Gold price today August 20: Gold bar and gold ring prices at the top, world gold price falls to the bottom

Gold price today August 20, 2025: Gold bar price is above 125 million and gold ring price increased slightly to 119.8 million. World gold price decreased in the opposite direction, falling to the bottom of the past 3 weeks.

Gold pricedomestic today 8/20/2025

As of 4:00 a.m. today, August 20, 2025, the domestic gold bar price remained at the peak compared to yesterday. Specifically:

DOJI Group listed the price of SJC gold bars at 124-125 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 124-125 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 18 yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 124.5-125 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 124-125 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to the same period yesterday.

SJC gold price at Phu Quy is traded by businesses at 123-125 million VND/tael (buy - sell), gold price has not changed in both buying and selling directions compared to yesterday.

As of 4:00 a.m. on August 20, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 117-120 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, August 20, 2025 is as follows:

| Gold price today | August 20, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 124 | 125 | - | - |

| DOJI Group | 124 | 125 | - | - |

| Mi Hong | 124.5 | 125 | - | - |

| PNJ | 124 | 125 | - | - |

| Bao Tin Minh Chau | 124 | 125 | - | - |

| Phu Quy | 123 | 125 | - | - |

| 1.DOJI- Updated: 2025-08-20 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 124,000 | 125,000 |

| AVPL/SJC HCM | 124,000 | 125,000 |

| AVPL/SJC DN | 124,000 | 125,000 |

| Raw material 9999 - HN | 109,800 | 110,800 |

| Raw materials 999 - HN | 109,700 | 110,700 |

| 2.PNJ- Updated: 2025-08-20 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 124,000 | 125,000 |

| PNJ 999.9 Plain Ring | 117,000▲200K | 119,800 |

| Kim Bao Gold 999.9 | 117,000▲200K | 119,800 |

| Gold Phuc Loc Tai 999.9 | 117,000▲200K | 119,800 |

| PNJ Gold - Phoenix | 117,000▲200K | 119,800 |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 gold jewelry | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3.SJC- Updated: 2025-08-20 04:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 124,000 | 125,000 |

| SJC gold 5 chi | 124,000 | 125,020 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 124,000 | 125,030 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 117,000 | 119,600 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 117,000 | 119,500 |

| 99.99% jewelry | 116,800 | 118,600 |

| 99% Jewelry | 112,925 | 117,425 |

| Jewelry 68% | 73,606 | 80,806 |

| Jewelry 41.7% | 42,411 | 49,611 |

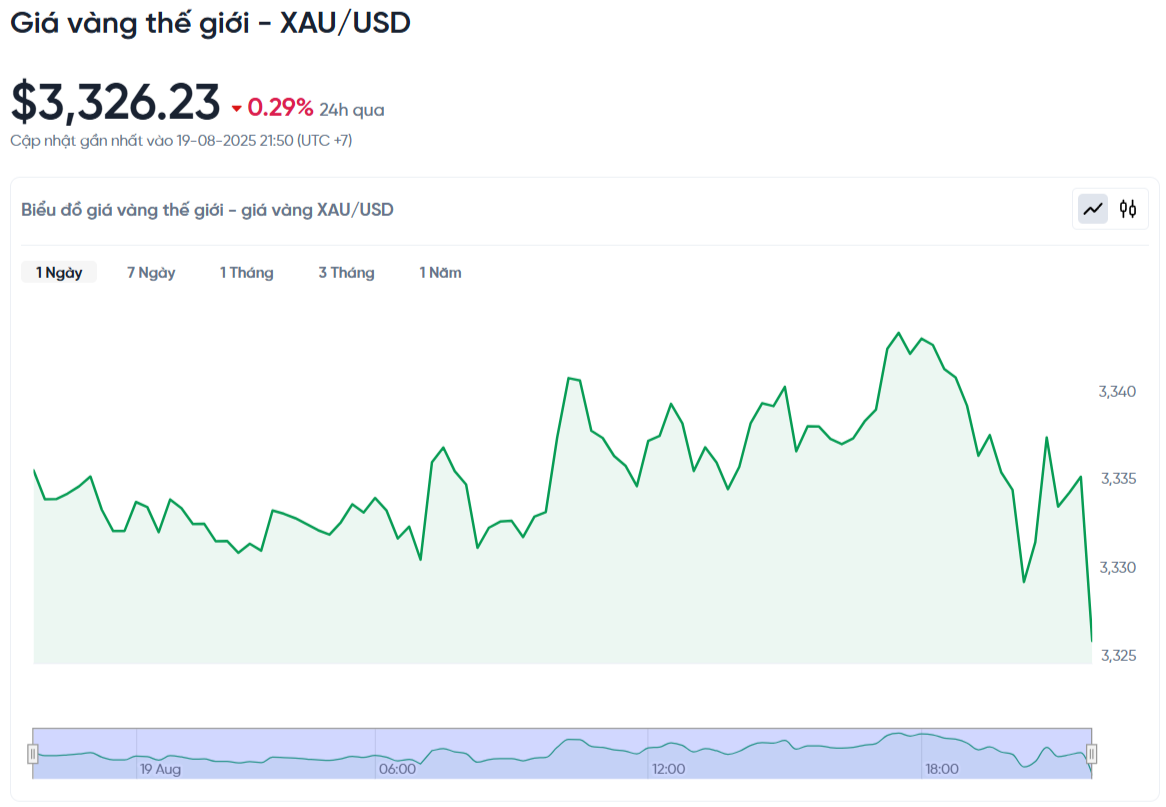

World gold price today August 20, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on August 20, Vietnam time, was 3,326.23 USD/ounce. Today's gold price decreased by 9.69 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,490 VND/USD), the world gold price is about 106.44 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.56 million VND/tael higher than the international gold price.

On the bustling Tran Nhan Tong street, long lines of people formed from early morning under the unpredictable sun and rain of Hanoi, all with the same purpose: buying gold. This image has become familiar in recent days when gold prices continuously reached new peaks, reflecting people's psychology of looking for safe investment channels in the face of unpredictable economic fluctuations.

SJC gold continues to affirm its position as the most popular product with a not-too-large price difference between dealers, creating favorable conditions for buyers to compare and choose. It is worth noting that although the gold price is at a record high, many people are still willing to wait in line to own each tael of gold, showing the belief that this item will continue to increase in price in the future.

World gold prices fell sharply after the announcement of data on housing construction activities in the US in July 2025 increased by 2.5%. This figure is higher than the predictions of economic experts. Compared to the same period last year, construction activities increased by nearly 13%.

While construction has exceeded expectations in the past two months, there are signs that it may slow later in the year. New building permits fell 2.8%. That was a much larger decline than economists had expected. Permits were also down nearly 6% from a year earlier.

The housing sector is closely watched because it reflects the overall health of the economy. It has been struggling recently. Homebuyers face high costs from two sides: rising mortgage rates due to the US central bank raising interest rates, and rising home prices due to limited supply.

Spot gold fell 0.29%, while December gold futures also fell 0.32% to $3,366.87 an ounce. The dollar index fell 0.1% against major currencies, while 10-year bond yields also fell, which helped gold, as they made it more attractive to investors holding other currencies.

The gold market is in the build-up to the Jackson Hole conference, so trading is expected to be quiet until the event begins, according to Kitco Metals expert Jim Wyckoff. At this annual conference, Fed Chairman Powell will speak on the economic outlook and the direction of monetary policy on Friday.

US President Donald Trump continues to call for the Fed to cut interest rates more aggressively. According to Wyckoff, Powell may be leaning towards easing, which would be beneficial for gold prices. The CME FedWatch tool shows the market is pricing in an 83% chance of the Fed cutting interest rates by 25 basis points in September.

Gold price forecast

Investors are awaiting the minutes of the Fed’s latest meeting, due on Wednesday, for clues on the economic outlook and the path of interest rates. In addition, UBS has just raised its gold price forecast to $3,600 by the end of March 2026, citing macro risks from the US economy and strong investment demand.

According to Ms. Roukaya Ibrahim, Chief Strategist at BCA Research, the gold price has been rising not only due to short-term factors but also due to long-term structural factors such as increased investment demand and strong central bank buying. Despite pressure from peak stock markets and high bond yields, the price of gold has maintained an important support level around the threshold of 3,300 USD/ounce.

Ms Ibrahim said: 'The fact that gold prices have risen despite the headwinds suggests that this rally is a long-term trend, not a temporary one. Gold's resilience since mid-April reinforces this view. Despite being oversold, gold has held firm, demonstrating that there are buyers on every dip.'

Ms Ibrahim predicts gold will rise sharply when the US Federal Reserve (Fed) starts cutting interest rates. The market expects the Fed to cut interest rates in September, followed by two more cuts later in the year.

'Gold prices have risen over the past three years despite high real interest rates and a strong US dollar. But in the near term, these two factors will become leverage to push gold prices higher, and real interest rates will fall as the US labor market slows or the Trump administration pressures the Fed to pursue an easing policy.'

BCA Research also forecasts a weaker USD in the coming months, which will further benefit gold. 'The USD could fall as foreign investment flows into the US are not enough to offset the current account deficit,' Ms Ibrahim explained.

Rhona O'Connell, Head of Market Analysis EMEA & Asia at StoneX, has just raised her 2024 average gold price forecast to $3,115 an ounce, up slightly by 1% from the previous $3,078. She commented that gold prices have recently fluctuated in a narrow range, with a difference of only 2% in the past week and 8% in the past three months.

Ms. O'Connell predicts that gold prices will average around $3,320 an ounce in the third quarter, but could fall to around $3,000 in the fourth quarter. She said that barring a major unexpected event or humanitarian crisis, gold's recent peak of $3,500 in April is unlikely to be breached.