Gold price today February 17, 2025: World and domestic gold prices continue to increase

Gold price on February 17, 2025: Domestic gold prices closed a week of strong increases in buying and unchanged selling. World gold prices continued to increase this week because there are still many driving factors.

Domestic gold price today February 17, 2025

At the time of survey at 4:30 a.m. on February 17, 2025, the gold price on the trading floors of some companies was as follows:

DOJI listed the price of 9999 gold today at 87.3 million VND/tael for buying and 90.3 million VND/tael for selling. No change in both buying and selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 88.8-89.8 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 87.3-90.3 million VND/tael (buying - selling), unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 87.5-90.3 million VND/tael (buy - sell), unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, February 17, 2025 is as follows:

| Gold price today | February 17, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 87.3 | 90.3 | - | - |

| DOJI Group | 87.3 | 90.3 | - | - |

| Mi Hong | 88.8 | 89.8 | - | - |

| PNJ | 87.3 | 90.3 | - | - |

| Vietinbank Gold | 90.3 | - | ||

| Bao Tin Minh Chau | 87.3 | 90.3 | - | - |

| Phu Quy | 87.5 | 90.3 | - | - |

| 1.DOJI- Updated: 2/17/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 87,300 | 90,300 |

| AVPL/SJC HCM | 87,300 | 90,300 |

| AVPL/SJC DN | 87,300 | 90,300 |

| Raw material 9999 - HN | 88,300 | 89,400 |

| Raw materials 999 - HN | 88,200 | 89,300 |

| AVPL/SJC Can Tho | 87,300 | 90,300 |

| 2.PNJ- Updated: 2/17/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 88,300 | 90,200 |

| HCMC - SJC | 87,300 | 90,300 |

| Hanoi - PNJ | 88,300 | 90,200 |

| Hanoi - SJC | 87,300 | 90,300 |

| Da Nang - PNJ | 88,300 | 90,200 |

| Da Nang - SJC | 87,300 | 90,300 |

| Western Region - PNJ | 88,300 | 90,200 |

| Western Region - SJC | 87,300 | 90,300 |

| Jewelry gold price - PNJ | 88,300 | 90,200 |

| Jewelry gold price - SJC | 87,300 | 90,300 |

| Jewelry gold price - Southeast | PNJ | 88,300 |

| Jewelry gold price - SJC | 87,300 | 90,300 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 88,300 |

| Jewelry gold price - Jewelry gold 999.9 | 87,600 | 90,100 |

| Jewelry gold price - 999 jewelry gold | 87,510 | 90,010 |

| Jewelry gold price - 99 jewelry gold | 86,800 | 89,300 |

| Jewelry gold price - 916 gold (22K) | 80,130 | 82,630 |

| Jewelry gold price - 750 gold (18K) | 65,230 | 67,730 |

| Jewelry gold price - 680 gold (16.3K) | 58,920 | 61,420 |

| Jewelry gold price - 650 gold (15.6K) | 56,220 | 58,720 |

| Jewelry gold price - 610 gold (14.6K) | 52,610 | 55,110 |

| Jewelry gold price - 585 gold (14K) | 50,360 | 52,860 |

| Jewelry gold price - 416 gold (10K) | 35,130 | 37,630 |

| Jewelry gold price - 375 gold (9K) | 31,440 | 33,940 |

| Jewelry gold price - 333 gold (8K) | 27,380 | 29,880 |

| 3. SJC - Updated: February 17, 2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 87,300 | 90,300 |

| SJC 5c | 87,300 | 90,320 |

| SJC 2c, 1C, 5 phan | 87,300 | 90,330 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 87,300 | 90,100 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 87,300 | 90,200 |

| 99.99% Jewelry | 87,300 | 89,700 |

| 99% Jewelry | 85,811 | 88,811 |

| Jewelry 68% | 58,152 | 61,152 |

| Jewelry 41.7% | 34,558 | 37,558 |

Thus, domestic gold prices closed a week of strong increases in buying prices and unchanged in selling prices at some major gold brands.

With a difference of 3 million VND between buying and selling prices and an increase of 500,000 VND/tael in buying price, gold buyers are losing 3 million VND/tael after one week.

This difference is 2-3 times higher than normal times and pushes the risk onto the buyer.

Currently, the domestic gold price depends on the world gold price. However, the domestic price is listed by the gold trading enterprises. With SJC gold bars, the enterprises look at the selling price of the State Bank to the designated units. As for gold rings, it depends entirely on supply and demand, the enterprises list themselves.

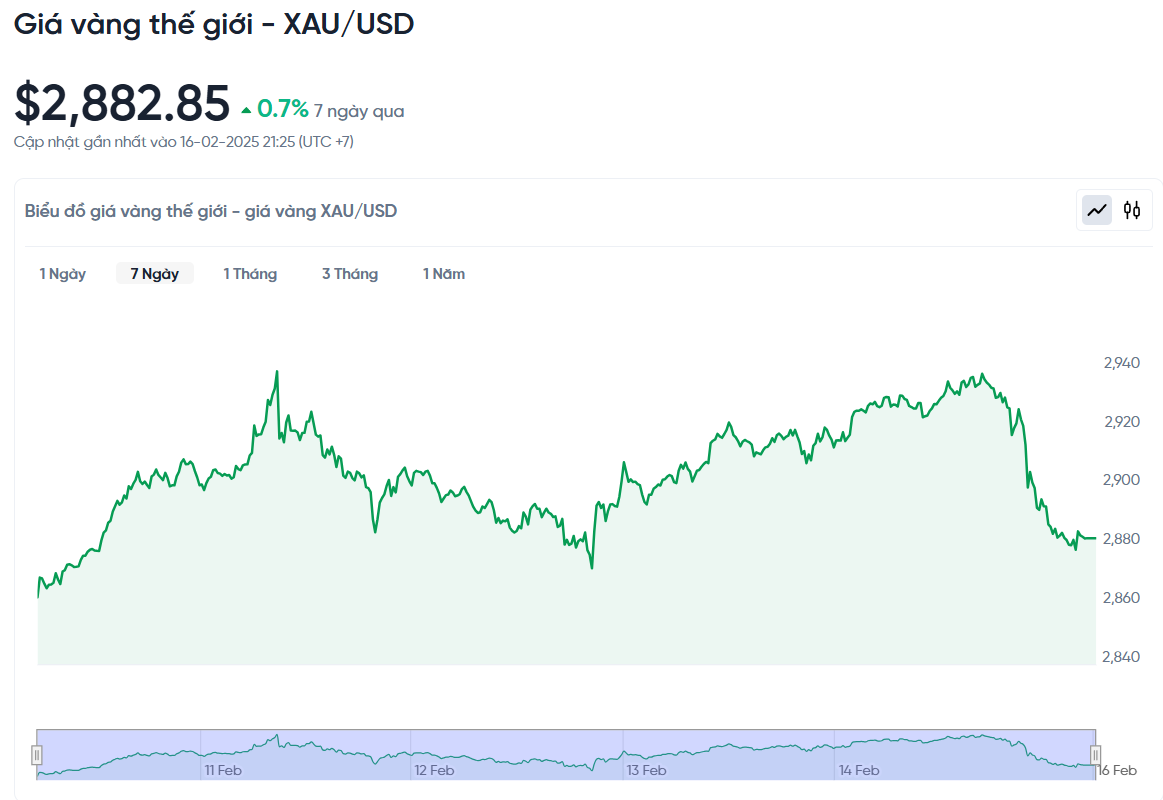

World gold price today February 17, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 am today, Vietnam time, was 2,882.85 USD/ounce. Today's gold price is unchanged from yesterday. Converted to the USD exchange rate, on the free market (25,750 VND/USD), the world gold price is about 90.46 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 160 thousand VND/tael lower than the international gold price.

The world gold price unexpectedly fell at the end of the week, to 2,882.85 USD/ounce, although it had jumped to 2,939 USD/ounce in the middle of the week. However, this precious metal still increased by 20.17 USD compared to the end of last week.

After a series of consecutive record-setting events, the world gold price is slowing down. The world gold market ended the trading week below the 2,900 USD/ounce mark due to strong profit-taking activities. Despite the 'plummeting' reversal, both experts and investors believe that the gold price will increase next week.

The main reason for the fall in gold prices was speculation that US President Donald Trump would propose tariffs as a negotiating tactic. Mr. Trump said he would impose tariffs on countries that tax imports from the US, increasing market uncertainty. Although these tariffs may take months to be implemented, the uncertainty has affected safe-haven assets such as gold and the US dollar.

However, according to Morgan Stanley, this drop in gold prices could be a good buying opportunity, especially in the context of a recovering global economy, rising geopolitical tensions and growing government fiscal spending.

The Relative Strength Index (RSI) has exited overbought territory after remaining there for much of February. This suggests the decline could pause if buyers defend the February 12 low of $2,864 an ounce.

The psychological level of $2,850/ounce is the first important support. If this level is broken, gold prices could continue to fall to $2,790/ounce (October 31 high) and then $2,730/ounce (January 27 low).

If gold breaks above $2,900 an ounce, the next resistance will be the record high of $2,942 an ounce. A break above this level could see gold move towards $2,950 an ounce and $3,000 an ounce.

There are still many factors driving the gold price to continue to rise. The threat of tariffs could increase investment demand for gold and spur money flows into the market. In addition, the demand for physical gold in the US and UK amid tariff threats will also support the gold price increase. Furthermore, forecasts of weak retail sales could weaken the US dollar, thereby continuing to support the gold price increase. Data from the derivatives market also shows that the gold price is likely to increase further, with the expected price adjusted from 2,950 USD to 3,000 USD in the near future.

This morning, the USD-Index increased to 106.71 points; the yield on 10-year US Treasury bonds increased to 4.477%; US stocks increased sharply after President Donald Trump's move to postpone tax imposition; oil prices decreased, listed at 74.74 USD/barrel for Brent oil and 70.74 USD/barrel for WTI oil.

Gold price forecast

With a US bank holiday today (Presidents Day), the market is likely to be less volatile. However, if gold closes at current levels, there could be another correction of about $30-40 before prices rise again.

Looking ahead to the gold price trend, the latest Kitco News weekly gold survey shows that industry experts remain positive but more divided than last week, while retail traders are also more cautious in their expectations for further gains.

In a survey on Wall Street, 14 analysts participated in the response, of which 71% said that gold prices will continue to increase, only 14% said that gold prices will decrease and the remaining 14% predicted that gold prices will remain stable.

Similarly, in an online survey on Main Street, 201 investors responded, of which 65% predicted gold prices to continue to rise, only 24% predicted gold prices to fall and the rest predicted gold prices to remain flat.

Adrian Day, chairman of Adrian Day Asset Management, said: 'Gold prices will rise. Gold still has momentum and the factors supporting buying are still intact.'

Agreeing, Rich Checkan - President and COO of Asset Strategies International - said: 'Gold prices will continue to rise. The current trend is still very solid and the market is facing many uncertainties'.

The $3,000/ounce level is considered an important psychological threshold. Some experts believe that gold prices could reach this mark in the first or second quarter of this year, depending on developments in monetary policy and the world economic situation.

Marc Chandler, director of Bannockburn Global Forex, warned: 'Gold cannot rise forever. We may be approaching a correction before continuing the rally.'

Meanwhile, Adam Button, an expert at Forexlive.com, commented: 'The $3,000 mark is attractive, but the gold bull cycle may be coming to an end. Some investors may want to take profits.'