Gold price today February 12, 2025: Domestic and world gold prices fell sharply due to profit-taking activities

Gold price today February 12, 2025: World gold price and gold price both decreased sharply due to profit-taking activities from investors after gold price reached a historical peak before.

Domestic gold price today February 12, 2025

At the time of survey at 4:30 a.m. on February 12, 2025, the gold price on the trading floors of some companies was as follows:

DOJI listed the price of 9999 gold today at 88 million VND/tael for buying and 90.5 million VND/tael for selling. A sharp decrease of 300 thousand VND/tael for buying and 800 thousand VND/tael for selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 88.1-89.8 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 200 thousand VND/tael for buying - unchanged for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 88-90.5 million VND/tael (buying - selling), down 300 thousand VND/tael in buying direction - down 800 thousand VND/tael in selling direction compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 88.2-90.7 million VND/tael (buy - sell), down 100 thousand VND/tael in buying - down 600 thousand VND/tael in selling compared to yesterday.

The latest gold price list today, February 12, 2025 is as follows:

| Gold price today | February 12, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 88 | 90.5 | -300 | -800 |

| DOJI Group | 88 | 90.5 | -300 | -800 |

| Mi Hong | 88.1 | 89.8 | -200 | - |

| PNJ | 88 | 90.5 | -300 | -800 |

| Vietinbank Gold | 90.5 | -800 | ||

| Bao Tin Minh Chau | 88 | 90.5 | -300 | -800 |

| Phu Quy | 88.2 | 90.7 | -100 | -600 |

| 1.DOJI- Updated: 12/2/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 88,000▼300K | 90,500▼800K |

| AVPL/SJC HCM | 88,000▼300K | 90,500▼800K |

| AVPL/SJC DN | 88,000▼300K | 90,500▼800K |

| Raw material 9999 - HN | 87,600▼1400K | 89,500▼800K |

| Raw materials 999 - HN | 87,500▼1400K | 89,400▼800K |

| AVPL/SJC Can Tho | 88,000▼300K | 90,500▼800K |

| 2.PNJ- Updated: 12/2/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 88,000▼300K | 90,500▼600K |

| HCMC - SJC | 88,000▼300K | 90,500▼800K |

| Hanoi - PNJ | 88,000▼300K | 90,500▼600K |

| Hanoi - SJC | 88,000▼300K | 90,500▼800K |

| Da Nang - PNJ | 88,000▼300K | 90,500▼600K |

| Da Nang - SJC | 88,000▼300K | 90,500▼800K |

| Western Region - PNJ | 88,000▼300K | 90,500▼600K |

| Western Region - SJC | 88,000▼300K | 90,500▼800K |

| Jewelry gold price - PNJ | 88,000▼300K | 90,500▼600K |

| Jewelry gold price - SJC | 88,000▼300K | 90,500▼800K |

| Jewelry gold price - Southeast | PNJ | 88,000▼300K |

| Jewelry gold price - SJC | 88,000▼300K | 90,500▼800K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 88,000▼300K |

| Jewelry gold price - Jewelry gold 999.9 | 87,800▼500K | 90,300▼500K |

| Jewelry gold price - 999 jewelry gold | 87,710▼500K | 90,210▼500K |

| Jewelry gold price - 99 jewelry gold | 87,000▼490K | 89,500▼490K |

| Jewelry gold price - 916 gold (22K) | 80,320▼450K | 82,820▼450K |

| Jewelry gold price - 750 gold (18K) | 65,380▼370K | 67,880▼370K |

| Jewelry gold price - 680 gold (16.3K) | 59,050▼340K | 61,550▼340K |

| Jewelry gold price - 650 gold (15.6K) | 56,350▼320K | 58,850▼320K |

| Jewelry gold price - 610 gold (14.6K) | 52,730▼310K | 55,230▼310K |

| Jewelry gold price - 585 gold (14K) | 50,480▼290K | 52,980▼290K |

| Jewelry gold price - 416 gold (10K) | 35,220▼200K | 37,720▼200K |

| Jewelry gold price - 375 gold (9K) | 31,510▼190K | 34,010▼190K |

| Jewelry gold price - 333 gold (8K) | 27,450▼160K | 29,950▼160K |

| 3. SJC - Updated: 12/2/2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 88,000▼300K | 90,500▼800K |

| SJC 5c | 88,000▼300K | 90,520▼800K |

| SJC 2c, 1C, 5 phan | 88,000▼300K | 90,530▼800K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 88,000 | 90,500▼200K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 88,000 | 90,600▼200K |

| 99.99% Jewelry | 88,000 | 90,100▼200K |

| 99% Jewelry | 86,207▼198K | 89,405▼198K |

| Jewelry 68% | 58,424▼136K | 61,560▼136K |

| Jewelry 41.7% | 34,725▼83K | 37,808▼83K |

SJC Company representative said that many customers brought gold to sell for profit when they saw that the domestic gold price was at an all-time high. Also because of many sellers, the gold price was immediately adjusted down sharply by the companies, the domestic gold price was affected by the profit-taking selling pressure in the market.

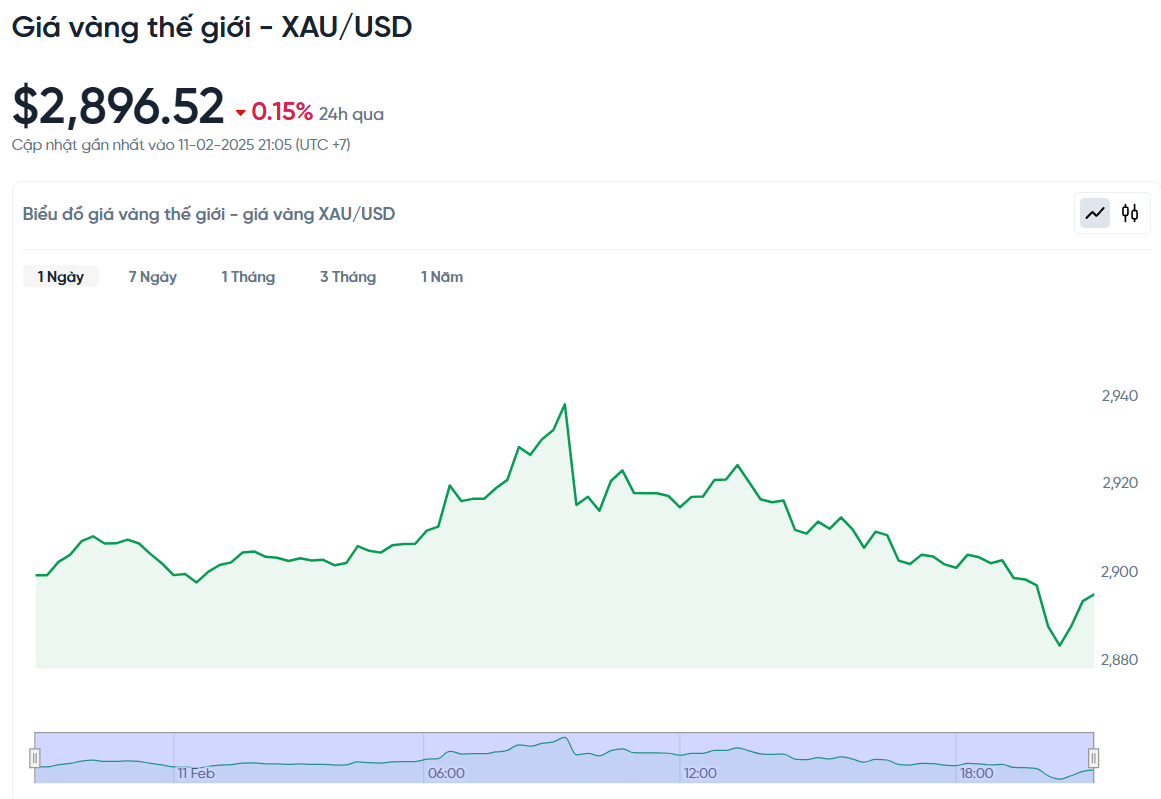

World gold price today February 12, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 am today, Vietnam time, was 2,896.52 USD/ounce. Today's gold price decreased by 4.32 USD compared to yesterday. Converted according to the USD exchange rate, on the free market (25,760 VND/USD), the world gold price is about 90.94 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 440 thousand VND/tael lower than the international gold price.

World gold prices fell sharply due to profit-taking activities from investors after gold prices hit a historical peak earlier. However, the market remained optimistic due to concerns about a global trade war after US President Donald Trump imposed new tariffs.

"The market is seeing profit taking from short-term investors. Gold has rallied quite strongly and needs a pullback to consolidate the chart," said Jim Wyckoff, senior market analyst at Kitco Metals.

Money continues to flow into gold as investors react to US President Donald Trump's new tax policies on steel and aluminum imported from the country. On the other hand, China also imposed a 10% - 15% tax on 14 billion USD worth of imported goods from the US in response to Washington's previous additional tax. Trade tensions between the superpowers have investors worried about risks and looking to gold as a safe haven.

Investors are closely watching a speech by Federal Reserve Chairman Jerome Powell and U.S. inflation data on Wednesday for clues on interest rate trends. Higher-than-expected inflation could prompt the Fed to delay rate cuts, which could slow gold's gains in the short term.

Gold is often seen as a hedge against inflation, but higher interest rates reduce the appeal of gold because it is a non-yielding asset. Any new statements from President Trump could cause uncertainty, which could support gold prices, Wyckoff said. Profit-taking bouts like today could be viewed by bullish investors as buying opportunities on dips.

In India, gold rental prices hit a record high due to tight supply as banks moved gold to the US to avoid potential tariffs.

Meanwhile, silver fell 1.6% to $31.53 an ounce, platinum fell 0.8% to $986.20, and palladium fell 0.7% to $976.

Gold price forecast

Gold expert Tran Duy Phuong believes that it is reasonable for gold prices to cool down after reaching an all-time peak of over 2,900 USD/ounce. Because in just 1 day, gold prices increased by 80 USD/ounce; in 1 week increased by 160 USD/ounce and in 1 month increased by 300 USD/ounce are too fast and too hot increases.

Mr. Phuong predicts that if investors take profits, the world gold price will drop sharply, possibly up to 100 USD/ounce, causing the domestic gold price to plummet.

FxPro market analyst Alex Kuptsikevich predicts that the gold bull run has just begun and the $3,000/ounce level is just the beginning. He predicts that the price of the precious metal is likely to reach $3,400/ounce between August and October this year.

Adrian Day even predicted that gold prices will reach $3,500-4,000/ounce in the next 12 months and emphasized that "this is just the beginning of the precious metal before entering a new growth phase".

Many experts believe that gold could reach $3,000 an ounce in the first quarter of 2025. However, several factors could affect the rate of price increase. If the US Federal Reserve (Fed) moves to raise interest rates to control inflation, gold prices could stagnate. Factors such as trade tensions, central bank demand for gold, and geopolitical situations will affect price trends.

If investment money continues to flow into gold, the price could go beyond $3,000. However, if there is strong profit-taking, the price of gold could be adjusted.