Gold price today March 3, 2025: World and domestic gold prices are expected to decrease in March

Gold price today 3/3/2025: World gold price and domestic gold price closed the week with a sharp decline and huge losses. Experts predict a deep downward trend in gold prices in March.

Domestic gold price today March 3, 2025

At the time of survey at 4:30 a.m. on March 3, 2025, the gold price on the trading floors of some companies was as follows:

DOJI listed the price of 9999 gold today at 88.5 million VND/tael for buying and 90.5 million VND/tael for selling. Today's gold price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 90.4-91 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 88.8-90.5 million VND/tael (buying - selling), unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 88.8-90.5 million VND/tael (buy - sell), unchanged in both buying and selling directions compared to yesterday.

.jpg)

The latest gold price list today, March 3, 2025 is as follows:

| Gold price today | March 3, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 88.5 | 90.5 | - | - |

| DOJI Group | 88.5 | 90.5 | - | - |

| Mi Hong | 90.4 | 91 | - | - |

| PNJ | 88.5 | 90.5 | - | - |

| Vietinbank Gold | 90.5 | - | ||

| Bao Tin Minh Chau | 88.8 | 90.5 | - | - |

| Phu Quy | 88.8 | 90.5 | - | - |

| 1.DOJI- Updated: 3/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 88,500 | 90,500 |

| AVPL/SJC HCM | 88,500 | 90,500 |

| AVPL/SJC DN | 88,500 | 90,500 |

| Raw material 9999 - HN | 90,000 | 90,400 |

| Raw materials 999 - HN | 89,900 | 90,300 |

| AVPL/SJC Can Tho | 88,500 | 90,500 |

| 2.PNJ- Updated: 3/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 89,800 | 90,500 |

| HCMC - SJC | 88,500 | 90,500 |

| Hanoi - PNJ | 89,800 | 90,500 |

| Hanoi - SJC | 88,500 | 90,500 |

| Da Nang - PNJ | 89,800 | 90,500 |

| Da Nang - SJC | 88,500 | 90,500 |

| Western Region - PNJ | 89,800 | 90,500 |

| Western Region - SJC | 88,500 | 90,500 |

| Jewelry gold price - PNJ | 89,800 | 90,500 |

| Jewelry gold price - SJC | 88,500 | 90,500 |

| Jewelry gold price - Southeast | PNJ | 89,800 |

| Jewelry gold price - SJC | 88,500 | 90,500 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 89,800 |

| Jewelry gold price - Jewelry gold 999.9 | 88,000 | 90,500 |

| Jewelry gold price - 999 jewelry gold | 87,910 | 90,410 |

| Jewelry gold price - 99 jewelry gold | 87,200 | 89,700 |

| Jewelry gold price - 916 gold (22K) | 80,500 | 83,000 |

| Jewelry gold price - 750 gold (18K) | 65,530 | 68,030 |

| Jewelry gold price - 680 gold (16.3K) | 59,190 | 61,690 |

| Jewelry gold price - 650 gold (15.6K) | 56,480 | 58,980 |

| Jewelry gold price - 610 gold (14.6K) | 52,860 | 55,360 |

| Jewelry gold price - 585 gold (14K) | 50,590 | 53,090 |

| Jewelry gold price - 416 gold (10K) | 35,300 | 37,800 |

| Jewelry gold price - 375 gold (9K) | 31,590 | 34,090 |

| Jewelry gold price - 333 gold (8K) | 27,520 | 30,020 |

| 3. SJC - Updated: 3/3/2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 88,500 | 90,500 |

| SJC 5c | 88,500 | 90,520 |

| SJC 2c, 1C, 5 phan | 88,500 | 90,530 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 88,500 | 90,400 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 88,500 | 90,500 |

| 99.99% Jewelry | 88,500 | 90,100 |

| 99% Jewelry | 86,207 | 89,207 |

| Jewelry 68% | 58,424 | 61,424 |

| Jewelry 41.7% | 34,725 | 37,725 |

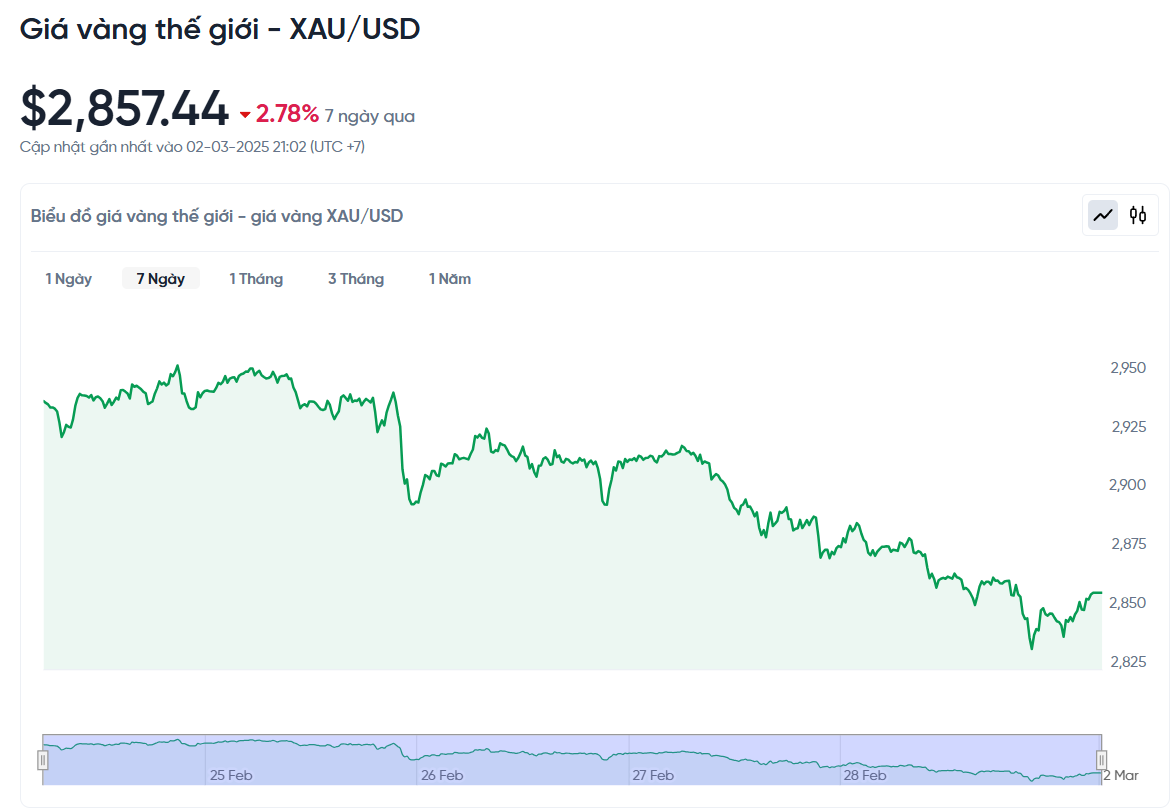

World gold price today March 3, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 am today, Vietnam time, was 2,857.44 USD/ounce. Today's gold price is unchanged compared to yesterday. Converted to the USD exchange rate, on the free market (25,830 VND/USD), the world gold price is about 89.96 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 540 thousand VND/tael higher than the international gold price.

The world gold price ended the trading week with a sharp decrease of 130 USD/ounce in just three days. Overall, the precious metal lost 2.78% of its value for the week, marking the sharpest decline since November 2024.

Despite the large drop, many experts remain optimistic about gold’s long-term prospects. The market has been on a tear for some time now, and a correction is expected to help stabilize the market.

One of the main reasons for the decline in gold prices is the temporary withdrawal of safe-haven money from the gold market, causing the precious metal to fail to maintain important levels. If prices continue to slide below $2,800/ounce, the possibility of gold correcting further in the short term is very high.

In addition, the US stock market has recently been volatile, with the S&P 500 hitting a record high. At the same time, Bitcoin and many other cryptocurrencies have also weakened after the post-US election surge. When these risky assets decline in price, money will not necessarily flow into gold but may find other investment channels such as US government bonds.

In addition, the gold market is also under pressure from profit-taking activities of investors. After a long period of increase, gold prices need a technical adjustment to accumulate before they can conquer new price zones.

Geopolitical developments also had a significant impact on gold price trends. The meeting between US President Donald Trump and Ukrainian President Volodymyr Zelensky at the White House on February 28 failed to reach an agreement, increasing tensions and uncertainty in financial markets.

At the same time, President Trump continued to take tough trade actions when he announced an additional 10% tax on imported goods from China from March 4, bringing the total tax rate to 20%. He also threatened to impose a 25% tax on goods from the European Union (EU), Mexico and Canada, which could put further pressure on the global economy.

Investors are now closely monitoring key economic data such as US GDP growth and unemployment rates to assess the possibility of the US Federal Reserve (Fed) adjusting interest rates. In the short term, this uncertainty is reducing the upward momentum of gold prices.

The domestic gold market was also negatively affected, as the price of SJC gold bars and gold rings fell for three consecutive sessions, moving away from the 91 million VND/tael mark. However, the price of Doji gold rings remained higher than gold bars by 500,000 VND to 1 million VND per tael.

If the world gold price continues to fall, domestic gold will also inevitably follow a similar downward trend. However, the difference between the price of gold rings and gold bars shows that the demand for gold jewelry is still more stable than that of gold bars.

Gold price forecast

According to expert Tran Duy Phuong, the gold market often follows a rule: 'Buy when there are rumors, sell when official news appears.' With the world gold price closing the week at 2,858 USD/ounce, the possibility of gold prices continuing their downward trend in March.

According to the assessment, the gold price may adjust down by about 200 USD/ounce, bringing the price down to nearly 2,750 USD/ounce. This is consistent with the usual trend after each gold peak.

A Kitco survey on Wall Street shows that only 21% of experts predict that gold prices will increase again in the near future, while 64% believe that gold prices will continue to decrease. The rest believe that gold prices will go sideways.

The Main Street online survey of 138 investors also reflected a cautious sentiment. 45% of investors believe gold prices will rise, 28% predict gold will fall, and the rest believe prices will be little changed in the coming days.

Adrian Day, chairman of Adrian Day Asset Management, said that gold prices may continue to fall due to profit-taking pressure, but this correction is not worrying. This is just a normal development in the gold market.

Marc Chandler, CEO of Bannockburn Global Forex, said that gold prices could continue to fall to $2,770/ounce if they fail to hold the support level of $2,814/ounce.

Analyst Jess Colombo agrees that this is just a natural market correction, but if gold closes below $2,800 an ounce, investors should be more cautious with gold mining stocks and short-term trading positions.

Factors such as economic uncertainty, rising inflation, and the risk of recession will continue to boost safe-haven demand for gold in the coming period. In recent weeks, consumer confidence in the US has declined sharply, while inflation concerns have increased.

The latest report from the Atlanta Federal Reserve Bank shows that the US GDP in the first quarter may decrease by 1.5%, compared to the previously forecast increase of 2.3%. This is one of the sharpest declines in the history of this index, increasing concerns about the US economic outlook.

Although gold prices are under pressure to fall in the short term, many experts remain optimistic about the long-term prospects of this precious metal.