut interest rates by 0.25 percentage points in September, while 53.3% thought that interest rates would remain at 4.25-4.5%/year. Compared to the previous evening, the expectation of a rate cut has dropped significantly, from 57.9% to 45.7%.

President Donald Trump has repeatedly criticized Fed Chairman Powell and even threatened to fire him. The Trump administration has also accused the Fed of overspending on construction projects. However, interfering with the central bank's operations could have many consequences, and even the US Treasury Secretary has affirmed the Fed's independence.

Gold prices have been under pressure recently due to a stronger US dollar and easing geopolitical tensions. In addition, the Trump administration has reached a series of trade agreements with many countries, reducing investors' demand for gold as a safe haven asset.

Although there may be some volatility in the short term, gold prices still have a chance to recover when the Fed returns to monetary easing. When interest rates decrease, the USD will weaken, creating conditions for gold prices to increase. In addition, the Trump administration still wants to maintain low interest rates at around 2%, instead of the current 4.5%, which could limit the USD's long-term growth.

President Trump announced a 25% tariff on Indian goods from August 1, in response to the country's high tariffs on US goods and arms purchases from Russia. These moves could destabilize the market, thereby supporting gold prices in the future.

.jpg)